Thank you for visiting our BitIRA review for 2025. In order to determine whether BitIRA is a trustworthy organization and the best self directed IRA for cryptocurrencies, we have examined BitIRA’s digital IRAs, fees, customer reviews, ratings, and complaints, cold storage vs. online wallets, and much more.

BitIRA Review: Summary

We think BitIRA excels in all facets of IRA investment. The company quickly combined an established investment vehicle with a new asset class in an extraordinary way, and today, they are not just the finest provider of digital IRAs, but also one of the best providers of IRAs overall.

The company not only provides what may very well be the greatest crypto or Bitcoin IRA, but it also has some of the best customer service you will ever find. A formula that is difficult to top requires ongoing innovation, a commitment to customer education, an A+ rating from the BBB and a AAA rating from the BCA, as well as inclusion in the International Business Times’ Hottest Fintech Startups 2021.

In conclusion, in our opinion, BitIRA is the greatest self-directed IRA for cryptocurrencies currently available, and we heartily endorse the business to anyone wishing to diversify and expand their retirement savings with digital assets.

Introduction: The BitIRA Review

Cryptocurrencies are on the rise in 2025! Fundstrat co-founder Tom Lee forecasts that Bitcoin could soar to $250,000, supported by promising market trends. According to Lee, Bitcoin has entered a crucial phase in its market cycle, with 2025 shaping up to be favorable for the broader cryptocurrency market.

For investors, the exciting news is that Bitcoin and other digital currencies can now be included in an Individual Retirement Account (IRA), offering the potential for tax-deferred growth. However, only a handful of companies provide access to digital assets in IRAs, and even fewer have maintained an impeccable track record.

Unquestionably, BitIRA is one of them, and in our in-depth BitIRA review, we’ll explain why this business stands out from the competition and continues to astound its clients with service and support. We promise to be frank with you about whether this is the finest self-directed IRA for cryptocurrency.

Let’s start by examining the company’s origins and goals.

What Is BitIRA?

As a sister concern of Birch Gold Group, one of the leading gold IRA providers, BitIRA has a unique advantage. This affiliation has provided them with extensive experience and a competitive edge in the realm of cryptocurrency IRAs.

It’s important to note that the IRS approved digital currencies as eligible assets for IRAs back in 2014, and BitIRA was established in 2017. During their brand establishment and cryptocurrency selection process, the company exercised a cautious approach.

BitIRA’s growth has been notable, combining both rapid expansion and stability. While we will delve deeper into BitIRA reviews and ratings shortly, it’s worth noting that they have garnered significant praise from various sources.

One noteworthy accolade is their inclusion in the International Business Times’ Hottest Fintech Startups 2021 list. This list features companies that are making a substantial and positive impact on the fintech industry. The presence of an IRA company on this prestigious list speaks volumes about BitIRA’s significance in the industry.

Have a look at this short video to get an introduction to BitIRA and learn the tax benefits of a Bitcoin IRA

Is BitIRA Legit?

It is evident that BitIRA is a reputable company dedicated to providing top-tier self-directed IRAs for cryptocurrencies, and they have consistently delivered on this commitment without any compromise.

Moreover, BitIRA’s mission goes beyond merely offering excellent crypto IRAs. Similar to their approach with their gold IRA company, Birch Gold Group, BitIRA places significant emphasis on customer education and service.

Since its establishment, BitIRA has made extensive efforts to educate both visitors to their website and customers who open accounts with them. Their website serves as a comprehensive information hub, offering insights into the crypto market, financial markets, and various economic and legal aspects. Additionally, they provide in-depth discussions on the cryptocurrencies they offer and other subjects related to IRAs and cryptocurrency investments.

BitIRA Reviews And Ratings

BitIRA Ratings

Maintaining an impeccable track record in customer service can be a challenging endeavor, and it becomes even more demanding when dealing with cryptocurrencies.

