Joe Pags recently welcomed Rich Jacoby, CEO of GoldenCrest Metals, onto his show for an in-depth conversation about the economy, the weakening U.S. dollar, and why more Americans are turning to gold and silver for stability.

While you can watch the full interview below, we’ve broken down the key takeaways below for those who prefer reading — and for anyone looking to understand why precious metals are back in the spotlight.

Tariffs, Inflation, and the “Perfect Storm”

Pags opened the discussion by pointing out how unstable the economy feels for everyday Americans. Gas prices are fluctuating week to week, inflation continues to eat into paychecks, and no one knows what tomorrow might bring.

Jacoby explained that tariffs, while designed to boost U.S. manufacturing in the long run, come with short-term costs. Importers pass those expenses on to consumers, meaning higher prices at the store. Combined with stubborn inflation, Americans are facing what Jacoby described as a “perfect storm.”

The Dollar’s 10% Drop and a Global Confidence Crisis

One of the most concerning developments is the dollar’s decline. The U.S. currency has dropped roughly 10% in value this year, sending a troubling signal to global markets.

According to Jacoby, this isn’t just a market fluctuation—it’s a warning that the world is losing confidence in the dollar as the global reserve currency. Central banks around the world are buying gold at record levels as a hedge against U.S. instability.

Get up to $25,000 in FREE Silver

The Risks of the GENIUS Act and Digital Dollars

When Pags asked whether Americans should pull their money out of banks, Jacoby advised against panic but strongly recommended diversification.

“Most Americans have 100% of their savings tied to the stock market or dollar-based assets,” he explained. GoldenCrest Metals helps savers move a portion of their IRA or 401(k) into physical gold and silver through self-directed retirement accounts.

These assets are stored securely in insured depositories — giving Americans a hedge against both inflation and currency devaluation.

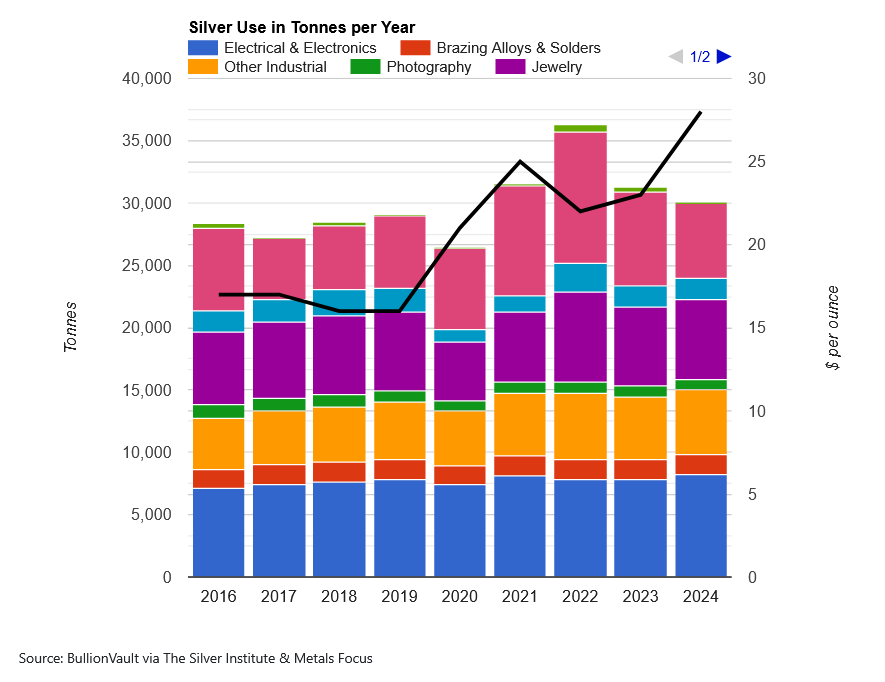

Silver’s Rising Role in Technology

While gold remains the classic safe haven, Jacoby highlighted silver as an overlooked opportunity. With demand soaring from industries like electric vehicles, solar energy, and AI technology, silver is no longer just a “little brother” to gold.

“The supply is tight and the demand’s exploding right now,” Jacoby said, calling silver the most undervalued asset on the market today.

If you’re ready to take action

The Risks of the GENIUS Act and Digital Dollars

The conversation then shifted to digital money. Jacoby warned that the GENIUS Act could pave the way for private companies — from Wall Street to Big Tech — to issue their own digital stablecoins without meaningful oversight.

That scenario could be dangerous. Imagine a future where your paycheck is deposited into a digital wallet controlled by a private corporation. Your funds could be tracked, frozen, or even blocked based on your behavior or political views.

“If you don’t like how Big Tech censors free speech now, wait until they control the money,” Jacoby cautioned.

Tangible Wealth vs Digital Wealth

Unlike digital coins, gold and silver are tangible. You can hold them in your hand, store them in a safe, and know they’ll never be worth zero.

Jacoby contrasted the thousands of years of history behind precious metals with the volatility of digital assets. People have lost millions by forgetting crypto passwords, but gold and silver remain steady, enduring forms of wealth.

Jacoby explained that tariffs, while designed to boost U.S. manufacturing in the long run, come with short-term costs. Importers pass those expenses on to consumers, meaning higher prices at the store. Combined with stubborn inflation, Americans are facing what Jacoby described as a “perfect storm.”

Advice for First-Time Precious Metals Buyers

For those curious but hesitant, Jacoby suggested a cautious approach. Many GoldenCrest customers start small — investing $10,000 to $20,000 — and then expand their holdings as they get more comfortable.

He also recommended GoldenCrest’s FREE 2025 Wealth Defense Guide, which walks readers through the process of diversifying retirement savings into precious metals with tax advantages.

Getting Started With Gold and Silver

Joe Pags closed the interview by praising Jacoby and expressing his trust in GoldenCrest Metals. In uncertain times, this discussion underscored why Americans are turning back to tried-and-true assets like gold and silver.

For more information — or to request your FREE 2025 Wealth Defense Guide — visit GoldenCrestMetals.com