The investment landscape is a perpetually evolving environment, and as we march into 2024, the quest for financial growth continues to be at the forefront for many investors. From individuals planning for retirement to financial professionals mapping out their clients’ portfolios, understanding where potential growth lies is tantamount to successful investing.

This article explores diverse avenues for investment that show promise in the coming year. Whether you are a seasoned investor or charting your first course in the financial world, it’s crucial to consider where to allocate your capital to optimize for growth.

Top 10 Investments for Financial Growth in 2024

Here are the best investments for 2024 that are predicted to skyrocket during the coming years and can help you grow your wealth. Always remember to diversify your portfolio and put your money into different kinds of investments to limit your risk exposure and maximize your returns.

1. Stocks Keep Being Bullish

No surprise, stocks have long been the lifeblood of growth-oriented portfolios. Stocks maintain their impressive upward trajectory, building on last year’s positive momentum as the S&P 500 index crosses the threshold of 5,000.

No surprise, stocks have long been the lifeblood of growth-oriented portfolios. Stocks maintain their impressive upward trajectory, building on last year’s positive momentum as the S&P 500 index crosses the threshold of 5,000.

Analysts at UBS anticipate that the bullish trend will continue well, anchored by recent key indicators and a supportive broad economic scene. The driving forces behind this surge include a dynamic job market and an economy that’s growing at a rate beyond initial projections.

In 2024, look for companies with solid earnings growth, strategic market positioning, and innovative products like the global pharmaceutical company Eli Lilly and Company and Broadcom Inc. These qualities often signify a potential for a notable appreciation in share price. However, remember that stocks tend to be volatile and require risk tolerance.

2. Bonds Offer a Consistent Return

Bonds can serve as a counterbalance to the inherent volatility of stocks. While traditionally viewed as conservative investments, certain types of bonds—like high-yield or junk bonds—can contribute to portfolio growth.

Investing in bonds is widely regarded as a secure method to grow your wealth, offering a consistent return rate throughout a defined term. Among the array of choices, Treasury bonds stand out as a particularly dependable form of investment.

However, it’s worth noting that corporate and municipal bonds present engaging avenues for people who prefer to tread carefully while exploring different options.

3. Exchange-Traded Funds (ETFs) for Diversification

For those with an eye for diversification, ETFs (Exchange Traded Funds) offer exposure to a variety of asset classes, including equities, bonds, and sectors such as technology or health care.

Thematic ETFs focusing on trends like clean energy or robotics are becoming increasingly popular as they pinpoint strong growth in innovative sectors. However, they can have risks and may be more volatile than broader market ETFs.

4. Precious Metals Provide Security & a Hedge

In tumultuous economic times with high inflation, precious metals like gold and silver are often seen as safe havens.

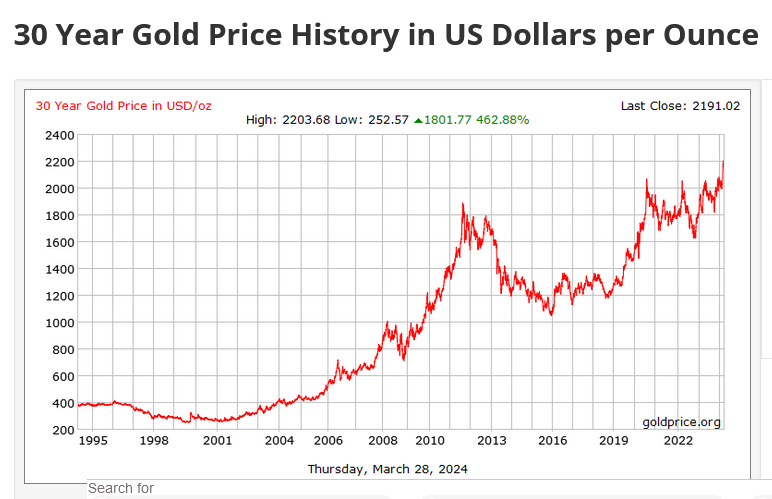

Although they don’t typically match the short-term growth of stocks or cryptocurrencies, gold has increased 462.88% in the last 30 years. Precious metals should be a part of a diversified growth strategy, especially through physical gold, ETFs, or stocks in mining companies.

However, keep in mind that gold stocks do not necessarily move in concert with bullion prices since mining companies succeed or fail based on their operating performance, and ETF companies are vulnerable, unpredictable, and controlled outside your hands.

However, keep in mind that gold stocks do not necessarily move in concert with bullion prices since mining companies succeed or fail based on their operating performance, and ETF companies are vulnerable, unpredictable, and controlled outside your hands.

When you invest in physical gold bullion through, for example, a gold IRA, this wouldn’t affect you directly as you are not relying on any third-party individual or company to look after your wealth for you. Instead, you are in control of your own wealth and financial growth.

Needless to say, we should always follow the money when investing for financial growth! Millionaire investors like Ray Dalio and Sam Zell believe gold is attractive as a store of wealth and a means of portfolio diversification.

