If you’re looking for insights on whether an Augusta home storage gold IRA is a safe and legal investment, or if there’s a better option out there, you’re in the right place.

Investing in gold and silver IRAs is gaining popularity among investors as a way to diversify their portfolios. Similar to traditional IRAs, withdrawing funds from gold IRAs can seem complex, and there may be tax considerations to keep in mind.

In this article, we’ll delve into Augusta’s home storage gold IRA, exploring its safety and legality, while also discussing the potential tax implications. Stick around as we present you with an alternative that might just suit your needs even better.

Is An Augusta Gold IRA A Good Investment?

Investing in an Augusta Precious Metals Gold IRA can be a strategic step for investors aiming to protect and diversify their retirement savings. Augusta offers the opportunity to incorporate physical gold and silver into tax-advantaged retirement accounts, which may help counter the impact of market fluctuations and economic uncertainty.

By allocating funds towards precious metals, investors can reduce their reliance on traditional investment avenues like stocks and bonds, which are susceptible to market downturns. Augusta Precious Metals prides itself on fostering a transparent and informative experience, distinct from fear-based sales tactics employed by some competitors.

Notably, the company holds an impressive A+ rating from the Better Business Bureau and has garnered accolades from industry leaders, including advisors to the likes of Joe Montana. Investing in an Augusta Gold IRA presents investors with a compelling opportunity to diversify their portfolios and fortify their financial futures.

Augusta Home Storage Gold IRA

You might be wondering if is it possible to have a home storage gold IRA? Well, technically it is. You can set it up by establishing an LLC and meeting specific criteria. But here’s the catch: you can’t store the precious metals in your own residence. They must be securely held in a registered depository location under the LLC’s name.

Now, it’s essential to note that Augusta Precious Metals doesn’t directly offer home storage gold IRAs. However, they can provide valuable information and resources for investors considering this option. Keep in mind that the IRS enforces strict rules and regulations for home storage gold IRAs, and failing to comply can result in significant tax penalties.

Typically, the physical storage of precious metals in a gold IRA is managed by third-party, IRS-approved storage facilities. These facilities can be located across the United States or even internationally, depending on the partnership between your chosen gold IRA provider and the storage facility.

The only gold IRA company we know in the US that offers home storage IRA is American Coin Co. We recommend that you contact them or your tax advisor for more information about storing your gold/silver IRA at home.

Gold IRA Rules & Regulations

The IRS regulates gold IRAs, just like a silver IRA or any other IRA, and requires that they be stored with an IRS-approved entity. These entities include banks, credit unions, trust companies, and, most commonly, depositories. As per the IRS regulations, the entity that holds the silver IRA must be both an IRS-approved custodian and a non-bank depository.

Although the IRS does not explicitly prohibit investors from storing gold IRAs at home, it is not advisable for several reasons. Firstly, it is more challenging to ensure that your precious metals are secure from theft or damage at home than it is in a safe deposit box or depository.

Secondly, if the IRS discovers your gold IRA is not being held with an approved entity, the penalty can be severe. You can lose your tax benefits and be hit with penalties and interest.

Lastly, most insurance companies do not cover precious metals stored at home, so you would have to spend extra cash on more expensive insurance policies.

FREE Gold IRA Guide!

Home Storage Gold IRA Possible Penalties

Investors are increasingly drawn to gold and silver IRAs to diversify their investment portfolios. Similar to traditional IRAs, withdrawing funds from gold IRAs can be daunting and may have tax implications. However, it’s vital for investors to understand the distinctions between gold IRAs and traditional IRAs.

One of the key aspects to consider when withdrawing funds from gold IRAs is the substantial penalties associated with early withdrawals. This is because precious metals investments, like gold, can be more volatile compared to stocks and bonds.

As a result, individuals with gold IRA accounts need to exercise caution when contemplating an early withdrawal, as the penalties can be significantly higher than those related to traditional IRAs.

Let’s take a closer look at the possible tax implications of a home storage gold IRA.

Tax Implications Of A Home Storage IRA

Investors must grasp another crucial aspect involving tax-deductible retirement accounts like gold and silver IRAs. When withdrawing a particular portion of their funds, account holders must be aware of the taxes they need to pay. It is imperative to understand the tax consequences of withdrawing from a gold IRA to avoid unnecessary penalties and ensure compliance with the Internal Revenue Code (IRC).

