Best Gold IRA Companies

Disclosure: We are reader-supported. If you buy through links on our site, we may earn a commission. Learn more.

When it comes to protecting your retirement account against market volatility, inflation, and a pending recession, a gold IRA or precious metals IRA may be one of the best options at your disposal.

Best Value Investing has reviewed and rated the 6 best gold IRA companies for 2026 to help you identify the company that best suits your individual needs.

What is a gold IRA? A gold IRA is a specialized, self-directed individual retirement account designed to hold physical gold and silver, and other precious metals. Just like traditional IRAs, a gold IRA allows pre-tax contributions, meaning that the investment earnings can accumulate tax-deferred.

Opening up a gold IRA account has many benefits, and can, for example, help you:

- ✅ Hedge against a weaker dollar and persistent inflation

- ✅ Limit exposure to economic uncertainty

- ✅ Mitigate the effects of geopolitical instability

- ✅ Diversify your portfolio with a tangible asset

- ✅ Take real ownership of your financial future

In this guide, we have reviewed and rated the best gold IRA companies in the industry to help you identify the best option to protect and grow your wealth today. We have rated each gold IRA company on a variety of factors, including BBB/BCA ratings, customer reviews and complaints, annual fees, precious metals selection, storage options, promotions, and buyback programs.

Let’s start with an overview of all contenders:

Top 6 Gold IRA Companies for 2026

#1. GoldenCrest Metals: Best For Integrity & Trust

PROMOTIONS GOLDEN CREST METALS

Annual Fees Covered for the First Year (All Customers Qualify)

$25,000 In FREE Silver

5 Years of FREE Storage

INVESTMENT MINIMUMS GOLD IRA

Investment Minimums Gold IRA: $10,000

INVESTMENT MINIMUMS CASH SALES

Investment Minimums Cash Sales: None

Best for Transparency Trust & Integrity

- A-BBB rating despite short time in business

- Boutique company with a personal approach

- Excellent customer reviews

- Transparency and trust is the main focus

- Lower spreads to offer more gold for the money

- All fees covered for the first year

- Tailored precious metals strategies

- An educational and long-term approach

- Free safe for non-IRA metals

Our top choice of gold IRA and precious metals company is GoldenCrest Metals – a strong contender in the gold IRA industry despite limited time in business. Launched at the outset of 2024 and led by CEO, Rich Jacoby, GoldenCrest Metals is charting a new course in redefining integrity and trust in an industry that has recently experienced its share of controversies. The firm’s commitment to transparent pricing and a non-aggressive sales approach has rapidly attracted a considerable client base in a notably competitive sector.

With opaque pricing mechanisms, misleading marketing tactics, and a lack of investor education and protection, GoldenCrest Metals set out to create a company that would redefine the standards of integrity and trust in gold investment. In other words, the company’s focus on transparency, honesty, and trust makes them stand out in an otherwise wildly debated industry when it comes to integrity.

What we like the most with GoldenCrest Metals is the fact that they are a boutique company with direct access to CEO, Rich, for questions. Not many gold IRA firms can offer this personalized service.

In addition, they are accredited by the BBB and have already gathered 5-star reviews on verified review sites. We also like that the company operates on smaller margins to ensure investors get the most for their money. Investors and people saving up for retirement should consider giving this relatively new gold dealer a chance for their precious metals investment.

>>>Read the full GoldenCrest Metals review.

Popular Gold Coins

- Canda Gold Maple Leaf

- American Eagle Gold Coins

- Gold American Eagle Proofs Coins

- Gold Australian Striped Marlin Coins

- Gold Australian Sea Turtle Coins

- Gold Maple Leaf Coins

- American Gold Buffalo Coins

Popular Silver Coins

- Silver American Eagle Coins

- Silver American Eagle Proof Coins

- Silver American Bald Eagle Coins

- Silver Australian Striped Marlin Coins

Pros

- Wide selection of laid-out IRA-eligible bullion in all four precious metals categories

- Up to $25K in FREE Silver *on qualifying accounts*

- Unique price protection plan

- No custodial and management fees for up to 10 years

- Thrift Savings Plans (TSP) available

- Offer free virtual educational webinars, plus one on one consult with gold IRA educators

Cons

- Not really clear what's available when in their inventory

- An offering of home delivery IRAs on whose prudence we still aren't sure of

GoldenCrest Metals Verified And Recent Customer Reviews

Very pleased with my experience and the professionalism that I received from Golden Crest Metals! Sebastian answered all my questions in a kind, polite and helpful way. 5 Stars.

#2. Birch Gold Group: The Gold IRA Specialist

PROMOTION AMERICAN HARTFORD GOLD

Get Up to $10,000 in FREE Precious Metals on Qualified Purchases

INVESTMENT MINIMUMS GOLD IRA

Investment Minimums Gold IRA: $10,000

INVESTMENT MINIMUMS CASH SALES

Investment Minimums Cash Sales: $10,000

What we like the most about Birch Gold Group:

- A+ BBB rating & AAA BCA rating

- Average review rating of 5/5 on TrustLink

- Stress-free and easy gold IRA set up

- Low investment minimums

- Exemplary track record with thousands of happy customers

- Buyback program

- On-going promotions

- Endorsed by Ben Shapiro, Steve Bannon, Dan Bongino, Ron Paul, and many more

Second on our list comes the gold IRA specialist, Birch Gold Group. Birch Gold’s team is made up of experienced professionals coming from high profile companies such as Citigroup and IBM. This established gold investment firm and reputable gold IRA company, has over two decades of industry experience. They truly live up to the reputation as a gold IRA specialist.

