Most Personalized Service

4.88/5

- Small family company personalized service

- Excellent range of precious metals

- 401k rollover experts

- Low fees and special offers on storage

- No-qualms buyback policy

- Only $2,000 to open a gold IRA account

- Remarkable customer reviews

Introduction: 2025 Noble Gold Review

It’s difficult to become well-known in the precious metals retirement investing industry in just five years. And gaining a good reputation is even more difficult. That is what Noble Gold Investments has done.

Despite being a relatively new company as a brand, it frequently appears as one of the best gold IRA providers.

In this Noble Gold review, we’ll examine this promising newcomer and see how it stacks up against its rivals—a category that undoubtedly has many significant participants.

NEW!! >>>Join Hercules Actor Kevin Sorbo and Noble Gold Investments FREE Gold Investment Masterclass

What Is Noble Gold?

Noble Gold Investments, headquartered in California, specializes in offering precious metals IRAs and has been in operation since 2017. While its history is relatively short compared to some long-standing competitors in the industry, it’s important to note that the brand’s limited history doesn’t necessarily reflect the experience of its team.

Noble Gold’s CEO, Collin Plume, is an experienced money manager with a background in insurance, real estate, and precious metals investment. With over 15 years of experience, Plume and his team have been in the business for decades.

During the last recession, Plume redirected his career path towards precious metals, gaining valuable expertise in a large firm in the sector. Inspired by this experience, he founded Noble Gold, a precious metals firm dedicated to protecting Americans’ retirement savings from economic uncertainties.

Here is a brief movie that explains Noble Gold and the benefits of using physical gold and silver to safeguard your retirement:

Noble Gold Celebrity Endorsement

TV personality Charlie Kirk has recommended Noble Gold, which implies that he recommends Noble Gold Investments to his friends and relatives.

Like many Americans, in times of economic uncertainty, I turn to gold & silver to protect my assets….

Charlie Kirk.

Noble Gold Products And Services

Now let’s take a closer look at Noble Gold’s offerings, starting with their gold and silver IRAs, fees, and storage options.

Noble Gold's Precious Metals IRA

Noble Gold Investments offers a variety of IRA investment options, with gold and silver IRAs accounting for approximately half of their business.

Noble Gold Investments offers a variety of IRA investment options, with gold and silver IRAs accounting for approximately half of their business.

They also provide independent precious metals sales. Opening a gold or silver IRA on their website is a straightforward process that can be completed in as little as 5 minutes.

Their dedicated team ensures personalized customer support and assists with custodial and storage services. While some competitors may claim faster processing times, Noble Gold Investments prioritizes the quality and reliability of their services.

If you’re ready to take action

Noble Gold IRA Fees And Storage

There are certain costs associated with starting a gold IRA, as there are with any reputable precious metals IRA provider. On the plus side, Noble Gold provides new customers with a free setup.

Gold IRA Fees

- Setup Fee: Free for new customers

- Annual Fee: $80

- Storage Fee: $150

A $150 storage fee and an additional $80 yearly cost are charged. The storage price includes insurance and is for segregated storage, which keeps your precious metals apart from those of other investors.

Customers’ precious metals are kept by Noble Gold in the facilities of International Depository Services. Additionally, IDS maintains sites in Canada’s Ontario, Delaware, and Texas.

You can speak with their IRA professionals about custodial fees, which Noble Gold’s IRA clients also pay.

Noble Gold Investment Minimums

What set Noble Gold aside from other competitors in the industry is that the company allows a minimum investment of only $2,000.

Investment Minimums

Direct Purchase/Gold IRA Transfer

$2,000

Gold IRA Rollover

$5,000

These smaller investments, however, are only appropriate if you are transferring your IRA or directly purchasing precious metals. The least investment you can make while rolling over is $5,000.

FREE Gold Investment Masterclass

Popular Noble Gold Bullion

Working as a precious metals broker is a significant aspect of the company’s daily operations. They provide a comprehensive range of products, including coins made of all four precious metals, bullion bars, and collector’s coins.

It’s worth noting that selling collector’s coins is uncommon among bullion dealers, especially those focused on IRA investment. Noble Gold distinguishes itself by offering an entire section dedicated to these coins, further strengthening their already impressive product selection.

1. Noble Gold Coins

It appears that IRA eligibility is the main objective when it comes to Noble Gold coins. The phrase “IRS Approved” is stamped on each of the gold coins that are now on offer on the website.

While some may find this helpful, it does leave out a few well-known gold bullion coins.