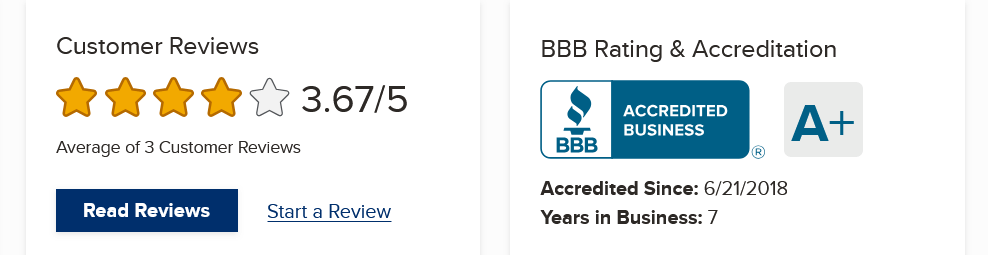

BitIRA has implemented effective strategies to mitigate the potential panic caused by the cryptocurrency market’s volatility. One notable achievement is their impressive ratings from reputable consumer protection organizations.

For instance, they have earned an AAA rating from the Business Consumer Alliance (BCA) and an A+ rating from the Better Business Bureau (BBB). These accolades place them among the top-tier businesses in consumer protection, a feat not easily accomplished.

Moreover, BitIRA’s commitment to customer satisfaction is evident in its clean record on the Complaint Board over its seven years of operation. This track record reflects their dedication to valuing and ensuring the complete satisfaction of each individual consumer.

BitIRA Reviews

BitIRA’s exceptional track record remains consistent, with customers consistently providing high ratings. You can gain further insights into the BitIRA user experience by visiting websites such as ConsumerAffairs and Birdeye.

- BitIRA has received an impressive rating of 5 out of 5 stars from customers on ConsumerAffairs based on 19 reviews

- And an equally remarkable rating of 4.9 out of 5 stars on Birdeye based on 69 reviews

Notably, there are no reviews of the company with less than 4 stars. Here is a selection of BitIRA reviews:

I want to thank the team for being so diligent and getting this done for me!

“BitIRA is a fantastic organization, it was a great experience to work with them. I had a 401k with schwab that had been sitting there for years, not doing much of anything. I’ve done some bitcoin investing with a coinbase account, and once I found out that I could rollover my 401k to Bitcoin, I was as good as sold. I found BitIRA after some research online and have been thoroughly impressed. Jeremy explained the whole process for me, and then Susan helped me with most of the paperwork to rollover the 401k.

Golden M.

- Yelp

Jeremy and the others at BitIRA are a fabulous team

“ its a first class organization over there. I found them while comparing to some other options to buy bitcoin for retirement and once i started talking to them it was clear that they were one of the best. They also have very competitive fees which made the decision that much easier for me. Happy i made the decision to go with them.”

Avril W.

When we delve into these reviews, it becomes evident that BitIRA garners overwhelmingly positive feedback from its clients. They applaud the organization for its transparency, honesty, expertise, and, perhaps most notably, its customer-centric approach.

Furthermore, BitIRA maintains an active presence on Facebook, providing a platform for interested individuals to engage and receive prompt responses.

A closer examination of these reviews underscores their authenticity. It is not uncommon for BitIRA team members to respond to customers, expressing their own satisfaction with the collaboration.

Such personalized attention to individuals can be a rarity, especially in industries on the cutting edge. Yet, BitIRA, much like its gold-focused counterpart, Birch Gold Group, remains unwavering in its commitment to its mission, even amidst what must be continuous growth.

Unleash Your IRA or 401(k)

What Is The Deal With Cryptocurrencies?

Cryptocurrencies, the asset class that’s a hot topic but often viewed with caution due to its notorious volatility and potential for substantial gains.

For inexperienced or impulsive investors, it has led to significant losses, yet it has also yielded substantial rewards for true believers and diligent researchers.

Despite being in existence since 2010, Bitcoin didn’t truly capture mainstream attention until 2017. During that year, its price skyrocketed from an already impressive $2,000 per token to around $20,000 by December.

The subsequent bear market wiped out a significant amount of wealth as the leading cryptocurrency plummeted to approximately $3,000.