They have received exceptional ratings, including an A+ from the BBB and an AAA from the BCA. With over 12,000 satisfied clients nationwide, Birch Gold Group offers an educational, no-pressure sales approach and a hassle-free gold IRA setup.

Endorsed by Ben Shapiro and other prominent celebrities such as Dan Bongino, Steve Bannon, Ron Paul, and Clay & Buck, they have been featured in major news outlets. Birch Gold Group provides valuable retirement savings options, and for example, Mr. Shapiro believes diversifying assets by including physical gold and silver is wise, considering it has never been worth zero.

Setting up new precious metals IRAs or helping individuals transfer or roll over existing retirement accounts into a gold IRA are some of the things that Birch Gold Group specializes in. If you’re interested in setting up or rolling over an IRA, just visit the website to initiate the process and connect with a specialist from Birch Gold Group.

For new accounts exceeding $50,000, Birch waives setup fees and covers shipping costs for cash purchases totaling $10,000 or more. Additionally, their buyback program simplifies the process of selling your precious metals.

>>>Read the full Birch Gold Group review.

Below are some of Birch Gold Group’s IRA-approved coins and bars you can choose from:

Gold

- American Buffalo Coin

- American Gold Eagle (bullion)

- American Gold Eagle (proof)

- Canadian Gold Maple Leaf

- Austrian Philharmonic Coin

- Australian Nugget/Kangaroo Coin

- Gold Gyrfalcon Coin

- Gold Polar Bear and Cub Coin

- Gold Rose Crown Guinea Coin

- Gold Twin Maples Coin

- Valcambi Combi Bars

- A Variety of Gold Bars and Rounds

Silver

- America the Beautiful Silver Series

- American Silver Eagle (bullion)

- American Silver Eagle (proof)

- Canadian Silver Maple Leaf

- Austrian Philharmonic Coin

- Australian Kookaburra Coin

- Mexican Libertad Coin

- Silver Gyrfalcon Coin

- Silver Polar Bear and Cub Coin

- Silver Rose Crown Guinea Coin

- Silver Twin Maples Coin

- A Variety of Silver Bars and Rounds

Platinum

- American Platinum Eagle Coin

- A Variety of Platinum Bars and Rounds

Palladium

- Canadian Palladium Maple Leaf Coin

- A Variety of Palladium Bars and Rounds

If you think Birch Gold Group sounds like a good fit for you, but still aren’t quite sure, request their FREE Information Kit. This kit is designed to help individuals learn more about investing in precious metals.

It includes some common questions and answers about setting up gold IRAs, highlights the benefits of investing in gold, silver, platinum, and palladium, and shares some of the various coins and bars you can choose to invest in.

Pros

- With over two decades in business, BGG is an established gold IRA company

- A+ rating by the BBB and AAA rating by the BCA

- Great customer reviews

- Educational, no-pressure sales approach

- Easy and stress-free gold IRA setup

- $10,000 investment minimum (less than most competitors)

- Waives shipping fees on all cash purchases

- Offers a buyback program

- On-going promotions

- Endorsed by Ben Shapiro, Steve Bannon, Ron Paul, Dan Bongino, and many more prominent names

Cons

- Birch Gold Group only does business in the United States

- Cannot set up an account online

Here are some of the 1,000’s of satisfied customers of Birch Gold Group:

The process of closing my IRA account & transferring the money into a Birch Gold account was effortless. Within a day of sending a text I was contacted by a representative who walked me through the process. Everything was thoroughly explained to me & I was able to set up my Birch account in a way that best suited my needs. I am very happy with my experience & very happy that I did this. I only wish I had done it sooner!

I had the best experience with every person I spoke with at Birch Gold Group! The are very knowledgeable about their business, kind, caring and helpful, It took quite a while to get my funds released from my TSA account but Emilyn Cortez and Cassie Back at Birch Gold walked me through the process so professionally! Stewart answered all my questions, so my transfer went smoothly, I highly recommend Birch Gold if you are thinking about investing in gold and silver.

Birch Gold Group for me is the only place I feel safe buying my precious metals from. I have recently made a big purchase from them. They stratigized, executed and delivered right on time. I am extremely please with the high quality of the product and highly recommend this company to take care of your business and securing your next order of precious metals.

#1 Goldco: Best Customer Service

PROMOTIONS GOLDCO

Unlimited FREE Silver (If Opening Up a Qualifying IRA)

INVESTMENT MINIMUMS GOLD IRA

Investment Minimums Gold IRA: $25,000

INVESTMENT MINIMUMS CASH SALES

Investment Minimums Cash Sales: $3,500

What we like the most about Goldco:

- White glove service

- Protects over $1 BILLION dollars in retirement savings

- No investment minimums

- Has the highest buyback guarantee

- Over 10,000 5-star reviews

- Up to $10,000 In FREE Silver

- Money Magazine awarded Goldco “The Best Customer Service” in 2025

- A+ BBB rating

- AAA Business Consumer Alliance rating

- The IRA process is tax & penalty free

- You can get started in just 15 minutes or less

Goldco is our third choice for the best gold IRA and precious metals company for 2026. Investors and retirees can rest assured that Goldco has rightfully secured its position as the leading and most trusted provider of precious metals IRAs in the United States.

Goldco is helping their customers set up a new precious metals IRA or rolling over an existing retirement plan into an IRA. The decision to create or roll over an IRA with Goldco will surely be one that you are pleased with for years to come.

Setting up a precious metals, or gold, IRA will help ensure you are protected against stock market crashes or falling economies; you won’t need to worry about losing all of your wealth if some of your money is invested in gold.