American Eagle Gold coins are a good place to start for those looking to purchase gold coins, both in bullion and proof varieties.

American Eagle Gold coins

- 1oz

- 1/2oz

- 1/4oz

- And 1/10oz denominations

Canadian Gold Maple Leaf coins

- 1oz

- 1/2oz

- 1/4oz

Australian Gold Kangaroo coins

- 1oz

- 1/2oz

- 1/4oz

- And 1/10oz

Australian Gold Philharmonic coins

- 1oz

- 1/2oz

- 1/4oz

- And 1/10oz

A very strong choice, as we already mentioned.

A 4-set American Gold Eagle Proof product option, which is also IRA-eligible, is also offered for Noble Gold coins. For proof coins and coins that are often regarded as collectibles, this is a fairly typical offering.

2. Noble Gold Silver Coins

When it comes to silver coins, Noble Gold Investments does not fall short. It is by no means a small selection, while not being the strongest we have seen.

Silver coins like these can be found in their collection:

- 1oz American Silver Eagle Silver Coins

- 5oz America the Beautiful Silver Bullion Coins

- 1oz Canadian Maple Leaf Silver Coins

- Australian Silver Kangaroo Silver Coins

- And the 1oz Austrian Silver Philharmonic Silver Coins

The proof form of the American Silver Eagle, which comes in special packaging and has a specific price tag to increase, is another option available to buyers of silver Noble Gold coins.

The proof form of the American Silver Eagle, which comes in special packaging and has a specific price tag to increase, is another option available to buyers of silver Noble Gold coins.

The 1-kilogram Australian Silver Coin is a really intriguing addition to the coin assortment. This coin is included in the Perth Mint’s normal mintage, however due to its size, you are unlikely to find it in the inventory of a domestic bullion vendor. Strangely, there aren’t many rounds available; the only one stated is the 1 oz Highland Mint Silver Round.

Noble Gold also offers a large selection of “junk silver” coins, so-called because they don’t match the standards for purity needed for IRA placement. Nevertheless, they are exceedingly well-liked and frequently sell for high amounts among coin lovers.

3. Noble Gold Platinum Coins And Bars

Given that the platinum group metals are a relatively new addition to coin production, it would be safe to state that the selection of Noble Gold coins of the platinum variety is as strong as it can be.

Coins of the American Platinum Eagle series come in:

- 1oz

- 1/2oz

- 1/4oz

- And 1/10oz denominations

demonstrating the quality of the product provided once more. Additionally, customers have the option of purchasing the 1 oz. Palladium Maple Leaf coin.

Despite the fact that both of these qualify, they aren’t labeled as IRA-eligible for whatever reason. Is it a mistake, or are these coins not accepted by Noble Gold retirement accounts?

We’ll leave the explanation to their officials.

NEW!! >>>Join Hercules Actor Kevin Sorbo and Noble Gold Investments FREE Gold Investment Masterclass

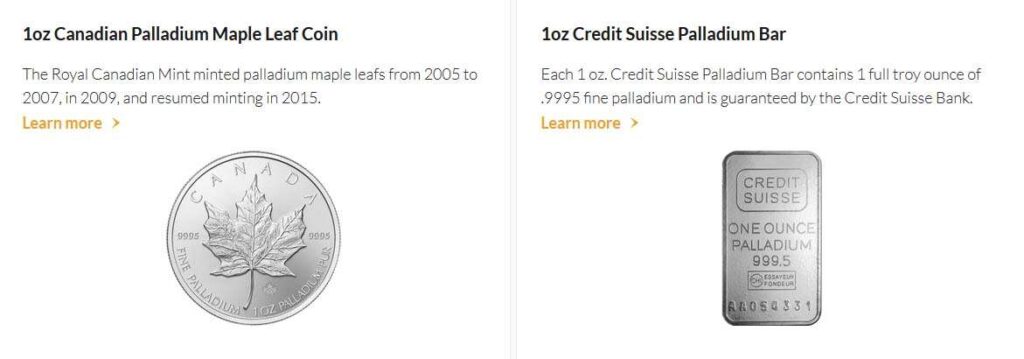

4. Noble Gold Palladium Coins And Bars

The 1 ounce Canadian Palladium Maple Leaf coin is the only item in this category, while not being the only palladium coin typically accessible.

Even though, like the platinum coins, this coin satisfies the purity requirements, there is no note indicating that it is IRA-eligible.

- 1oz Canadian Palladium Maple Leaf Coin

- 1oz Credit Suisse Palladium Bar

If you’re ready to take action

5. Noble Gold Rare Coins And Bullion Bars

Bullion bars are one product that IRA-focused precious metals merchants sometimes fall short on. They will typically be produced in a single weight and solely from sovereign mints, if and when they become available.

