Thank you for visiting our Goldco review for 2025. Goldco’s precious metals specialists have been assisting investors for years in utilizing a little-known exception to the regulations governing retirement accounts, which enables them to completely secure their retirement funds free from taxes and penalties.

In order to determine whether Goldco is a trustworthy firm, we have examined its precious metals IRAs, current verified customer reviews and ratings, complaints, products, annual fees, storage alternatives, buy-back program, pros & cons, and much more.

Best Gold IRA & Precious Metals Company

4.98/5

- A+ BBB rating & AAA BCA rating

- Average review rating of 4.9 on Trustpilot

- Stress-free and easy gold IRA set up

- Zero fees

- Highest buy-back guarantee

- Biggest promotions in the industry

- Unmatched customer service

Why Goldco?

Reasons To Choose Goldco As Your Precious Metals Company:

- Free Storage for Non-IRA Precious Metals

- Biggest Promotions in the Industry

- Unmatched Customer Service

- No High Pressure Sales Tactics

- Outstanding Ratings & Customer Reviews

- FREE and Easy IRA & 401(k) Rollovers

- A+ BBB Rating and AAA BCA Rating

- Highest Buy-Back Guarantee

- Money.com 2025 Best Customer Service

Current Promotions

- Get Up to $10,000 In FREE Silver (For Qualifying Purchases)

- Get FREE IRA Fees (For Qualifying Purchases)

- Free Shipping and Storage on Non-IRA Metals

Goldco

24025 Park Sorrento, Suite 210, Calabasas, CA 91302 www.goldco.com

Products Available:

- Bullion Bars

- Bullion Coins

- Self-Directed IRA

- Cash Sales of Precious Metals

Goldco Reviews And Ratings

In this Goldco review for 2025, we have investigated what consumers have to say about Goldco, as well as the company’s accreditations from the BBB and BCA to make sure investors are working with a reputable gold IRA investment firm.

Prior to investing money in anything, including stocks, bonds, cryptocurrencies, gold, or silver, it is imperative to conduct thorough research.

Thankfully, the Internet makes it challenging for any corporation to hide. Customers can express their complaints or compliments about the gold IRA companies online.

Goldco has outstanding customer ratings and is still highly regarded in its field despite being in operation for almost two decades.

Recent Verified Goldco Customer Reviews

Laurie Burket

- Verified Customer

Gold Co: Exceptional Service from Start to Finish

My experience with Gold Co was fantastic from beginning to end. The service was incredibly personalized, perfectly suited to my needs, and handled with the highest level of professionalism. I’m thrilled with the outcome and look forward to utilizing their services for years to come—highly recommend!