Goldco offers both gold and silver IRAs. Gold and silver IRAs are very similar to a traditional IRA in that they offer tax benefits and allow individuals to build wealth and prepare for their retirement. The main difference, however, is that instead of being required to only invest in stocks, you can invest in gold and silver coins and bars.

Goldco’s website offers a simple application form that individuals can fill out to start the process of creating an IRA or rolling over an existing 401(k), TSP, or similar retirement account. You’ll just need to indicate how you’re funding the account, and a member of Goldco’s team will work with you to get the money transferred to your new account.

Furthermore, Goldco is also third on our list because they offer competitive annual fees, no investment minimums, the highest buy-back guarantee, and have earned an A+ rating from the Better Business Bureau, as well as an AAA rating from the Business Consumer Alliance. This makes Goldco one of our top choices for opening a gold IRA account, ensuring security and peace of mind.

Moreover, Goldco has been recognized as the Company of the Year in 2024’s American Business Awards and Money Magazine awarded Goldco “The Best Customer Service” in 2025.

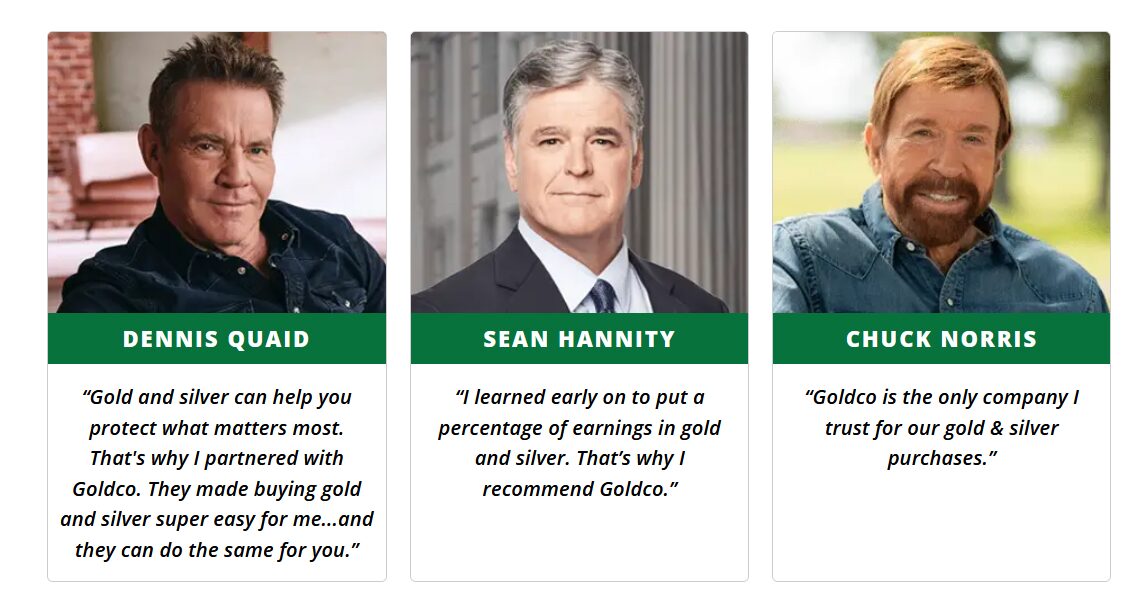

Plus, prominent figures like Sean Hannity, Chuck Norris, and Dennis Quaid have endorsed Goldco, supporting their mission to educate investors and retirees about the advantages of investing in precious metals, and protecting their retirement accounts such as IRAs, 401(k)s, TSPs, and pensions with physical assets like gold and silver.

Lastly, there are a wide variety of IRS-approved gold and silver coins and bars offered by Goldco, so you should have no trouble selecting an array of precious metals to fill your new IRA.

>>>Read the full Goldco review.

Gold

- Gold American Bald Eagle Coin

- Gold American Eagle Proof

- Gold American Eagle Coin

- Gold Buffalo Coin

- Gold Maple Leaf Coin

- Gold Lucky Dragon Coin

- Gold Australian Saltwater Crocodile Coin

- Royal Mint Gold Lunar Series: 2017-Year of the Rooster Coin

- Royal Mint Gold Lunar Series: 2018-Year of the Dog Coin

- Royal Mint Gold Lunar Series: 2019-Year of the Pig Coin

- Numerous PAMP Suisse and Perth Mint gold bars of various sizes

Silver

- Silver American Bald Eagle Coin

- Silver American Eagle Coin

- Silver American Eagle Proof Coin

- Silver Lucky Dragon Coin

- Silver Maple Leaf Coin

- Silver World War I Coin

- Silver WWII Victory Coin

- Silver Australian Saltwater Crocodile Coin

- Royal Mint Silver Britannia Lunar Series: 2015-Year of the Ram Coin

- Royal Mint Silver Britannia Lunar Series: 2016-Year of the Monkey Coin

- Royal Mint Silver Britannia Lunar Series: 2017-Year of the Rooster Coin

- Royal Mint Silver Britannia Lunar Series: 2018-Year of the Dog Coin

- Royal Mint Silver Britannia Lunar Series: 2019-Year of the Pig Coin

Goldco offers a FREE Gold & Silver Guide, if you’d like to learn more about setting up a gold IRA.

Pros

- A+ BBB rating & AAA BCA rating

- Unlimited FREE Silver Promotion

- No investment minimums

- Outstanding ratings & customer reviews

- Unmatched customer service

- Dedicated precious metals specialist

- Easy IRA & 401(k) rollovers

- No high pressure sales tactics

- Highest buyback guarantee

- Free storage for non-IRA precious metals

Cons

- Cannot set up an account online

Here are reviews from some of the 10,000’s satisfied Goldco customers:

Our appointment was on Monday 12/22/25. The Goldco team was very polite and knowledgeable. The onboarding process was quick and painless. It was much easier than I had anticipated. I would highly recommend Goldco to anyone.