Noble Gold is once more noticeable in this. The following types of gold bars are for sale:

- Johnson Matthey 1 Kilo Gold Bar

- Perth Minth 10oz gold bar

- Pamp Suisse 100-gram gold bar

- And the PAMP Suisse Lady Fortuna gold bar in 2.5-gram, 5-gram, 20-gram, 50-gram, 5oz, and 10oz weights

In addition, Noble Gold provides the 1oz Rand Refinery Silver Bar, the 10oz and 100oz Republic Metals Silver Bar, and the 5oz Silver Bar in the category of silver.

Customers can select between the 1oz and 10oz Baird & Co Platinum Bars for platinum. The 1oz Credit Suisse Palladium Bar is the only palladium bar on the market.

The numismatics portion, while not particularly large, might have its own overview, but we shall only quickly discuss it. They offer numismatics, specifically those produced by 19th-century sovereign mints, for sale in sets, individual pieces, and both gold and silver.

6. Noble Gold Survival Pack

The company’s Noble Gold Survival Packs stand out as a unique aspect of their operations. This product offering is positioned alongside their gold IRAs and individual bullion purchases.

Essentially, the Survival Packs consist of high-quality bullion intended for “disaster scenarios”. The website emphasizes the importance of being prepared for various potential disasters, including war. This approach is distinctive compared to competitors who typically highlight concerns such as inflation and economic crashes.

The following are the packs:

- $10,000 Noble Knight

- $25,000 Noble Baron

- $50,000 Noble Viscount

- $100,000 Noble Earl

- $250,000 Marquess

- $500,000 Noble Duke

These inform us about the titles of supposed royalty, if nothing else. Earl is higher than Baron, did you know that? We did not.

The website directs us to contact them for more information rather than revealing which precious metals are included. With a concentration on bullion rather than collectibles that carry a markup, it is most likely a combination of either simply gold and silver or all four precious metals.

After all, in the event of an emergency, you might not be able to convince the customer that your unique silver coin is worth more than the sum of its precious metal components. We are certain that the metals in these packs are of the highest quality, even though the lack of disclosure is not ideal.

Noble Gold’s No-Quibble Buyback program

If you want to sell your precious metals, Noble Gold offers a no-hassle repurchase program.

Additionally, Noble Gold will buy back your precious metals if you open a gold or silver IRA but then change your mind.