Moreover, investors should keep in mind that early withdrawals from a gold IRA may result in a 10% penalty. Nevertheless, certain circumstances, such as disability, specific medical expenses, or education expenses, may qualify account holders for penalty-free withdrawals.

By comprehending the regulations and unique penalties associated with gold and silver IRAs, investors can make informed decisions about their investment portfolios and effectively manage potential tax implications.

FREE Gold IRA Guide!

What Is Augusta Precious Metals?

Augusta Precious Metals, an investment firm specializing in precious metal investments, was established in 2012 by CEO Isaac Nuriani. Since its inception, the company has strived to become the go-to source for investors looking to diversify their portfolios with precious metals.

Augusta Precious Metals, an investment firm specializing in precious metal investments, was established in 2012 by CEO Isaac Nuriani. Since its inception, the company has strived to become the go-to source for investors looking to diversify their portfolios with precious metals.

Headquartered in Wyoming, the company is particularly renowned for assisting customers in setting up gold Individual Retirement Accounts (IRAs) across the United States. Over the course of 11 years, Augusta Precious Metals has earned a well-deserved reputation as a leader in the gold IRA market, continuously receiving accolades from customer watchdogs and independent review sites.

With powerful endorsements from notable figures such as Mark Levin and Joe Montana and thousands of satisfied customers, Augusta Precious Metals has rapidly gained popularity as a trusted brand in the industry. Moreover, the investment firm holds an impressive A+ rating from the Better Business Bureau (BBB) and an AAA rating from the Business Consumer Alliance (BCA).

Last but not least, Augusta Precious Metals has taken a proactive approach to educating customers and protecting them from potential scams and risks. With various educational materials such as “Avoid Gold IRA Dealer Lies, Gimmicks & High Pressure Tactics” and “What is Stagflation?” the firm has shown a willingness to help customers make informed and secure investment decisions.

Augusta Precious Metals Reviews

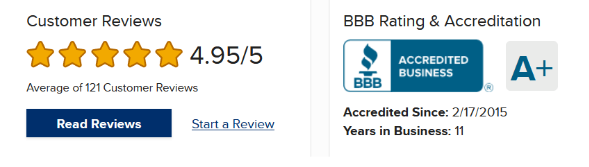

In today’s digital era, consumers often turn to online reviews to guide their purchasing choices. Negative feedback can swiftly damage a company’s standing. However, Augusta Precious Metals shines through by upholding an exceptional online reputation with countless satisfied customers.

This is exemplified by the numerous top ratings and rave reviews from reputable sources like BBB, BCA, and TrustLink. Rest assured, investors can place their trust in Augusta Precious Metals’ market credibility and stellar reputation.

Here’s a sample of some of Augusta’s customer reviews and ratings:

- For one, Augusta Precious Metals has an A+ BBB rating on the Better Business Bureau. Plus, they have an average of 4.95 out of 5 stars based on 121 customer reviews

- Second, the company has a AAA rating with the BCA and a 5 out of 5 star rating based on 98 client reviews

- And they have a 5 out of 5 star rating on TrustLink based on 286 customer reviews

- Augusta also has a 4.9 out of 5 star rating on ConsumerAffairs based on 136 customer reviews

Complaints

After extensively reviewing Augusta Precious Metals, we have made predominantly positive observations. Notably, the company boasts an outstanding reputation with both the Better Business Bureau (BBB) and the Business Consumer Alliance (BCA), as evidenced by their pristine record of zero complaints. This accomplishment holds significant weight within an industry that frequently encounters customer grievances.

However, amidst our analysis, we stumbled upon a potential area of concern regarding Augusta Precious Metals. Specifically, their requirement of a substantial minimum account balance of $50,000 to initiate a new gold IRA may not be attainable or desirable for all potential investors.

It’s worth mentioning that there are alternative gold IRA companies in the market that are more flexible, accommodating customers with significantly lower minimums (as low as $10,000).

FREE Gold IRA Guide!

Augusta Precious Metals Current Promotions

- If you choose to work with Augusta, up to 10 years of fees will be reimbursed to your IRA in premium silver coins

- They offer ZERO fees for up to 10 years (every customer qualifies)

- The company also offers one-on-one educational web conferences with Harvard-trained economist Devlyn Steele.