#4. Noble Gold Investments: Lowest Investment Minimum

INVESTMENT MINIMUMS GOLD IRA

Investment Minimums Gold IRA: $2,000

INVESTMENT MINIMUMS CASH SALES

Investment Minimums Cash Sales: $2,000

What we like the most about Noble Gold:

- Small family-owned company and personalized service

- Excellent range of precious metals

- Access to 401k rollover experts

- Low fees and special offers on storage

- No-qualms buyback policy

- Only $2,000 investment minimum to open a gold IRA account

- Only $2,000 investment minimum for regular purchases

- Remarkable customer reviews

- FREE Gold Investing Masterclass hosted by Kevin Sorbo

In fourth place among the best gold IRA companies comes Noble Gold Investments. What we like with Noble Gold is that the CEO and President, Collin Plume, aims to ensure that each client receives expert advice and the help they need to make sound financial investments to secure a successful future.

Additionally, Noble Gold doesn’t use a hard-sell approach that you may find with many other gold IRA companies, rather they focus on making sure the independent needs of each client are address. They also offer the best minimum IRA requirements in the sector, with $2,000 to open an IRA and a $5,000 rollover minimum.

Noble Gold’s clients are overwhelming happy with the service and attention they receive based on the large number of positive reviews the company has earned. Noble Gold is also an accredited business with the Consumer Affairs Alliance and the Better Business Bureau. They are also a member of the TrustLink Business-Consumer Alliance.

>>>Read the full Noble Gold Investment review.

Lastly, one of the stronger points of the company is the availability of IRA-eligible coins in numerous denominations. Likely due to their focus on precious metals dealership, they are able to offer IRA-eligible bullion in denominations that you simply will not find with most other gold IRA companies. Here’s their selection of IRA-eligible bullion:

Gold

- Canadian Gold Maple Leaf Coins

- American Gold Eagle Coins

- American Gold Eagle Proof Coins

- Four-Piece Set Proof Gold American Eagle Coins

- Australian Gold Kangaroo Coins

- Austrian Gold Philharmonic Coins

- Pamp Suisse 100 Gram Gold Bar

- Perth Mint 1-Ounce Gold Bar

- Johnson Matthey 1-Kilograph Gold Bar

- Pamp Suisse Lady Fortuna Gold Bars

Silver

- 5-Ounce America the Beautiful Silver Coins

- 1-Ounce American Silver Eagle Coins

- 1-Ounce Austrian Silver Philharmonic Coin

- 1-Ounce Australian Silver Kangaroo Coin

- 1-Ounce Canadian Silver Maple Leaf Coin

- 1-Kilograam Australian Silver Coin

- 1-Ounce Highland Mint Silver Round

- 5-Ounce Highland Mint Silver Bar

Platinum

- American Platinum Eagle Coins

- 1-Ounce Canadian Platinum Maple Leaf Coin

- Baird & Co 1- and 10-Ounce Platinum Bars

Palladium

- 1-Ounce Canadian Palladium Maple Leaf Coin

- 1-Ounce Credit Suisse Palladium Bar

If you think you’re ready to learn more about setting up a gold IRA with Noble Gold, request the FREE Gold IRA Guide. This helpful guide includes information about why you should consider investing in precious metals and the steps to take to set up a new gold IRA or roll over an existing retirement plan. It also shares some of the different gold, silver, platinum, and palladium coins or bars you can add to your account with Noble Gold.

Pros

- One of the lowest minimum IRA requirements in the sector, with $2,000 to open an IRA and a $5,000 rollover minimum.

- Low annual fees

- A+ BBB rating & AAA BCA rating

- Excellent customer reviews

- A company that functions just as strongly as a gold IRA provider as it does a precious metals dealer

- FREE Gold Investment Masterclass hosted by Kevin Sorbo

- Buyback program

Cons

- Only one US storage option in the form of International Depository Services

- Let us be fair: survival packs should probably be available for less than $10,000

Here are some of the happy customers of Noble Gold:

I’d like to share my experience working with Micah Haines at Noble Gold. I was initially skeptical about the process, but Micah’s knowledge, patience, and kindness quickly put me at ease. He explained everything clearly, answered all my questions. Even my bank representative commented on how smooth and well-organized everything was. Thanks to Micah, what began with uncertainty turned into confidence. I’m very thankful for his help and highly recommend Noble Gold for your precious metals purchases.

I’ve been working with Jake Bell for about 3 years now and it hasn’t disappointed, he’s very thorough and explains everything clear and it’s very knowledgeable and willing to help you in any way possible I highly recommend this company and Jake.

Noble Gold Investments has supplied me with great service and knowledge! Senior Sales Associate ***** ******* has been excellent and easy to work with, keeping me well informed and always answering my questions speedily and accurately. I recommend Noble Gold and ***** ******* to all I know that are looking for an honest and sound investment company.

#5. Augusta Precious Metals: Best For High-Income Investors

PROMOTIONS AUGUSTA

$0 Fees for up to 10 Years (on Qualifying Rollovers)

Order the Ultimate Guide to Gold IRAs and Get Paid in REAL Gold

INVESTMENT MINIMUMS GOLD IRA

Investment Minimums Gold IRA: $50,000

INVESTMENT MINIMUMS CASH SALES

Investment Minimums Cash Sales: $50,000

Since the company was first started in 2012, Augusta Precious Metals has developed a trusted reputation in the gold investment industry. The company offers an experienced and knowledgeable team to work with their customers, answer questions, and help each customer protect their retirement savings.