Reviewed on: Mar 12, 2025

Lyric Turner

- Verified Customer

Reviewed on: Feb 24, 2024

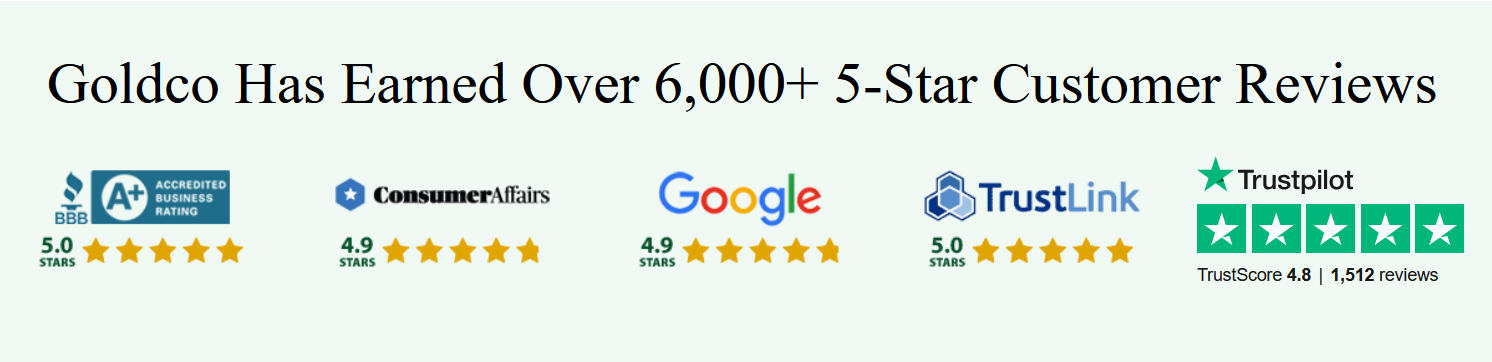

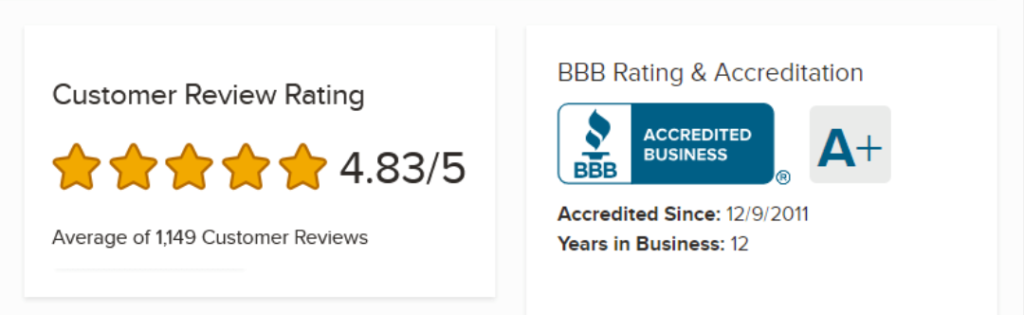

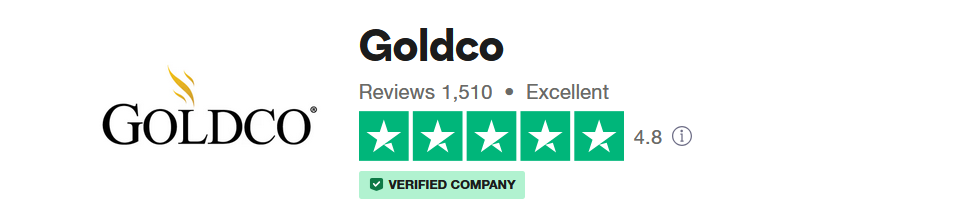

Here’s an overview of Goldco’s BBB and BCA ratings, plus customer reviews from the most popular review sites:

Goldco BBB Ratings & Customer Reviews

- A+ Rating by the Better Business Bureau (their highest rating) and a 4.83 of 5-star rating based on 1149 customer reviews

- AAA Rating by the Business Consumer Alliance (their highest rating) and a 4.8 of 5-star rating based on 1555 customer reviews