Operating a crypto IRA business during this period must have presented significant challenges. With mainstream media reports proclaiming the impending demise of cryptocurrencies, numerous clients sought reassurance.

BitIRA’s exceptional track record stands out even more, given that they maintained their pristine reputation throughout one of the most severe cryptocurrency bear markets in history. During the period when many believed that cryptocurrencies were heading to zero, BitIRA’s ability to convince customers that their $19,000 Bitcoin purchase was not ill-advised must have required tremendous perseverance.

However, with the current cryptocurrency market seeing Bitcoin trading at around $101398.53, BitIRA not only skillfully navigated these turbulent waters but also generously rewarded clients who placed their trust in them.

Why Cryptocurrencies In An IRA?

Undoubtedly, cryptocurrency stands out as an asset class with immense growth potential, but realizing significant returns typically requires either precise timing or a long-term holding strategy.

The latter approach, often referred to as “HODLing,” involves acquiring digital tokens and retaining them regardless of short- or medium-term market fluctuations.

Viewed from this perspective, cryptocurrencies can be a suitable addition to an IRA, despite their reputation for risk. They serve as a hedge that appreciates over time, much like gold.

The key difference is that gold investors are not exposed to news headlines reporting rapid, significant value fluctuations in their assets. However, as the long-term price chart of Bitcoin or any other cryptocurrency vividly illustrates, those who can weather these fluctuations often reap substantial rewards.

In the early days of cryptocurrencies, the concept of having thousands of altcoins may have seemed highly theoretical, perhaps as recently as 2017. Now, it’s the norm. Thanks to surging valuations and the continuous introduction of new tokens, the cryptocurrency market has grown to a multi-trillion-dollar industry.

Which Cryptocurrencies Does BitIRA Offer?

Among all the crypto IRA companies in the market, BitIRA stands out for its meticulous approach to token selection. They have evidently drawn inspiration from their precious metals division and are focusing on tokens with enduring value.

BitIRA’s expansion of its token offerings is somewhat unconventional. They initially started with a straightforward selection and hinted at the possibility of adding more coins in the future, while also providing summaries for each one.

Over time, they have introduced numerous new tokens, some of which were not initially given specific names, but the named tokens are still notably absent.

This cautious approach is driven by the ongoing regulatory uncertainties surrounding certain cryptocurrencies. BitIRA only includes tokens with a robust regulatory foundation and a strong presence in both institutional and retail markets in its offerings. For instance, they have discontinued offering Ripple due to regulatory concerns.

BitIRA Digital Assets

Right now, the company offers 18 different tokens. And these are:

BitIRA Digital Assets |

|---|

|

Bitcoin: The token that started it all and the most popular token. |

|

Bitcoin Cash: A hard fork of the original token that has beaten negative forecasts and became a top cryptocurrency in its own right. |

|

Chainlink: A cross-compatibility token that has seen tremendous price growth since 2017. |

|

Ethereum: The second-largest token that powers the Ethereum network, which hosts numerous altcoins and smart contracts. |

|

Ethereum Classic: Likewise a hard fork of the related token, which came about as a result of community disagreement over the elimination of miners’ rewards, among other things. |

|

Litecoin: A top token that shares similarities with both Bitcoin and Ethereum, starting with the name recognition and the accompanying lofty valuations. |

|

Zcash: A privacy-oriented digital currency. |

|

Stellar Lumens: A token that is meant to provide a payment infrastructure to individuals, institutions, and even sovereign nations. |

|

Aave: A lending-oriented token. |

|

The Graph: A “search engine” token that queries the blockchain network. |

|

Basic Attention Token: A web-browser integrated token whose issuers hope to reimagine how internet users browse and improve their experience. |

|

Livepeer: A video-streaming oriented cryptocurrency. |

|

Uniswap: A cryptocurrency that acts as its own exchange. |

|

Decentraland: A token that is used primarily to purchase digital real estate in its proprietary metaverse. |

|

Compound: A token that is its own exchange and, like Aave, focuses primarily on lending. |

|

DAI: A stablecoin with a 1:1 tether to the US dollar. |

|

Maker: A token that ties into DAI and functions as a lending platform for it, among many other things. |

|

Yearn Finance: Another lending-oriented token that ties into both DAI and Maker and, like many other tokens on this list, features a user-powered governance system. |

What About Other Cryptocurrencies?