What we like the most about Augusta Precious Metals:

- $0 Fees for up to 10 Years (on Qualifying Rollovers)

- A+ BBB rating and AAA BCA rating

- 1000s of 5-star reviews

- Money magazine: “Best Overall” Gold IRA Company in 2025

- Educational, no-pressue sales approach

- Account lifetime service

Fifth on our list of the best gold IRA companies for 2026 comes Augusta Precious Metals. The company is especially beneficial for high-income investors with its higher investment minimums and educational approach.

Augusta has an excellent track record with thousands of top ratings. They also have hundreds of top reviews on watchdog sites like TrustLink, as well as an A+ BBB rating and an AAA rating with the BCA. As a matter of fact, Augusta has been named:

- “Most-Trusted Gold IRA Company” by IRA Gold Advisor

- “Best Overall” Gold IRA Company in 2025 by Money Magazine

- And received “Best of TrustLink” 6 years in a row.

The company’s standout feature is its unique approach to customer education. Through a personal one-on-one web conference designed by on-staff Harvard-trained economist Devlyn Steele, investors and retirees receive valuable insights.

Augusta Precious Metals also offers a well-oiled process for stress-free and easy gold IRA rollovers or transfers, supported by trustworthy IRA specialists.

>>>Read the full Augusta Precious Metals review.

Gold & Silver Coins

- Gold American Eagle Proofs

- Gold American Eagle Coins

- Gold American Buffalo Coins

- Gold Canadian Eagle Coins

- Gold Canadian Maple Leaf Coins

- Australian Striped Marlin

- Gold or Silver Austrian Philharmonics

- Silver Canadian Eagle with Nest Coins

- Silver Canadian Soaring Eagle Coins

- Silver Canadian Maple Leaf Coins

- Silver American Eagle Coins

- Silver America the Beautiful Coins

- Gold or Silver Bullion Bars

With Augusta Precious Metals, you can also decide to purchase gold or silver for a personal investment outside of an IRA. They offer a large selection of gold bullion, premium gold, silver bullion, and premium silver that you can have shipped directly to your door.

Pros

- Excellent customer reviews

- Unique, free one-on-one educational web conference designed by Augusta's on-staff, Harvard-trained economist

- $0 Fees for up to 10 Years (on Qualifying Rollovers)

- Educational, no-pressure sales approach

- Easy and stress-free IRA setup

- A+ BBB rating and AAA BCA rating

- Free guide on how to avoid gimmicks & high-pressure tactics used by gold IRA companies

Cons

- IRA minimum deposits start at $50,000, which is quite high for some investors

- Cannot set up an account online

Here are some of the happy customers of Augusta Precious Metals:

Cierra is what makes our experience great. She provides outstanding customer service and always has since we've been doing business with Augusta Precious Metals. She has always taken great care of us. I'm sure we are not the only client to say so.

I am not experienced in any form of investment. Have considered a precious metals IRA for a few years and came across Augusta. Because this is what they do, and the only thing they do, I was confident that they had no ulterior motives. Have felt throughout the process that they were simply and earnestly only trying to help me accomplish this process. Well pleased with the results.

#6. American Hartford Gold: Good Precious Metals Assortment

PROMOTION AMERICAN HARTFORD GOLD

No Fees for the First Year in IRAs With a Minimum Account Purchase of $50,000s No Fees for the First 3 Years in IRAs With a Minimum Account Purchase of $100,000

INVESTMENT MINIMUMS GOLD IRA

Investment Minimums Gold IRA: $10,000

INVESTMENT MINIMUMS CASH SALES

Investment Minimums Cash Sales: $5,000

What we like the most about American Hartford Gold:

- A+ BBB rating & AA BCA rating

- Average review rating of 4.89/5 stars on the BBB

- 100% free gold IRA rollover

- Price match guarantee and buyback commitment

- A good amount of positive reviews

- Endorsed by Bill O' Reilly

- Free maintenance storage & insurance for up to 3 years

Sixth on the list of our best gold IRA companies for 2026 comes American Hartford Gold. American Hartford Gold was founded by Sanford Mann in 2015. The company’s headquarters are located in Los Angeles, California, but the company serves clients all across the country.

Additionally, the gold investment firm specializes in assisting investors and retirees with setting up a gold IRA. They also offer coins and bars for personal sale, providing options for diversifying portfolios. The company emphasizes their dedication to customer satisfaction, which is backed by a 100% satisfaction guarantee.

Despite being a relatively new player in the industry, American Hartford Gold has garnered positive feedback from customers and reputable review organizations. They have received an impressive A+ rating from the Better Business Bureau and AA rating from the Business Consumer Alliance.

Additionally, notable figures such as Lou Dobbs, Bill O’Reilly, Megyn Kelly, Rudy Giuliana, Liz Wheeler, and Rick Harrison have endorsed and partnered with the company. Plus, American Hartford Gold’s recognition as one of the fastest-growing private companies on the INC 5000 further instills trust in their services.

>>>Read the full American Hartford Gold review.

Below you’ll find a list of the different IRA-approved gold and silver bars that American Hartford Gold offers:

Gold Coins And Gold Bars

- American Buffalo Gold Coins

- American Gold Eagle Gold Coins

- Canadian Gold Maple Leaf Gold Coins

- Austrian Gold Philharmonics Gold Coins

- Canadian Buffalo 2021 Gold Coins

- Canadian Gyrfalcon Gold Coins

- Australian Wildlife Gold Coins

- Saint Helena Sovereign Gold Coins

- 1 Ounce Gold Bar

- And more.