- 2,920 Total Reviews With a 4.9 Average Star Rating on Google

- 254 Total Reviews With a 5 Star Average Rating on Trustlink

- 1688 Total Reviews With a 4.8 Average Star Rating on Consumer Affairs

- 1587 Reviews with 4.9 Average Star Rating on TrustPilot

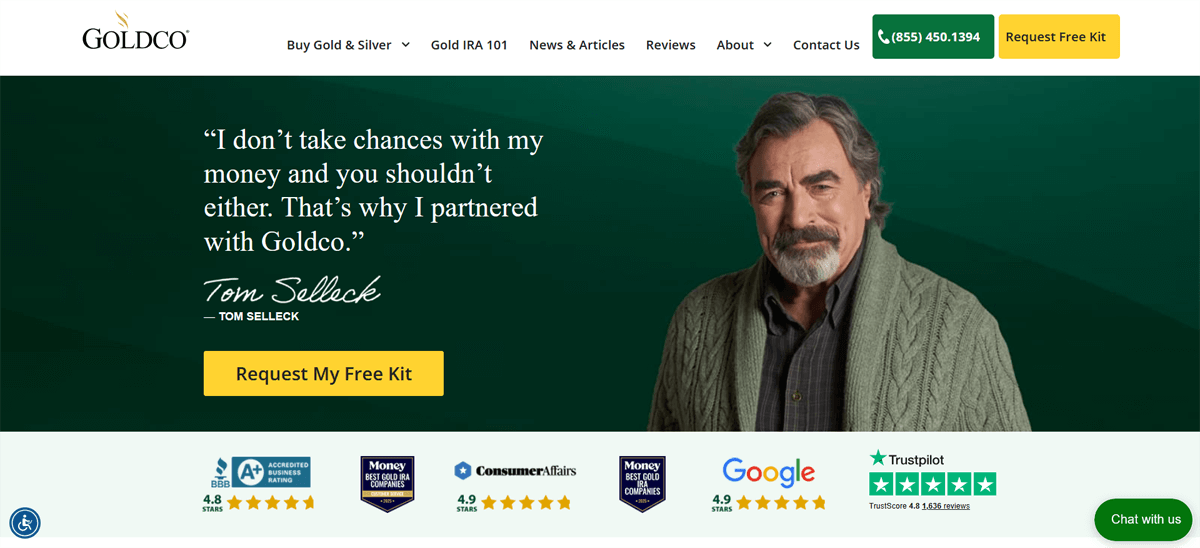

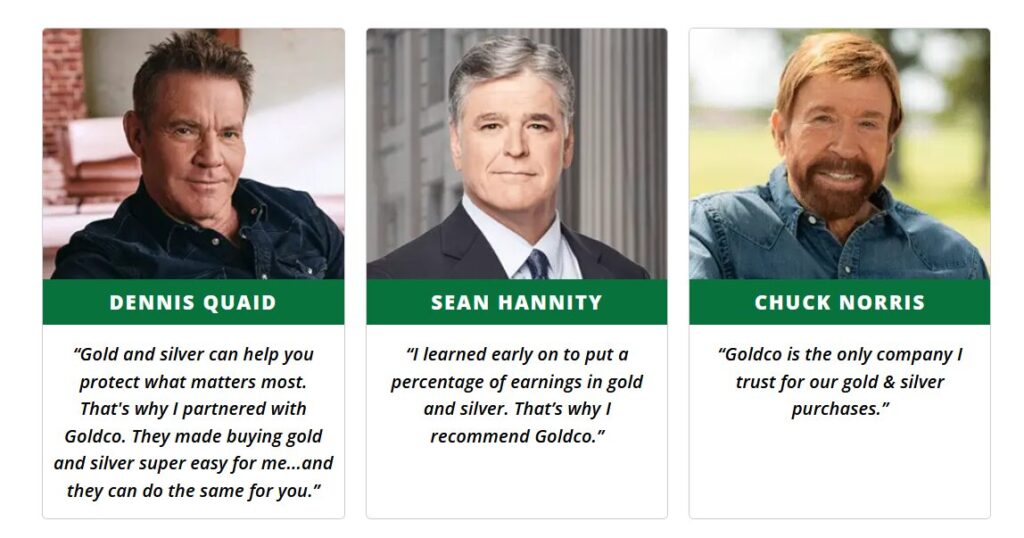

- Sean Hannity, Chuck Norris, and Dennis Quaid also endorsed Goldco as the precious metals company they recommend (see celebrity endorsements below)

What Is Goldco?

Goldco is the leading precious metals company in the US and is also ranked our #1 precious metals and gold IRA company. Trevor Gerszt has successfully been running Goldco for over a decade now.

The company, headquartered in Calabasas, California, is a full-service precious metals company specializing in gold or precious metals IRAs. They also directly sell precious metals coins and bars to customers and provide the highest buy-back price guarantee on the market.

“Our goal is to make gold and silver investments easy, seamless, and secure.” – Trevor Gerszt, CEO of Goldco

With over a decade of experience, the company has assisted thousands of individuals in diversifying, growing, and safeguarding their wealth with physical metals like gold, silver, platinum, and palladium.

Goldco’s Mission Is To Help Americans Protect & Secure Their Retirement Savings

Goldco Honors & Awards

As the top gold IRA company in the US, Goldco has earned numerous accolades and awards, including:

- Goldco was honored as the Company Of The Year in the 2024 American Business Awards

- They were also awarded Money.com 2025 Best Customer Service

- Goldco is ranked no. 317 on the 2024 Inc. 5000 List

- Inc. Magazine named Goldco the third fastest-growing financial service company in the US in 2015.

- And the Los Angeles Business Journal named it the 17th fastest-growing company in the greater Los Angeles Aream

- In 2021, Goldco and New Zealand Mint announced the release of the 2021 Chuck Norris 1 oz. silver coin

- And they also won the 2024 Stevie Awards

Goldco Celebrity Endorsements

Goldco has been endorsed by celebrities like Sean Hannity, Chuck Norris, and Dennis Quaid. They all support the business’ expansion activities to inform individuals about the advantages of purchasing gold and silver as well as the protection that actual precious metals provide for IRA, 401(k), TSP, and pension accounts.

They claim to refer Goldco to their friends and family as the gold and silver supplier.

For example, Sean Hannity is an American talk show host, author, and conservative political analyst, who means,

“I learnt early on to deposit a percentage of earnings in gold and silver. Because of this, I suggest Goldco.”

And Chuck Norris, an American actor and martial artist, also says that,

“Goldco is the sole reliable source for gold and silver.”

NEW YORK, NY – MAY 11: Sean Hannity appears on FOX News Channel’s “Hannity” at FOX Studios on May 11, 2015 in New York City. (Photo by Rob Kim/Getty Images)

Who Is Goldco Best For?