Ray Dalio means, “In a world of ongoing pressure for policymakers across the globe to print and spend, zero interest rates, tectonic shifts in where global power lies, and conflict, gold has a unique role in protecting portfolios. It’s wise to hold some of what central banks can’t create more of.“

Ray Dalio Tweet

Learn how to protect your retirement like Chuck Norris

5. Real Estate Is Projected to Rebound

While the pandemic has certainly affected the real estate sector, forecasts indicate a robust rebound in 2024. Real estate investment remains a stalwart strategy for wealth accumulation, offering both a concrete asset and the opportunity for capital growth through appreciation and rental income revenue streams.

While the pandemic has certainly affected the real estate sector, forecasts indicate a robust rebound in 2024. Real estate investment remains a stalwart strategy for wealth accumulation, offering both a concrete asset and the opportunity for capital growth through appreciation and rental income revenue streams.

For those considering venturing into the real estate market, properties situated in areas showing signs of high demand, potential for growth, and strong rental returns should be at the top of your list. With predictions pointing towards a continued upswing in the housing market, your investment is poised to yield substantial long-term gains.

The real estate terrain, although shaken by recent global events, stands on the brink of a promising future. Now could be an opportune moment to harness its potential for your financial portfolio.

Additionally, consider Real Estate Investment Trusts (REITs) for a more liquid approach to investing in this market segment.

6. Cryptocurrencies Offer Extraordinary Growth Potential

The cryptocurrency market is noted for its volatility but also its extraordinary potential for growth. With increasing institutional acceptance and mainstream integration, select cryptocurrencies could represent high-growth opportunities in 2024.

The cryptocurrency market is noted for its volatility but also its extraordinary potential for growth. With increasing institutional acceptance and mainstream integration, select cryptocurrencies could represent high-growth opportunities in 2024.

Predominantly, Bitcoin stands out as a top-tier digital currency. Forecasters anticipate its worth to climb to an impressive $250,000 by the year 2024.

Venture capitalist Tim Draper said in an interview with Coin Bureau, “I would say that my number $250,000 will probably come pretty soon, so I’ll stick with $250,000 … I actually think that if it hits $250,000, it’ll go way past it.”

Tim Draper Tweet

Most Trusted Crypto IRA Company

4.6/5

- Location: Pasadena, California

- Founded in: 2021

- CEO: Guy Gostlak

- Products sold: Cryptocurrencies, Fractional Metals

- Review: Average review rating of 4.6

- Minimum Investment: $5,000 (can be lower for certain types of accounts)

FREE Crypto Investment Guide!

7. Commodities Typically Counter the Stock Market

Commodity investments can be a hedge against inflation and provide growth through physical goods such as agriculture, oil, energy, and materials. Their performance often counters the stock market providing diversification for investors.

It’s anticipated that the upward trend in commodity markets may make a return in 2024. Supply complications persist as the international community shifts from conventional energy forms toward renewable alternatives. The pace of this transformation is being hindered by geopolitical unrest around the globe, which, in turn, heightens the risks associated with supply and resource security.

A GlobalData poll found that gold, lithium, and copper are among the commodities set to see the greatest price increases in 2024.

8. Green Energy Could Yield Significant Growth

The green energy sector is set to expand as global efforts to address climate change continue. Investing in companies and technologies that support sustainable energy could yield significant growth as the world seeks greener solutions.

The green energy sector is set to expand as global efforts to address climate change continue. Investing in companies and technologies that support sustainable energy could yield significant growth as the world seeks greener solutions.

In addition, placing your investments with businesses leading in renewable energy sectors such as wind, solar, and hydropower—or opting for funds committed to sustainable ventures—represents a sound decision for individuals dedicated to making choices that are both eco-conscious and socially considerate.

9. Technology Is a Growth Engine

The technology sector is a growth engine, consistently pushing the boundaries of innovation. Within the technological sphere, domains such as cloud computing, artificial intelligence (AI), the Internet of Things, and cybersecurity are poised for significant expansion shortly.

Capitalizing on this potential growth by investing in tech-centric companies or a robust technology-focused exchange-traded fund (ETF) may prove to be a prudent financial move.

10. Health Care Will Never Go Out of Demand

An aging global population and advancing medical technologies make the healthcare sector another growth avenue.

An aging global population and advancing medical technologies make the healthcare sector another growth avenue.

Healthcare services and products will never go out of demand, and with the global health crisis in mind, 2024 is expected to see a rise in demand.

Biotechnology, healthcare technology, and pharmaceuticals are areas to watch for developments that might drive investment growth.

How to Invest for Growth: Conclusion

Investing for growth in 2024 requires a mix of strategic asset allocation and a willingness to adapt to changing conditions. It’s important to tailor your investment approach based on your individual risk tolerance, financial goals, and time horizon. Consultation with a financial planner can further help define the path that best suits your investment objectives.

With thoughtful consideration and an informed strategy, the opportunities for growth in 2024 are abundant across many sectors. Look to balance potential with security and prudence, and your investments can flourish in the year ahead.

Disclosure: This is not a financial advice article. Refer to a professional for financial advice.