In times of economic uncertainty, having liquidity is essential. You also need an asset that holds its value, which is why a strong buyback program is critical when investing in gold.

But does your gold company offer one? Unfortunately, many companies promise the world but fall short when it comes time to deliver.

Many clients start by testing a gold company. They purchase a small amount of gold and try selling it back after a month or two.

Nearly all of them return disappointed—either by what they get back or, worse, by not being able to sell at all.

To ensure this doesn’t happen to you, we’ll share 5 reasons why a buyback program is crucial so that you know what to look for in a gold firm. We’ll also present 8 gold companies that all offer legit buyback programs.

5 Reasons Why A BuyBack Policy Is Crucial

Investing in gold with a company that has a reliable buyback program is crucial for several reasons:

#1. Liquidity and Flexibility

A solid buyback program ensures you can sell your gold quickly and easily. Without one, you may face challenges finding buyers or be forced to sell at a loss through less reputable avenues.

#2. Fair Market Pricing

Reputable gold IRA companies with established buyback programs typically offer fair market value for the gold they repurchase, protecting you from losing money during resale—especially if gold prices have appreciated since your original purchase.

#3. Reduced Risk of Fraud

Selling gold through companies without buyback options can expose you to the risks of scams or shady buyers. A trustworthy company with a strong buyback policy minimizes this risk, ensuring your gold is valued fairly and sold through legitimate channels.

#4. Convenience

A seamless buyback process saves you time and effort. Instead of navigating uncertain markets or negotiating with third parties, you can quickly sell your gold back to the original company—especially helpful during urgent financial needs or market volatility.

#5. Confidence in the Company’s Integrity

A robust buyback program reflects a company’s confidence in the quality of their product. If they’re willing to buy it back, it demonstrates their trust that the gold they sell will retain its value, offering you greater peace of mind as an investor. For instance, Goldco offers the highest buyback guarantee in the industry.

Why Invest In Precious Metals?

In tumultuous economic times with high inflation and geopolitical tension, precious metals like gold and silver are often seen as safe havens.

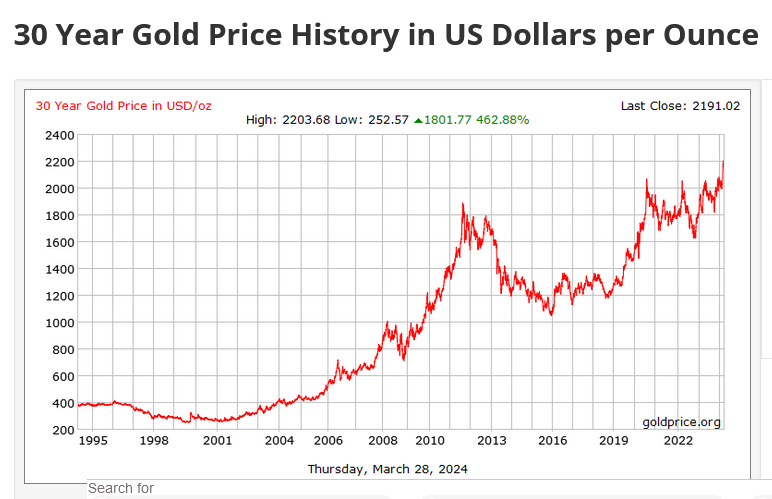

Although they don’t typically match the short-term growth of stocks or cryptocurrencies, gold has increased 462.88% in the last 30 years.

Precious metals should be a part of a diversified growth strategy, especially through physical gold, ETFs, or stocks in mining companies.

However, keep in mind that gold stocks do not necessarily move in concert with bullion prices since mining companies succeed or fail based on their operating performance.

However, keep in mind that gold stocks do not necessarily move in concert with bullion prices since mining companies succeed or fail based on their operating performance.

ETF companies are vulnerable, unpredictable, and controlled outside your hands.

When you invest in physical gold bullion through, for example, a gold IRA, this wouldn’t affect you directly as you are not relying on any third-party individual or company to look after your wealth for you.

Instead, you are in control of your own wealth and financial growth.

Needless to say, we should always follow the money when investing for financial growth! Millionaire investors like Ray Dalio and Sam Zell believe gold is attractive as a store of wealth and a means of portfolio diversification.

Ray Dalio means, “In a world of ongoing pressure for policymakers across the globe to print and spend, zero interest rates, tectonic shifts in where global power lies, and conflict, gold has a unique role in protecting portfolios. It’s wise to hold some of what central banks can’t create more of.“

Ray Dalio Tweet

Learn how to protect your retirement like Chuck Norris

Top 8 Gold Companies Offering Buyback Programs

Best Value Investing has carefully reviewed and vetted these 8 precious metals and gold IRA companies below and made sure they offer legit buyback programs.

To learn more about each company, you can either click the “Learn More” button or visit our best gold IRA companies page.

Conclusion

Before investing your hard-earned money in gold and silver, it’s crucial to ensure your precious metals company offers a buyback program in case you want to liquidate your metals.

Investors can rest assured that choosing any of these gold firms on our list will provide them with the choice of selling back their metals with ease if they so choose.

Disclosure: This is not a financial advice article. Refer to a professional for financial advice.