Goldco is a great choice for many types of investors, including those who:

- Want to diversify parts of their IRA, 401(k), TSP, or other pension accounts with gold, silver, or other precious metals.

- Want to own a physical asset. Contrary to corporations, which can cease to exist at any time, precious metals have always existed and always will. Therefore, precious metals need to be your first pick if you desire a physical asset in your investing portfolio that has never, to date, lost all of its worth.

- Investors who want to protect their wealth from stock market volatility and inflation. If the stock market gives you the willies, you should diversify your investment portfolio with precious metals to lower your risk. Usually, traditional securities move in the same direction as gold and silver, not the other way around. In this approach, you can use gold and silver to weather market downturns until the cycle turns around. Of all assets, it has only had the greatest long-term growth.

- People who are nearing retirement and fear the looming recession. Consider the financial crisis of 2008 and the current one brought on by the Covid fallout. Financial analysts foresee a new recession, and precious metals can provide stability and financial insurance when you need it most.

If you’re ready to take action

Goldco Gold IRA: Products

Let’s look at Goldco’s products now that we are aware of what Goldco is and who they are best suited for. Goldco offers two major services or products: precious metal IRAs and direct purchases:

1. Non-IRA Precious Metals

Through the company, any investor may purchase precious metals – no specific age nor source of income is required.

When purchasing precious metals outright, you can choose whether to store them in a safe vault or have them delivered to your house. Even the shipment of your precious metals is free at Goldco.

You can learn more about how to invest in gold in this gold investing guide.

2. Precious Metal IRAs

Goldco is an expert in managing IRAs for precious metals. Their precious metals professionals will take care of 95% of the paperwork for you and will guide you through each stage of the simple and stress-free IRA creation process that they offer.

You can open a gold IRA or precious metals IRA with the same tax benefits as a standard IRA (if you have earned money and are younger than 70½ years old).

Per IRS regulations, Goldco stores IRA precious metals in a third-party, state-of-the-art vault. They use Equity Trust Company as its preferred IRA custodian.

3. Traditional-Based IRA Vs Roth-Based IRA

3.1 Traditional-Based Gold IRA

Your contributions to a traditional IRA are tax deductible (within certain income parameters). When you start taking distributions from your gold IRA, the amounts withdrawn are taxable as ordinary income. At age 59½, you can begin receiving distributions without incurring penalties.

For those who believe that they will be in a lower tax bracket in retirement, traditional IRAs can be a viable option.

By doing this, people can take advantage of tax breaks on their contributions made while they were working and in a higher tax band, and then pay taxes on withdrawals at a lower rate after retiring.

You should be aware that required minimum distributions (RMDs) apply to conventional IRAs, including traditional gold IRAs. This suggests that beginning at taking annual distributions from your IRA starting at the age of 72.

3.2 Roth-Based Gold IRA

With a Roth gold IRA, in contrast to a standard IRA, your contributions are NOT tax deductible. This indicates that you will not receive any tax benefits from your account contributions while you are an employee.

As opposed to a standard IRA, a Roth IRA does not require you to pay taxes on distributions made from the account.

If a person believes their current tax level is lower than their future retirement tax bracket, they may want to consider a Roth IRA as a wise investment.

When people make contributions while they are still employed, they will not be taxed, but when they make withdrawals in retirement, they won’t be taxed at all.

A Roth IRA does not have a requirement for minimum distributions either. Additionally, as of 2025, you cannot contribute to a Roth IRA if your modified adjusted gross income is greater than $150,000.

Please be aware that the parameters supplied here for both regular and Roth IRAs are very broad. Before choosing between a traditional IRA and a Roth IRA, you should consult your tax expert to ensure that you are making the best decision possible for your particular situation and tax profile.

We’re willing to bet that by this point you’re curious about Goldco’s annual fees and transaction minimums, so let’s move on to that. In general, Goldco’s pricing structure for its precious metal IRAs is competitive.

Goldco Gold IRA Fees

Goldco’s preferred Custodian charges a flat annual account service fee which includes a one-time IRA account set-up fee of $50, as well as a $30 wire fee. Annual maintenance is $100, and storage is $150 for segregated storage or $100 for non-segregated storage.

Fees for gold storage and custodianship can vary depending on the company you select to handle these services (required by the IRS, as all IRA assets must be managed by a custodian). Depending on the Custodian, storage fees can range from $10 to $60 per month, or as a percentage of assets, from 0.35% to 1% annually. Goldco does not charge any storage fees for cash transactions over $25,000.