Silver Coins And Silver Bars

- America the Beautiful Silver Series

- Saint Helena Sovereign Silver Coins

- American Silver Eagle Silver Coins

- Australian Wildlife Silver Coins

- Europa and the Bull Silver Coins

- South African Krugerrand Silver Coins

- Canadian Buffalo 2021 Silver Coins

- Canadian Gyrfalcon Silver Coins

- 2014 Canadian Arctic Fox Silver Coins

- A Variety of Silver Bars and Rounds

Platinum

- American Platinum Eagle Coin

- A Variety of Platinum Bars and Rounds

If you still need another reason to consider working with American Hartford Gold, you may be interested to hear about the promotion they are currently offering.

Customers who open a qualified IRA will be eligible to receive as much as $5,000 in FREE Silver.

Pros

- Billions of dollars of precious metals have been delivered to thousands of satisfied customers

- Good palette of gold and silver bullion, especially for a gold IRA company

- Competitive fee structure

- A good amount of positive reviews

- Price match guarantee and buyback commitment

- 100% free IRA rollover - Free maintenance storage & insurance for up to 3 years

- Ranked #1 for Inc 5000 in the precious metals vertical

Cons

- No price listing on their products with unclear markup

- No international shipping

Here are some of the happy customers of American Hartford Gold:

Quick and easy to deal with Jesse is an incredibly friendly and knowledgeable representative who made purchasing gold and silver a breeze. He was extremely patient, taking the time to educate us throughout the process. Thanks to his guidance, opening our account and closing the transaction was seamless. I’m so glad I had the pleasure of working with him!

As with any business it's a combination of good customer service and quality products and I got both here. Lauran De Winter did an excellent job of explaining, in minute detail, the intricacies of buying precious metals and the pros and cons of each type. As this was my first time buying metals it was immensely appreciated. Dani Harris executed the sale with professional precision that did not waste time yet did not cut corners. I felt like a valued customer throughout the entire transaction and highly recommend their service for first time buyers as well as experienced ones.

What Is A Gold IRA?

A gold IRA, also called a precious metals IRA, is a specialized, self-directed individual retirement account designed to hold gold and silver, and other metals.

Just like traditional IRAs, a gold IRA allows pre-tax contributions, meaning that the investment earnings can accumulate tax-deferred.

A gold IRA (also called a precious metals IRA) differs from a traditional IRA in the sense that it strictly holds physical gold, silver, or other metals.

In contrast to a gold IRA, a regular IRA typically holds paper assets such as stocks, bonds, ETFs, funds, and so forth.

Benefits Of A Gold IRA

In unpredictable times like these, it is more crucial than ever to look to assets that can protect your funds from inflation and other economic strains.

The advantages of opening a gold IRA account are numerous, and they include:

- Protection against a declining dollar and inflation

- Minimize susceptibility to financial instability

- Reduce the negative effects of geopolitical unrest

- Reduce the negative effects of the economic crisis caused by the coronavirus

- Add diversification to your holdings

- Take real ownership of your financial future

Are There Different Types Of Gold IRAs?

Yes, there are two types of gold IRAs available:

1. Traditional-Based Gold IRA

Your contributions to a traditional IRA are tax deductible (within certain income parameters). The money you withdraw from your gold IRA when you start taking distributions is taxed as ordinary income. At age 59½, you can begin receiving distributions without incurring penalties.

For those who believe that they will be in a lower tax bracket in retirement, traditional IRAs can be a viable option.

In this way, they can benefit from tax advantages from their contributions during their years of employment in the higher tax bracket and pay taxes on withdrawals at a lower rate once they retire.

You should be aware that conventional IRAs, including traditional gold IRAs, are subject to the required minimum distribution (RMD) requirement. This implies that starting at age 70½, you must start drawing annual payments from your IRA.

2. Roth-Based Gold IRA

With a Roth gold IRA, in contrast to a standard IRA, your contributions are NOT tax deductible. This indicates that you will not receive any tax benefits from your account contributions while you are an employee.

As opposed to a standard IRA, a Roth IRA does not require you to pay taxes on distributions made from the account.

If a person believes their current tax level is lower than their future retirement tax bracket, they may want to consider a Roth IRA as a wise investment.

While they are still employed, they will not enjoy a tax benefit from their contributions, but when they retire and start taking withdrawals, they won’t be subject to any taxes at all.

A Roth IRA does not have a requirement for minimum distributions either. Additionally, as of 2026, you cannot contribute to a Roth IRA if your modified adjusted gross income is greater than $168,000 for single households and $252,000 for married couples filing jointly.

The parameters offered here for both regular and Roth IRAs are extremely broad, so please be mindful of that. To make sure you’re making the greatest choice for your own unique tax profile, you should speak with your tax advisor before deciding between a standard and a Roth IRA.

Do I Need To Pay Taxes On My Gold IRA?

By making an investment in a gold IRA, you can diversify your retirement portfolio while still receiving tax benefits.

Because of this, there are no tax repercussions when you move or roll over a portion of your current IRA account into a gold IRA. In other words, until you withdraw your payments, you are not required to pay taxes on them.

You are nevertheless only permitted to contribute a certain amount to these accounts each year, and these limits are subject to change. These regulations will be modified by your gold IRA provider.

FREE Gold & Silver Ultimate Guide!

What Are The Fees Of A Gold IRA?

When compared to a regular or Roth IRA that only invests in paper assets, a precious metals or gold IRA frequently has higher fees.

Three types of fees are often associated with a gold IRA:

1. Account Setup Fee

The initial setup price for new accounts ranges from $50 to $150.