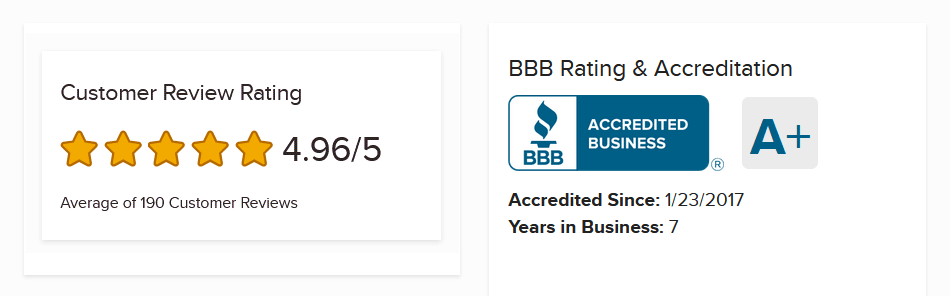

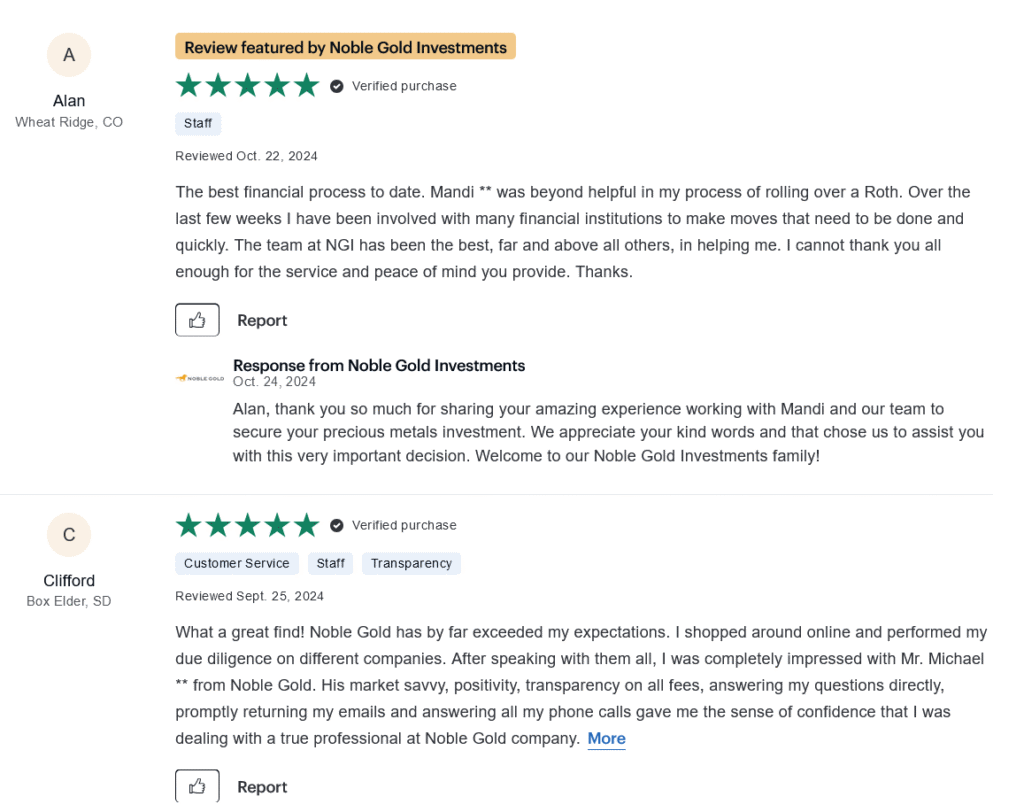

Noble Gold Investment Reviews & Ratings

In the IRA sector, we don’t need to be overly concerned about a company’s freshness because we have reviews. Over the course of 5 years, Noble Gold has built an excellent reputation that rivals many of their longer-established competitors.

- – To begin with, Noble Gold boasts an A+ rating from the Better Business Bureau (BBB), and they are accredited by the BBB, a distinction that some prominent names like Monarch Precious Metals do not have. On the BBB website, Noble Gold has garnered a remarkable 4.97 out of 5 rating, based on 202 customer reviews, all of which sing the company’s praises

- – Additionally, the Business Consumer Alliance (BCA) has awarded Noble Gold an AA rating, which is just shy of the highest rating possible. Their presence on the BCA website shows only one closed complaint and a stellar 5 out of 5-star rating, based on 4 reviews

- – Furthermore, ConsumerAffairs reflects a perfect 5 out of 5-star rating for Noble Gold, backed by 808 ratings, the vast majority of which are 5-star reviews. Notably, there are no reviews rating the company under 4 stars, underscoring the consistently high level of customer satisfaction

- – And a 4.9 out of 5-star review on Google based on 587 customer reviews

- – Lastly, the company holds a 4.9 out of 5-star rating on Trustpilot based on 571 customer reviews

Tim

- Verified Customer

For several years now, I have been grateful for choosing Noble Gold. With vast bonified resources coupled with an extraordinary ability to locate, purchase, and deliver the highest quality coins. Rep,/ Salesmen Steven, was assigned to help me with my very first gold and silver coin purchase. Nervous and uninformed, Steven helped me understand the processes in its entirety. This fear of uncertainty was quickly replaced by new business relations. vanished only minutes into our initial conversation. professional solid business relations

Reviewed on: April 2, 2025

Sherri Tucker

- Verified Customer

The customer service was excellent from professionalism to knowledge of product. Follow-up was great too. No complaints!!

Reviewed on: March 25, 2025

Noble Gold Investments’ Complaints

Overall, the company has received 3 complaints, all of which have been addressed and lack any details. Due to the fact that it hasn’t changed their reviews on these watch websites, we are inclined to believe that there was some sort of misunderstanding.

Overall, there is hardly anything to suggest wrongdoing on the part of the business, and reviewers do go out of their way to emphasize what a wonderful experience they had with Noble Gold.

Pros and Cons Of Noble Gold

Pros

- One of the best minimum IRA requirements in the sector, with $2,000 to open an IRA and a $5,000 rollover minimum. Joined by a low and transparent annual custodial fee of $80 and an annual storage fee of $150

- Remarkable customer reviews and reputation, practically spotless despite being in business for only 5 years

- A website and company that functions just as strongly as a gold IRA provider as it does a precious metals dealer

- Offers a FREE Gold Investment Masterclass with Kevin Sorbo from the movie Hercules

Cons

- Only one US storage option in the form of International Depository Services

- Let us be fair: survival packs should probably be available for less than $10,000

Noble Gold Review Verdict: Is The Company Legit?