Cardano, Horizen, Dash, EOS, IOTA, Ripple, TRON, and Bitcoin SV are among the coins that BitIRA advertises on its website as being interested in but not yet available.

Several of these tokens are older and more established compared to some of the tokens on the aforementioned list.

However, because BitIRA has already hinted at delivering these tokens before some of the ones on the above list, they still have a provisional status.

As was previously said, this is due to regulatory considerations and will change whenever the regulatory status of these currencies changes.

How Will My Digital IRA Be Taxed?

Similar to their gold IRA services, BitIRA promotes a hands-off approach for investors. However, this doesn’t mean you lose control over your self-directed IRA. In fact, it’s quite the opposite: BitIRA’s custodian provides a platform that allows you to trade cryptocurrencies within your account while enjoying tax deferment benefits. Think of it as an exchange tailored for IRAs.

Any capital gains and trades conducted within your account remain tax-deferred as long as you refrain from making withdrawals. This is a significant advantage when dealing with crypto assets, especially since many individuals engage in frequent cryptocurrency trading.

While there may be exceptions to this rule, should you wish to move your tokens, the custodian is available to assist you in avoiding any errors.

Free Digital IRA or 401(k) Guide

Rollovers Of 401(k)s And Existing Or Inactive IRAs

Rollovers and transfers are among the most commonly used methods for funding a self-directed IRA. Once you’ve reached out to BitIRA’s representatives and established your account, the custodian will assess your funding options.

You can fund your digital IRA using one or more retirement plans, such as active or past 401(k)s, TSPs, and various government-sponsored programs. Additionally, funds from an existing IRA can be liquidated and transferred to your new self-directed account. While transfers between custodians are generally preferred, they may not always be feasible. If you opt for a rollover, it’s important to note that setting up your account may take longer.

Active retirement plans, which are typically more challenging to liquidate and transfer to a new self-directed IRA than passive ones, may not always be eligible for an IRA rollover.

How Does BitIRA Store My Digital Assets?

Because of the way the business manages digital asset safekeeping, we believe BitIRA is the best self directed IRA for cryptocurrencies.

Because they may be traded over-the-counter, you might think that the digital assets in your IRA are just as secure as those found on an exchange.

However, this is actual. For all of its clients’ digital assets, BitIRA offers true cold storage, in contrast to its competitors. Let’s take a closer look at BitIRA’s storage options.

Cold Storage Vs Online Wallets

1. Cold Storage Options

The security of digital assets remains a significant concern for Bitcoin enthusiasts. Storing long-term assets on an exchange is generally discouraged, even in the absence of exchange hacks and similar incidents.

The only truly secure method for holding cryptocurrency is through a hardware wallet, such as a USB stick. Once loaded onto the stick and plugged in, only you will have access to the digital assets. Hardware wallets are impervious to various types of attacks, including hacks and breaches.

BitIRA takes security to an even higher level by offering grade-5 nuclear bunkers, which are continuously monitored and guarded by trained personnel. This exceptional feature sets BitIRA apart from other Digital Currency IRA companies, providing an unparalleled level of security for your investments.

2. Online Wallets

Convenience is the primary factor for so many individuals to choose online wallets over hardware ones. A hardware wallet can be accessed much more quickly and conveniently through an internet wallet, and vice versa for transferring assets into and out of them.

BitIRA offers you the best of both worlds through its innovative storage system.

BitIRA Assets: Secure, Yet Available At All Times

BitIRA employs a comprehensive security and insurance system to ensure the utmost accessibility and protection for their clients. The mentioned over-the-counter platform doesn’t directly hold the digital assets within your IRA; its role is to facilitate the purchase and secure storage of these assets.

