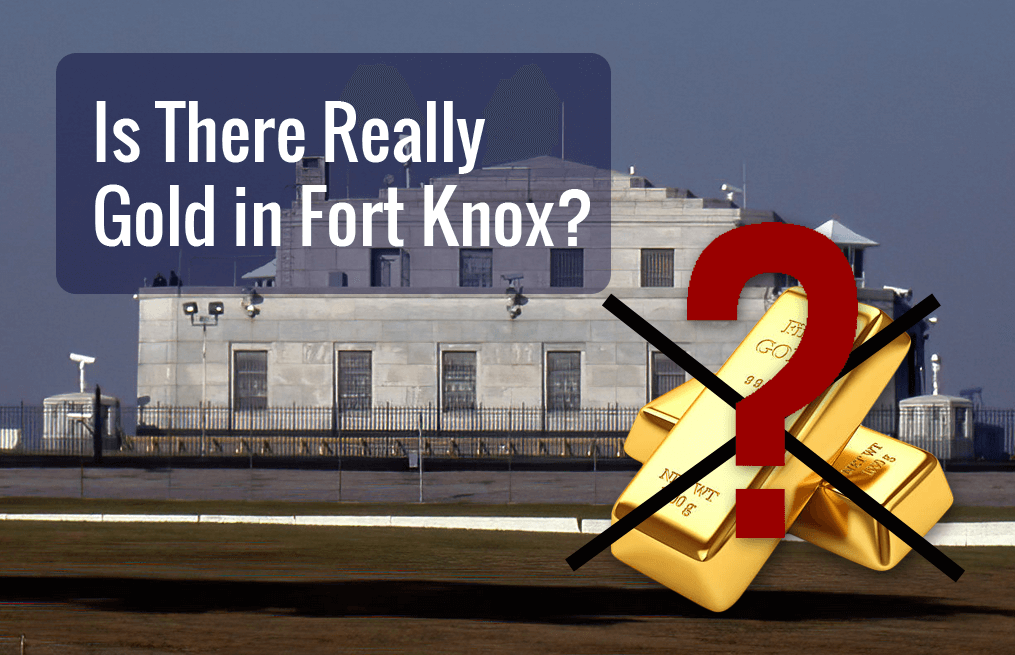

For decades, Fort Knox has been shrouded in mystery, fueling speculation about whether its gold reserves are truly intact. But what if the skeptics have a point? What if an audit uncovers a shocking truth—that the gold is missing or, worse, was never there?

The Audit That Could Rock Global Markets

On February 16, 2025, Elon Musk reignited the debate, publicly questioning the existence of the U.S. gold reserves. His comments quickly gained traction, prompting Senator Rand Paul to call for a full-scale audit—the first comprehensive inspection since 1953.

While the U.S. Treasury’s Office of Inspector General routinely verifies gold stored at the Federal Reserve Bank of New York (confirming 13.45 million troy ounces as of late 2024), Fort Knox remains an enigma. Without modern transparency, the world is left to wonder:

Is America’s most famous vault still brimming with gold, or is it a financial relic hiding an uncomfortable truth?

A full audit could send shockwaves through global markets. If the reserves are confirmed, it could silence critics for good.

But if the gold is missing, the consequences could be catastrophic—triggering a market meltdown and a crisis of confidence in the U.S. dollar. In this report, we break down the potential fallout from both scenarios.

Claim Your Gold While You Still Can

Request the Ultimate Gold & Silver Guide and learn how to protect your retirement savings with precious metals. *Shipping costs covered.

What If Fort Knox Is Empty? The Financial Earthquake That Could Follow

1. Immediate Market Shock

If an audit reveals an empty Fort Knox, the global financial system would be thrown into chaos. Headlines declaring “Fort Knox is Empty!” would send investors into a frenzy, igniting a historic gold-buying spree. Prices would surge past record highs as demand for physical gold skyrockets.

2. The U.S. Dollar Faces a Crisis

The dollar—already a fiat currency—would take a severe hit. Without gold backing even the perception of its value, trust in the U.S. financial system could erode overnight. A weakening dollar would drive inflation higher and push foreign investors to dump U.S. Treasury bonds, sparking a potential debt crisis.

3. Federal Reserve & Government Response

The U.S. government would be forced into damage control mode, with options ranging from:

- Denial & Reassurance – Officials could attempt to downplay the situation, urging calm in an effort to prevent panic

- Market Intervention – To restore confidence, the government might raise interest rates, sell off strategic assets, or even attempt to acquire gold at any price

- Drastic Measures – In a worst-case scenario, historical precedents like the 1933 gold confiscation under Executive Order 6102 could resurface, limiting private gold ownership

4. Long-Term Fallout: A New Monetary Order?

A missing gold reserve could mark a turning point for global finance. It might accelerate the transition away from fiat currencies, fueling interest in gold, Bitcoin, and other tangible assets. Nations skeptical of the dollar’s dominance could push for alternative reserve currencies, fundamentally reshaping international trade.

Would the exposure of an empty Fort Knox trigger the greatest financial scandal in history? If the gold is gone, the world may never be the same.

What If the Gold Is Still There? A Blow to Conspiracy Theories and Faith Restored

For years, skeptics have whispered that Fort Knox is a façade, its gold secretly depleted. But what if an audit proves them wrong?

If the vaults are opened and every bar of gold is accounted for, it would be a resounding victory for the U.S. government. Conspiracy theories would crumble overnight, and faith in America’s financial standing would be reinforced.

1. The End of a Financial Myth

The moment Fort Knox is verified as fully stocked, the decades-long speculation would be laid to rest. Gold skeptics, financial doomsayers, and conspiracy theorists would be left scrambling for alternative explanations. The U.S. Treasury could point to the audit as definitive proof that America’s gold reserves remain untouched.

2. Strengthening U.S. Economic Power

A confirmed gold reserve could solidify the U.S. position as a financial powerhouse. It might even spark discussions about returning to a gold-backed currency—a move that could reshape global trade dynamics. Countries that once questioned the dollar’s strength might find themselves reevaluating their economic strategies.

Could a Fort Knox audit change the course of financial history? Whether it confirms the reserves or exposes a crisis, the results could redefine the future of global markets.

Savvy investors know the importance of diversifying their investment portfolio with tangible assets like gold and silver in times of economic uncertainty. Historically, these assets have moved in the opposite direction to stocks and other paper assets.

Request this FREE Gold and Silver Guide to learn everything you need to know about precious metals investing.