- Order the Ultimate Guide to Gold IRAs and Get Paid in Real Gold

Pros And Cons Of Augusta Precious Metals

To give you a better overview, here are some pros and cons of Augusta Precious Metals:

Pros

- Thousands of top ratings — plus hundreds of top reviews with the BBB, BCA, TrustLink, and others

- Unique, free one-on-one educational web conference

- Endorsed by Hall of Fame quarterback & multimillionaire Joe Montana

- Mark Levin, host of The Mark Levin Show, is a big believer in Augusta gold

- Up to 10 years of fees reimbursed to your IRA in premium silver coins (ask what you qualify for)

- Easy and stress-free IRA setup, with a streamlined process

- A+ rating with the BBB and AAA rating from the BCA

- Buy-back program

Cons

- IRA minimum deposits start at $50,000

- Cannot set up an account online, just request a free Gold IRA Guide

Augusta Home Storage Gold IRA: FAQ

What are the benefits of buying gold and silver within an IRA?

Investors stand to gain numerous advantages by acquiring physical gold and silver as a means of diversifying their savings. These precious metals often boast an uncorrelated value in relation to other assets, thus presenting a potential safeguard against inflation.

Furthermore, the strategic purchase of metals within a self-directed IRA empowers investors to enjoy growth that is either tax-deferred or even tax-free (in the case of a Roth IRA). Additionally, opting for a gold IRA enables investors to personally select their purchases and steer clear of portfolio management fees.

How are my precious metals stored in an Augusta Gold IRA?

Augusta Precious Metals, as a trusted IRA custodian, has partnered with reliable third-party storage providers to ensure the safekeeping of precious metals held in its Gold and Silver IRA. The company takes meticulous care to securely store the metals in insured facilities that adhere to Augusta’s high-security protocols.

These top-quality storage facilities are equipped with state-of-the-art security systems, including comprehensive surveillance and multiple levels of access control. Trained personnel provide round-the-clock protection, and the facilities themselves are fully insured, exceeding the value of the stored metals. This provides peace of mind to investors, safeguarding their assets.

Augusta’s security protocols include strict guidelines for handling and storing precious metals, minimizing the risk of damage, loss, or theft. These protocols undergo regular review and updates to ensure constant safety. This is particularly crucial for long-term investments.

Can I take physical possession of the precious metals held in my Augusta Gold IRA?

Yes, you are permitted to take physical possession of any precious metals held within your Augusta Gold IRA. However, for individuals under 59½ years of age, distributions are considered early withdrawals and are subject to a 10% penalty.

Does Augusta Precious Metals offer free shipping?

Yes, investors can rest assured that their precious metals will be swiftly and securely delivered to their chosen depository storage facility, complete with complimentary shipping and transit insurance.

Can I see and hold the precious metals in my gold and silver IRA?

Yes, for those who wish to visit their purchased metals in person, simply reach out to your custodian to make the necessary arrangements.

In what cities can I store my IRA metals with Augusta?

Investors have the option to select a convenient depository from multiple locations in various U.S. cities. At present, storage facilities can be found in Los Angeles, CA; Salt Lake City, UT; Nampa, ID; Las Vegas, NV; Shiner, TX; Dallas, TX; South Fargo, ND; Wilmington, DE; Bridgewater, MA; New Castle, DE; and New York, NY. For an updated list, please feel free to contact Augusta Precious Metals.

Recap Augusta Home Storage Gold IRA

A home storage gold IRA is technically feasible if setting up an LLC and meeting specific criteria. It is crucial to note that the precious metals cannot be stored in the investor’s residence; they must be securely held in a depository location registered under the LLC’s name.

While Augusta Precious Metals does not directly offer home storage gold IRAs, they provide information and resources for investors considering this option. It is important to be aware that the IRS has strict rules and regulations concerning home storage gold IRAs, with non-compliance resulting in significant tax penalties.

In summary, investors seeking to diversify their portfolios with precious metals should consider Augusta Precious Metals. With a proven track record, robust customer support, and a commitment to education and security, the company is well-equipped to assist investors in achieving their investment goals.

FREE Gold IRA Guide!

Augusta Precious Metals Alternatives

If you want to look around a bit more before making a final decision on what gold IRA provider to choose, we have reviewed and rated the 8 best gold IRA companies of 2024. We have rated each gold IRA company on a variety of factors including BBB/BCA ratings and complaints, customer reviews, annual fees, precious metals selection, storage options, promotions, and buy-back programs.