Goldco Investment Minimums

Do you wonder how much money you need to invest with Goldco? The chart below lists the minimum investments for IRA and non-IRA transactions (cash sales):

Goldco Investment Minimums

Precious Metal IRAs

$25,000

Non-IRA Transactions (Cash Sales)

$10,000

If you’re ready to take action

Popular Goldco Gold Coins & Silver Coins

Let’s now take a look at some popular gold and silver coins offered by Goldco.

Investors often opt for certain tried-and-true assets within their IRAs. These assets not only comply with the IRS regulations but also symbolize the finest quality, such as gold and other precious metals.

Among the notable choices are American Eagle gold and silver coins, which offer a diverse selection and consistently replenish IRA portfolios.

Here is a sample of popular Goldco gold coins and silver coins for IRA and non-IRA purchases:

Gold Coins

- Gold American Bald Eagle Coin

- Gold American Eagle Proof

- Gold American Eagle Coin

- Gold Buffalo Coin

- Gold Maple Leaf Coin

- Gold Lucky Dragon Coin

- Gold Australian Saltwater Crocodile Coin

- Royal Mint Gold Lunar Series: 2017-Year of the Rooster Coin

- Royal Mint Gold Lunar Series: 2018-Year of the Dog Coin

- Royal Mint Gold Lunar Series: 2019-Year of the Pig Coin

- Numerous PAMP Suisse and Perth Mint gold bars of various sizes

Silver Coins

- Silver American Bald Eagle Coin

- Silver American Eagle Coin

- Silver American Eagle Proof Coin

- Silver Lucky Dragon Coin

- Silver Maple Leaf Coin

- Silver World War I Coin

- Silver WWII Victory Coin

- Silver Australian Saltwater Crocodile Coin

- Royal Mint Silver Britannia Lunar Series: 2015-Year of the Ram Coin

- Royal Mint Silver Britannia Lunar Series: 2016-Year of the Monkey Coin

- Royal Mint Silver Britannia Lunar Series: 2017-Year of the Rooster Coin

- Royal Mint Silver Britannia Lunar Series: 2018-Year of the Dog Coin

- Royal Mint Silver Britannia Lunar Series: 2019-Year of the Pig Coin

Additionally, bars from reputable refineries of all four precious metals are other popular additions.

Goldco Offers The Highest Buy-Back Guarantee

Goldco offers the highest buy-back price guarantee, allowing investors and retirees to sell their precious metals and receive a better deal than from other coin dealers.

What Are The Criteria For The Buy-Back Program?

When it comes time to sell your metals, Goldco will request that you give them first dibs (you will almost certainly get a better price from Goldco than a random coin dealer or broker who usually tries to make a lowball offer). You are not compelled to return your metals to Goldco, though. You get to decide that.

Goldco’s Storage Options

Here’s some important information about storing precious metals. Non-IRA metals can be kept at home, but IRA metals need to be stored in an IRA-approved depository, like a high-tech vault. Goldco can help you transfer any gold or silver bullion you buy to a secure vault.

Goldco offers various storage companies, but they highly recommend the Delaware Depository. They have a fortified facility with Class 3 vaults and insurance from Lloyd’s of London underwriters. They also have top-notch electronic security.

Additionally, two more options are Brinks in Salt Lake City and IDS in Dallas, Texas. The Dallas facility is the only one to offer segregated storage.

But if you’re not satisfied with the partner facilities Goldco provides, you’re free to choose another depository.

Is A Goldco Gold IRA A Safe Investment?

A Goldco gold IRA is an investment that provides security and protection for investors and retirees. And with over a decade of experience helping Americans safeguard their retirement funds, Goldco has gained a strong reputation with more than 6,000 5-star reviews on consumer watchdog websites.

Why choose a Goldco gold IRA for investment security?

First, a precious metals specialist at Goldco will guide you through the entire process of setting up your new IRA, ensuring a smooth and hassle-free experience.

Second, your precious metals investments will be securely stored with a custodian, just like any other IRA asset. Gold IRA custodians are experts in storing precious metals and have secure vaults to keep them safe.

Furthermore, custodians carry insurance to protect your investments in the unlikely event of theft or destruction. This means that even if something were to happen, your investments would be made whole.

Because of this we feel 100% comfortable saying that opening up a precious metals IRA with Goldco as your choice of gold IRA company is completely safe.

If you’re ready to take action

Easy And Stress-Free IRA & 401(k) Rollovers

You might be wondering, what about my current retirement plan? Your current retirement plan is not a concern because Goldco makes the rollover procedure simple and pleasant.