The actual assets are maintained offline, safeguarded within a top-rated, secure nuclear bunker with a grade-5 rating. This level of security is on par with, or even exceeds, that of a traditional bullion vault. The facility is so secure that not even James Bond could gain access.

All the assets held in your account are fully insured, providing an extra layer of reassurance. This means that in the event of any issues during cryptocurrency transactions within the IRA or a breach in the vault, you won’t incur any losses.

BitIRA aptly describes this as an end-to-end insurance solution. Since its inception, BitIRA has been dedicated to offering clients the secure acquisition and storage of digital assets within their IRA, making it one of the company’s core strengths and primary focuses.

BitIRA Fees

What Are The Fees Associated With A BitIRA Account?

Because each account is different, BitIRA’s pricing structure is less transparent than that of some of its competitors.

Given that these rates can vary from account to account given the level of meticulousness and zero-tolerance for error for which they are known, one shouldn’t be surprised that the organization is reluctant to provide a flat price structure.

The general expenses listed below are some that you should be aware of when opening a BitIRA account:

- Setup Fee: $50

- Wire Fee: $30

- Bitcoin or Other Crypto Purchases Fee: $100

- Selling Tokens Fee: $100

- Investment Minimums: $5,000

In addition, be prepared to pay more costs if you withdraw money from your account. Furthermore, BitIRA no longer levies a yearly custodian fee.

Given that the company’s price structure is subject to change, you should undoubtedly contact them to obtain a more accurate estimate or a specific sum.

Is A Digital IRA The Right Choice For Me?

If you have even a passing interest in the Bitcoin market, the answer is likely yes.

Investing in cryptocurrencies does involve a certain degree of risk tolerance, but those who can navigate it have often reaped significant rewards. One advantage of holding Bitcoin in your IRA is that it can reduce the likelihood of engaging in panic selling or other common issues that frequently affect cryptocurrency investors.

You gain exposure to one of the fastest-growing asset classes without needing to fret over minor fluctuations, unlike regular crypto investors.

Furthermore, unlike typical cryptocurrency investors, you have access to the expertise of BitIRA’s professionals. While neither BitIRA nor Birch Gold officially offer investment advice, they are available to assist you through various phases of the crypto market and provide clarity.

The cryptocurrency investment landscape can be incredibly confusing, especially during times of market turmoil or industry developments. Having experts on hand is a significant advantage.

To add to this, a digital IRA offers remarkable flexibility, allowing you to diversify your retirement savings according to your preferences. Unlike traditional IRA and employer-sponsored retirement plans, which primarily consist of stocks and bonds, a digital IRA provides opportunities for diversification, safety, and returns.

Free Digital IRA or 401(k) Guide

Why BitIRA Over Its Competitors?

BitIRA’s appeal lies in its track record as a reliable business that not only serves its clients effectively but also operates within the bounds of the law. Working with both cryptocurrency and IRA professionals provides you with access to a wealth of expertise in IRA management that is hard to match.

In a market as enticing as cryptocurrency, many businesses are tempted to rush in without full consideration. BitIRA, on the other hand, has avoided this temptation and diligently ensured compliance at every step in an industry known for its complexity.

Opting for BitIRA means securing strong long-term prospects. Regardless of how the market fluctuates, the company remains committed to staying at the forefront, ensuring customer satisfaction, and safeguarding their assets.

The past five years have been challenging, and the future is likely to hold more surprises as the cryptocurrency market continues its unpredictable growth, even confounding seasoned crypto enthusiasts. Yet BitIRA has managed to make navigating this complexity seem effortless.

As an additional bonus, BitIRA provides the best customer service among IRA companies. Just as they carefully assess and manage each token in their offering, they treat every client with the utmost respect, making them feel valued.

The company itself is part of this long-term vision. It’s easy to have confidence in BitIRA’s ability to operate successfully for years and decades to come, thanks in part to its track record in providing precious metals IRAs. The retirement account you establish with them reflects this commitment to the long term.