Additionally, if the account size is sufficient, some businesses will forgo this fee. To give you two instances, Augusta Precious Metals is waiving all your fees for up to 10 years (all customers qualify).

Also, Birch Gold Group will not charge any setup fees for new accounts that are over $50,000 and will not charge shipping costs for any cash purchases that are over $10,000.

2. Admin/Custodial Fee

A yearly administrative or custodial cost is further charged, ranging from $50 to $150 depending on the size of the account, in addition to the establishment price.

3. Storage Fee

The repository also charges storage fees, which can range from $100 to $150 yearly depending on the amount of gold being housed. The fee also varies depending on if you like segregated or non-segregated storage.

*4. How Do Gold IRA Companies Make Their Money

Companies typically make money by adding a markup or fee to their prices.

Most gold IRA businesses add a “markup” to the spot price, which is effectively their take to facilitate the transaction, in place of the standard commission for buying or selling gold.

Gold Coins Or Gold Bars?

You can pick between bullion bars and sovereign coins when buying gold for your gold IRA.

You can pick between bullion bars and sovereign coins when buying gold for your gold IRA.

In order to evaluate if gold or silver in the form of bullion bars or coins is appropriate for a gold IRA, the IRS has created rules for metal “fineness” standards.

This means that the IRS only allows specific gold and silver coins and bars, such as:

- Gold or Silver American Eagles

- Gold or Silver American Eagles (Proof coins)

- Gold or Silver American Buffalos

- Gold or Silver Canadian Maple Leafs

- Gold or Silver Austrian Philharmonics

- Silver America the Beautiful Coins

- Gold or Silver Bullion Bars

- American Silver Eagles

- And more.

Whatever bullion or coins you decide to use, a reputable gold IRA provider is aware of what is and is not permitted for a gold IRA. Coins may be simpler to trade than bullion bars and have a tendency to fetch bigger premiums when sold, despite the fact that both are effectively priced the same way—per ounce based on the spot price of gold.

In addition, markups on small bullion bars are frequently larger. And institutional investors would benefit more from large bars. The firms that offer gold IRAs (mentioned above) all have advantageous buy-back policies for both coins and gold bullion.

How Do I Fund My Gold IRA?

It’s excellent to open a gold IRA, but it’s much better if it’s funded by an existing plan. The companies offering gold IRAs that are listed in this page offer assistance with a range of rollovers, including:

- The whole or partial rollover of a 401(k), TSP, or comparable inactive retirement account.

- The full or partial rollover of a SIMPLE or SEP IRA.

- Rollovers of less popular plans and accounts, like SIMPLE or SEP IRA.

Rollovers are not as problematic as they might seem when working with any of these gold IRA businesses.

A professional handles the rollover on behalf of the custodial firm and whatever administration the gold IRA firm may use. And other sources can be used to fund the new gold IRA.

Can I Rollover My 401(k) Into Gold?

Yes.

In reality, many investors in gold IRAs use money they’ve accumulated through standard IRA or company-managed 401(k) accounts. Additionally, retirees who take their accounts with them when they leave the workforce also convert to gold.

Many people opt to transfer just a portion of their IRA or 401(k) to a gold IRA in order to diversify their retirement savings, which is always the best course of action. Discover more in our comprehensive guide on how to buy gold with your 401(k).

Where Should I Store The Gold In My IRA?

The bullion in your IRA must be held by a certified depository, a company distinct from the custodian who will handle your daily paperwork, per IRS regulation. It goes without saying that you are not permitted to store your IRA gold in a house safe, safety deposit box, or underneath a mattress.

The majority of gold IRA providers work with a variety of properly screened custodians to ensure that your metals are held securely.

If none of them meet your needs, you can add a repository of your own to the mix as long as it complies with legal requirements.

For instance, there are some similarities between Brink’s, the Delaware Depository, and IDS. All three have a comparable set of perks despite the fact that only IDS of the three offers segregated storage:

• An independent building where the gold is processed

• The depository uses the best technologies available to operate the facility and its vaults

• They feature electronic systems and high-defense vaults for security

• In addition, a multi-faceted policy insures their assets

Typically, the organization handles insurance coverage as well as logistics for shipment

Note: It is your responsibility to ensure that any company you invest with possesses all necessary permits, registrations, insurance, and bonds to safeguard your money. So, request proof of such licenses and other documents.

When Can I Take Distributions?

You have the option to take funds in cash value if you are at the required age to begin receiving distributions from your account, which is typically 59½ years old. Or you might have the metals themselves transported directly to you.

However, be aware that you will be subject to the appropriate taxation and will be liable for any IRS fines associated with early withdrawals. The basic line is that you should hold a gold IRA until it matures and approach it as a long-term retirement investment.

Keep in mind that you must begin receiving benefits at the age of 70½.

How To Start A Gold IRA

Opening a gold IRA is easy, especially when you work with precious metals professionals who are familiar with all the ins and outs of this kind of IRA.

Next, allow us to walk you through the simple 4 steps to opening a gold IRA:

- Step 1: Select Your IRA Plan

To begin with, if you want to invest in precious metals, you must first open a self-directed IRA. You can open a new IRA account as an investor or transfer funds from an existing retirement account. To ensure that you comply with requirements and that any retirement accounts you presently possess are suitable for a gold IRA transfer or rollover, or other precious metals IRA, it is crucial to speak with a tax counselor and precious metals expert.

- Step 2: Select A Precious Metals Custodian

Second, in accordance with IRS guidelines, gold IRA funds must be kept with a custodian. Finding a custodian with experience in gold IRA investing will therefore be made easier if you deal with precious metals investing experts like those at GoldenCrest Metals or Birch Gold Group. That way, you’ll ensure that your self-directed IRA is set up appropriately.