Here is the procedure in brief:

- Your old/current IRA can be used to fund your new Goldco gold IRA with the assistance of a precious metals specialist

- When the funds from your previous IRA transfer, a precious metals expert at Goldco can assist you in choosing precious metals in accordance with your demands and financial objectives

- When all is said and done, you will be taken through each phase, which typically takes about 10 business days

It’s really a quick and pain-free process!

For more information, check out How To Buy Gold With Your 401(k) – Complete 2025 Guide or request the >>>FREE 2025 Gold & Silver Guide.

Now that you are aware of your storage options, let’s discuss the advantages and disadvantages of Goldco.

Pros And Cons Of Goldco

To give you a quick recap, here are some pros and cons of Goldco:

Pros

- Zero IRA Fees & No Investment Minimums

- Free Storage for Non-IRA Precious Metals

- Biggest Promotions in the Industry

- Unmatched Customer Service

- No High Pressure Sales Tactics

- Outstanding Ratings & Customer Reviews

- FREE and Easy IRA & 401(k) Rollovers

- A+ BBB Rating and AAA BCA Rating

- Highest Buy-Back Guarantee

- 2024 Company Of The Year Award

Cons

- Cannot Set Up an Account Online, Just Request a FREE Gold & Silver Guide

How To Start A Goldco Precious Metals IRA

If you believe that precious metals are right for you, the quickest approach to open a Goldco precious metals IRA is to complete an online application. A gold IRA precious metals specialist from Goldco will then get in touch with you.

Investors are required to provide their personally identifying information, including their social security number, in order to initiate the account opening process. Furthermore, if you do not have an existing account with one of Goldco’s recommended precious metals custodian businesses, they will assist you in setting up one.

As part of the setup procedure, Goldco will send you a comprehensive booklet either via email or mail that outlines all the available precious metals options. This free guide will provide you with all the necessary information to make informed decisions about the types of metals you wish to invest in.

With that, let us take a look at the simple 3-step gold IRA opening process next.

Simple 3-Step Gold IRA Opening Process

To get started opening a gold IRA or precious metals IRA with Goldco is easy. This is the setup process in short:

Sign Your Agreement

You must read, accept, and sign a standard customer agreement in order to protect your purchase of precious metals and to acknowledge your understanding of Goldco's business policies.

Fund Your Account

Goldco gives you a couple choices for funding your account, including mailing a check to their Los Angeles headquarters or sending money via bank wire. They will even give you a FedEx mailing label if you would rather pay by check, enabling you to expedite your precious metals purchase at no additional expense.

Select Your Precious Metals

It's time to start considering which precious metals to deposit to your account once you have money in it. You get to choose, and Goldco takes care of shipping after that. Additionally, you have the option of having your coins transferred directly to you, to an independent, insured depository, or even to someone who qualifies for free storage.

As simple as that!

It’s easy to open a precious metals IRA, and the entire procedure takes about 10 days. Plus, the precious metals experts at Goldco will guide you through the entire procedure and assist you with the paperwork.

Next, we will delve a little deeper into the reasons why investing in precious metals is a wonderful strategy to protect your wealth if you are still unsure about it.

Why Invest In Precious Metals?

Every day Americans are experiencing the impact of inflation, war, high gas prices, and the Fed’s interest rate increases. Moreover, millions are witnessing their retirement savings diminish as the stock market is volatile.

A recession is on the horizon as the Fed struggles to keep inflation in check. A global recession is now 98% certain, according to the research firm Ned Davis. Many Americans are shifting their money out of the stock market and into safe-haven assets, such as actual gold and silver, as a result of the possibility of new stagflation.