Yes! Noble Gold Investments stands out as a prominent player in the precious metals industry. While excelling in their operations, it’s worth noting a few aspects.

Firstly, they may not possess the extensive inventory of other leading precious metals and numismatics dealers. Additionally, they might not specialize entirely in gold IRA investments like some other companies do.

However, this distinct approach contributes to their company profile. Whether you appreciate their unique approach, including their oddly-named Survival Packs, is a matter of personal preference. Notably, there are no negative reviews from those who have chosen Noble Gold.

One of their notable strengths is the availability of IRA-eligible coins in various denominations, thanks to their focus on precious metals dealership. This distinguishes them from other gold IRA companies that usually offer limited denominations.

With just five years in operation, Noble Gold is expected to expand their offerings and provide additional products and services to their customers. While having specialists for specific areas is advantageous, the convenience of having all services unified under one familiar umbrella should not be overlooked.

NEW!! >>>Join Hercules Actor Kevin Sorbo and Noble Gold Investments FREE Gold Investment Masterclass

If you’re ready to take action

Noble Gold FAQ's

Lastly, here’s a summary of our Noble Gold review in an easy FAQ format.

Is investing in precious metals a good idea?

We think it is. Gold and silver values have historically moved counter to those of paper assets, making them effective hedges against inflation. Although past results don’t guarantee future results, the data suggests that gold has often performed better when the dollar has been weaker in the past. In actuality, many people perceive the relationship between gold and the dollar to be inverse.

Why starting a gold IRA?

After retirement, traditional IRA investments might not be sufficient to support you and your loved ones. Not if the economy continues to look as iffy as it has lately.

Investors have long looked to gold as a way to potentially counter losses brought on by economic unrest. By actually owning physical gold (and silver) within a retirement plan, a gold IRA or precious metals IRA enables you to diversify a component of your retirement portfolio, including pre-existing IRAs and former 401(k)(s) with previous employers. As a result, you are able to safely keep physical precious metals in an account that is tax-deferred.

Should I invest in physical gold, futures options (ETFs), gold mining stocks, or gold funds?

It is significantly riskier to invest in gold indirectly than to buy the actual commodity. You run the danger of losing your investment if you rely on a third party to manage your wealth for you, regardless of whether they are an individual or business. You have control over your riches when you own physical gold. You have an extra layer of security and safety with physical gold that you don’t have with gold exchange traded funds (ETFs), gold mining stocks, or funds.

You can possess physical gold coins or gold bars while still receiving the same tax advantages from an IRA when you invest in a gold IRA.

Do my precious metals have to be bars or can they be coins?

Yes. Although well-known gold IRA providers frequently suggest Equity Trust as their preferred custodian and Delaware Depository as a storage option, you are free to select your own custodian and storage provider.

Can I store my precious metals at home?

Yes, for non-IRA precious metals. not precious metals for a real IRA. IRS regulations restrict storing precious metals in IRAs at home or in a conventional safety deposit box. They must be kept by an authorized non-bank trustee or a bank that complies with access-restrictive IRS regulations. To maintain compliance with deposit and distribution requirements, access to the precious metals in your precious metals IRA must be restricted in specific ways, just like it would be with a standard IRA.

Are the values of the precious metals I buy for my IRA guaranteed?

No. Precious metals’ future value, like that of all assets, is uncertain and subject to a range of market factors. But we think your best bet to protect yourself against a stock market catastrophe, inflation, and the devaluation of the dollar is actual precious metals.

When will I be eligible for distributions from my gold IRA?

The IRS states that you or the beneficiary of your precious metals IRA can begin drawing withdrawals from the account without incurring penalties at age 59½.

How long does it take to rollover a traditional IRA into a gold or silver IRA?

Usually between two and three weeks, but since every application is unique, the time required varies from case to case.

What is the advantage for customers to set up an IRA with a gold IRA company as opposed to going to the custodian and setting it up with them?

The IRA Processing Department of the gold IRA company will give the customers with excellent support and specialist account setting knowledge throughout the entire process. 95% of the paperwork is completed by them. Customers may rest easy knowing that any gold IRA firm mentioned on How To Invest Gold will keep them informed at every stage of the transfer procedure via daily calls or emails from the IRA Processing staff. Additionally, these businesses frequently offer lifetime account assistance.

Noble Gold Alternatives

We have analyzed and ranked the best gold IRA companies for 2025 if you want to do more research and company comparisons before selecting a gold IRA provider.