Does BitIRA Have Any Downsides?

While BitIRA’s limitations are few and far between, it’s essential to acknowledge where they may fall short compared to their competitors. The primary limitation, which even some of the 5-star reviews acknowledge, is the relatively limited selection of assets.

Although BitIRA has recently expanded its offering to 18 tokens, it still lags behind some digital IRA providers that offer a more extensive range of tokens and facilitate the direct purchase of additional assets. Given the rapid expansion of the cryptocurrency market, the desire to invest in a broader spectrum of tokens may be strong, and some individuals might find the relatively small selection less appealing.

However, this aligns with BitIRA’s cautious approach to compliance, investments, and client relationships. Additionally, it’s worth noting that the minimum deposit requirement to open an account with a starting balance of $5,000 is considerably higher than the requirements of some competitors.

Pros And Cons Of BitIRA

To give you a quick recap, here are pros and cons of BitIRA:

Pros

- A+ BBB Rating and AAA BCA Rating

- Great Customer Reviews

- Multilayer Security Protects IRA Digital Assets

- Excellent Resources for Learning About Cryptocurrency Investments

- Dedicated Digital Currency IRA Specialists

- Growing Selection of Digital Assets

- Easy IRA Setup & 401(k) Rollovers

- Works With Trust Custodians Equity Trust Company and Preferred Trust Company

- Well-Established Precious Metals IRA Specialist Sister Company, Birch Gold Group

Cons

- Somewhat Limited Choices of Digital Assets

How To Open A Digital BitIRA?

Opening a digital BitIRA is an easy and straightforward process. Here is the 4-step opening process:

- Step 1: Reaching out to BitIRA by filling out an online form will be your first step. This will give you access to a FREE guide on digital IRAs, where you can read up on everything you will need to know about adding cryptocurrencies to an IRA.

- Step 2: The next step is for a BitIRA representative to get in touch with you and discuss your investing objectives with you. Various legal factors must also be taken into account. BitIRA has a team of experts who are knowledgeable in every facet of retirement investing for these goals.

- Step 3: Then, together with a BitIRA specialist, you will choose your custodian.Note: BitIRA is not a custodian, but rather partners with a licensed IRA custodian that will be managing your digital IRA. This separate company will handle the paperwork surrounding your new IRA on an ongoing basis, as well as work with any existing or former custodians you might have.

- Step 4: Buy the digital assets you want to put in your IRA. As terrifying as this may seem, a BitIRA expert will take your hand and guide you through the entire process from beginning to end, as well as offer advice on which cryptocurrency to invest in.

Last but not least, accounts are often available in a matter of weeks, at which point you will have full freedom to use your IRA to invest in cryptocurrencies as you see fit.

Verdict: BitIRA Review 2025

Is BitIRA The Best Crypto IRA?

It’s challenging to imagine a different assessment when the overwhelming majority of BitIRA’s reviewers have awarded it top marks. The company excels in all aspects of IRA investment.

BitIRA seamlessly melded a well-established investment vehicle with a new asset class in a remarkable manner. Today, it stands as not only the premier provider of digital IRAs but also one of the finest IRA providers overall.

Whatever your retirement goals related to cryptocurrencies may be, BitIRA is poised to assist you in achieving them. Additionally, you can look to their precious metals division, which has maintained its top-ranking status since 2003, for an indication of what this relatively new company can deliver.

BitIRA doesn’t just offer what could be the best crypto or Bitcoin IRA; it also boasts some of the most exceptional customer support you’ll encounter.

Maintaining a formula that’s hard to surpass entails ongoing innovation, an unwavering commitment to customer education, and impressive ratings such as an A+ from the BBB and a AAA from the BCA. Being featured in the International Business Times’ Hottest Fintech Startups 2021 further solidifies their position.

In summary, in our estimation, BitIRA currently stands as the premier self-directed IRA for cryptocurrencies, and we wholeheartedly endorse the company to anyone seeking to diversify and grow their retirement savings through digital assets.

Free Digital IRA or 401(k) Guide