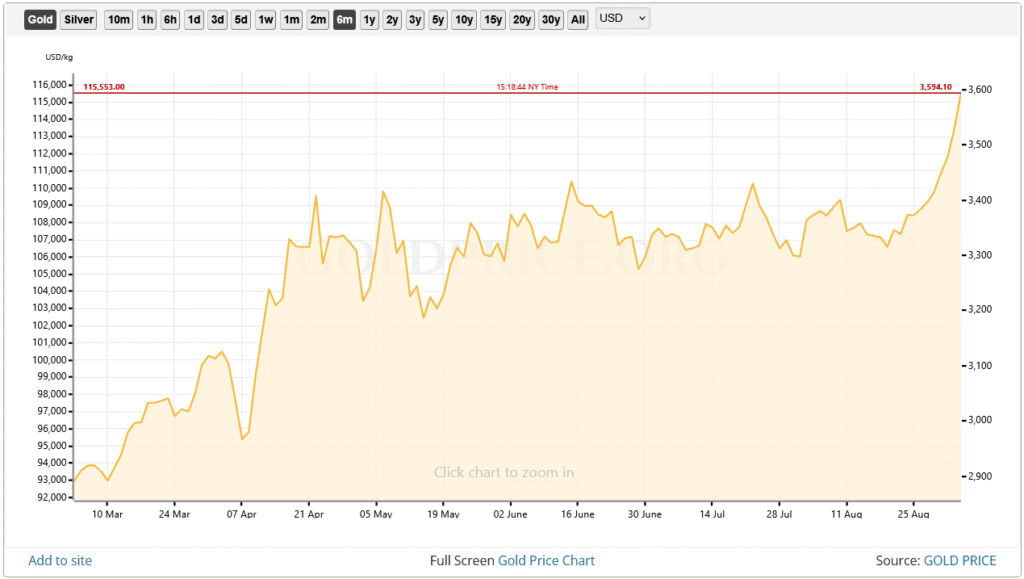

The global spot price of gold has risen significantly over the past 30 years, which shows it’s an asset class investors can rely on:

The precious metals market is also projected to hit $403.08 billion in 2021-2028 and shows a CAGR of 5.6%. And central banks keep stocking up on gold as North America is currently storing 813,962.69 US$m worth of gold according to World Gold Council’s data, which is a sign they fear what’s coming next.

2025 Gold Price Prediction

According to Samantha Dart, co-head of commodities research at Goldman Sachs, gold prices could soar to $4,000 an ounce in 2025. This already happened in February!

Additionally, Ole Hansen, a renowned commodity expert from Saxo Bank in Denmark has predicted that gold prices could reach an all-time high of $4000 per ounce. Should markets conclude global inflation will continue to rise despite the monetary tightening, Ole believes the golden metal is set for gains!

Lastly, billionaires like Thomas Kaplan and Jeff Gundlach believe gold can be headed to $3000 to $5000 per ounce. The future is looking good for the yellow metal.

Now, let’s look at what precious metals can do for you.

What Precious Metals Can Do For You!

Precious metals will help you:

- Hedge against a weaker dollar, the CBDC, and inflation

- Protect from stock market volatility

- Limit exposure to economic uncertainty and Trump tariffs

- Mitigate the effects of geopolitical instability

- Diminish negative fallout from the coronavirus economic crisis

- Diversify your portfolio

- Take private ownership of your financial future

It is more crucial than ever to look to safe-haven assets in order to protect and potentially even increase your money during these unpredictable times.

More significantly, gold has never lost value and is a tangible item you can possess. Precious metals stand on their own and serve as a store of value in contrast to equities, bonds, and mutual funds, which are all correlated to the dollar.

Furthermore, investors have the legal right to hold and store gold and silver outside of the banking or financial systems, reducing governmental oversight.

For more information, check out 4 Secrets to Safeguarding Your Savings With Precious Metals in 2025:

Why A Gold IRA Or Precious Metals IRA?

When planning for retirement, it’s important to consider the potential limitations of traditional IRA investments. Economic uncertainties and the possibility of a declining dollar may jeopardize your savings. As a result, many investors seek out IRAs that can withstand such challenges. Gold, in particular, has proven to be a resilient and safe investment over time.

A gold or precious metals IRA allows investors to diversify their retirement portfolio by owning physical gold and other metals. This option extends to existing IRAs and previous 401(k)(s) from past jobs. Additionally, investors can securely hold physical precious metals within a tax-deferred account.

One notable advantage is the availability of a Roth gold IRA, which functions similarly to a regular Roth IRA. With a Roth gold IRA, investors can contribute after-tax money, accumulate tax-free gains, and withdraw tax-free payouts. The key difference is that a Roth gold IRA invests in tangible assets like physical gold and other precious metals.

To truly invest in precious metals, the ability to take physical delivery of them is crucial. Otherwise, you would be making paper investments that may lose value in the event of a declining dollar.

However, if you have a gold IRA and are at least 59½ years old, you have the option to receive your dividends in cash or physical precious metals.

What To Watch Out For!

There will, regrettably, always be con artists. We want to let you know what to watch out for when investing in gold or silver because of this.

Beware of sales tactics and assertions that you can keep your metals in your home-based gold IRA. We have not yet seen evidence that it would follow IRS regulations and might incur penalties.

Additionally, a gold dealer is not acting in your best interest if they advise you to put all of your money into precious metals. Make sure they only suggest investing portions of your portfolio because the main point is to diversify your holdings.