- Step 3: Select Your Precious Metals

To avoid retirement investment blunders, it’s critical to keep in mind that precious metals must adhere to specific IRS guidelines and restrictions. Choosing the appropriate sorts of gold, other precious metals, or cryptocurrency will be made easier if you work with a precious metals specialist.

- Step 4: Purchase Precious Metals

Once you’ve decided the metals you want to invest in, you can buy them and coordinate storage with your custodian. Your assets will be kept in a bullion depository by the custodian in order for them to be accessible when you need them.

FREE Gold & Silver Ultimate Guide!

How To Manage Your Precious Metals

Even after the account has been opened and funded, getting started may seem difficult. There may be some debates on the coin denomination to buy in, even among the most ardent gold investors. Those with less willpower are more susceptible to outside forces, which are never far away in the world of finance.

In your account, all precious metals serve the same function in relation to other assets. They were most likely purchased with safety in mind and are probably a type of hedge. However, the utility of precious metals might vary greatly among one another.

You may want your gold IRA for the following reasons:

Gold

- The safest choice and the most defensive of the four. The least volatile asset on the downside is gold, which frequently exhibits subdued price movement. In any crisis situation, it performs admirably, even when the circumstances are unusual.

- There is a small amount of industrial influence. Despite the fact that gold has several applications and is used in a variety of industries, it is primarily thought of as an investment metal. Even individuals purchasing gold jewelry frequently consider how much it will cost in weight in the future.

- The most represented of the precious metals, with the broadest range of investment opportunities both inside and outside of an IRA. When choosing products from the inventory, collectors and IRA investors will be limited in their options.

Silver

- In the world of precious metals, silver is frequently gold's opposite. Since the metal never ceases to play this role on a larger scale, it is always both a safety play and a defensive one. Silver, despite following the price of gold, acts differently from gold within the realm of precious metals.

- Contrary to popular belief, people purchase silver because of a certain set of advantages rather than because it is less expensive than gold. The production sector for metal is enormous, and green technology is becoming more and more popular. Any big changes in manufacturing sector demand would be very favorable for silver's price.

- A similarly broad selection of gold investment choices is available, including numerous new and vintage coin variations that may be held inside or outside of an IRA. Compared to the other two precious metals, gold and silver both have a sizable segment of coin lovers.

Platinum and Palladium

- These can be regarded as industrial metals in the perspective of precious metals. They fluctuate just as much as silver does, but for different reasons. These days, palladium is valued higher than gold. The price of platinum, historically the equivalent of gold, is currently about half that of gold.

- The mine supply of platinum and palladium is now constrained. Mining is rather localized and doesn't happen often. For instance, one nation produces about 40% of the annual production of palladium. The metal has reached fresh all-time highs as a result of this. Despite a lack of availability, the number of technologies using platinum and palladium is growing.

- Contrary to popular belief, there are numerous investing opportunities for platinum and palladium. Many investors are interested in sovereign coins made of either platinum or palladium in addition to a variety of bars.

Securing Your Wealth With A Gold IRA That Lasts

A gold IRA can help you diversify, safeguard, and grow your retirement savings account and also hedge against a declining currency, increasing inflation, and geopolitical instability.

Each of these gold investment firms has the experience and knowledge to assist you accomplish the retirement of your dreams, despite the fact that your present investing status and future objectives are all distinct.

Therefore, start by requesting a free gold IRA information kit or guide from any of these businesses, and a representative will get in touch with you and give you all the information you’ll need to choose the greatest investment for your future.

Before you go, you may want to check put our video on the secret wealth strategy billionaires use that you can mirror:

Frequently Asked Questions

What is a gold IRA?

Self-Directed IRAs were created to give individuals more freedom in selecting the types of investments they would like to hold in a retirement account. A gold IRA is an example of a Self-Directed IRA where individuals hold gold, silver, or other precious metals rather than the traditional stocks and bonds.

By holding some investments in precious metals, individuals are able to diversify their portfolio and set themselves up for future financial success. With a diversified portfolio, you’re less likely to be negatively impacted by a stock market crash since some of your funds are held in other investment opportunities, such as gold.

Will the value of a gold coin increase?

As the value of gold increases, the value of a gold coin will also increase. The face value of each coin (what is printed on the coin) is not a true reflection of its value. Rather, the value is likely much higher based on the current price of gold.

When is the best time to purchase gold?

The ideal time to purchase gold is when it is at a lower value. In general, the value of gold is at a lower amount when the stock market is over performing. Gold may also come down in price in some months, including January, March, and April.

How can I invest in gold?

There are a few different ways you can invest in gold. One is to purchase gold coins or bars from a gold investment company or a local coin shop. Hold the coins until you are satisfied with the growth in their value or you need the money for retirement or another big expense.

You can also invest in gold by setting up a gold IRA. Gold IRAs are a form of Self-Directed IRA where funds are held in gold, rather than the traditional stocks and bonds. Setting up a gold IRA is a good way to invest in gold or other precious metals without worrying as much about taxes.

How much of my portfolio should be held in gold?

The answer to this question will be different for each person depending on their current financial position, their age, and personal preferences. If you’re close to retirement age, you’ll likely want to take fewer investment risks, so you might not want a large percentage of your money invested in gold.

On the other hand, if you’re still young, you have more time to be a bit more aggressive with your investments and to take greater risks, so you may choose to have a larger portion of your portfolio invested in gold.

You can always chat with a financial advisor and shift investments around in your portfolio based on what makes sense at the time based on the economy and your personal financial goals.