Fortunately, you can relax knowing that Goldco’s precious metals specialists will carefully analyze your long-term investing goals and suggest the best course of action for you.

Goldco Customer Service

Goldco has associates ready to answer any questions you may have or help you with account-related issues.

The company’s normal business hours are:

Monday to Friday:

5:00am to 7:00pm (PST)

Saturday:

6:00am to 4:00pm (PST)

If you need any assistance, you can fill out and submit an online contact form and one of Goldco’s precious metals specialists will contact you within 24 hours.

Goldco Review 2025 Verdict: Is Goldco Legit?

The conclusion of our Goldco review for 2025 is that Goldco keeps proving itself to be the best and most reliable supplier of gold IRAs and precious metals.

Firstly, Goldco is dedicated to providing exceptional customer service and a seamless IRA rollover experience, completely free of charge. They have a team of IRA Specialists who will guide you through the entire process. Also, if you opt for a cash sale, an account executive will ensure prompt delivery of your precious metals with no shipping fees.

Secondly, Goldco truly offers a “white glove service” with knowledgeable representatives who provide expert assistance from start to finish. Their outstanding customer service has garnered widespread satisfaction.

With low annual fees, a buy-back guarantee, and top ratings from the Better Business Bureau and Business Consumer Alliance, Goldco is the best and safest option for opening a gold IRA.

Moreover, Goldco has established strategic partnerships with reputable custodians and depositories to ensure the security of your metals. In recognition of their excellence, Goldco was named Company of the Year in the 2024 American Business Awards.

Based on our assessment, Goldco goes above and beyond to ensure complete customer satisfaction with their investment.

That said, if you are thinking of rolling over a retirement account to IRA-approved gold and silver coins, then Goldco should be first on your call list! >>> Get Your FREE 2025 Gold & Silver Guide Now!

>>Or, see if you qualify for Goldco’s special promotion of up to $10,000 in FREE silver here!<<

Goldco FAQ

Is Goldco a legit precious metals and gold IRA company?

Goldco has over ten years of experience assisting customers with investments totaling over $1 billion in gold and silver. What’s best? Its secure storage alternatives are supported by nationally renowned insurance providers, guaranteeing the security of your precious metals.

Goldco can assist you whether you’re interested in starting a precious metals IRA or just buying gold or silver.

What types of precious metals does Goldco offer?

Goldco provides proofs, coins, and bars of gold and silver. Palladium and platinum are not available. You can look at the following precious metals firms if you wish to invest in platinum or palladium.

What is the minimum investment required for Goldco?

Goldco’s investment minimums are $25,000 for IRAs and $10,000 for cash sales.

How much are Goldco’s annual fees in total?

Goldco doesn’t charge any fees for starting a gold IRA with them. However, there will be custodian and storage fees of $280-$330 depending on if you choose segregated or non-segregated storage for your precious metals.

How do I roll over my IRA or 401(k) to Goldco?

If you want to expand your retirement savings portfolio securely and with tax advantages, rolling over your 401(k) or retirement account to an IRA through Goldco is a fantastic option.

The process is simple. First, you’ll need to contact Goldco for an account application. Once you’ve been approved for an account, Goldco will support you throughout the transfer process.

No need to stress, they’ll just ask for some basic information about your current retirement plan, such as the account number, the name of the current custodian, the amount of funds available in the plan, and the type of retirement account you’re interested in rolling over.

Can I take physical possession of the gold in my IRA?

As the proud owner of your IRA, you can rest easy knowing that your precious metals are safely and securely stored in a top-of-the-line depository. And when you reach the age of 59 ½ and become eligible for distributions, you’ll have the exciting option to withdraw your funds in either cash or physical metals.

For more information about the rules and regulations, visit our article Can I Take Physical Possession Of Gold In My IRA?

What are the potential risks of investing in precious metals?

It’s important to take risks into account when investing in precious metals. The value of your metals may change depending on market conditions, just like any other investment. It’s a rollercoaster ride that’s thrilling as your fortune increases and tense as it declines.

You should always conduct your research before choosing to invest in any asset class as these investments do not produce any income as they just represent a tangible asset rather than an income source. You might begin by >>> requesting this Free Gold & Silver Guide to learn more.

Is everyone eligible for a precious metals IRA?

Yes, anyone who has earned income qualifies to open a precious metals IRA. It’s a great option for anyone with earned income looking to secure their financial future.

Goldco Alternatives

Lastly, we have analyzed and ranked the best gold IRA companies for 2025 if you want to do a little more research before deciding on a provider for your gold IRA.