Gold IRA Specialist

4.89/5

- A+ BBB rating and AAA BCA rating

- Average review rating of 5/5 on TrustLink & Birdeye

- Stress-free and easy gold IRA set up

- Exemplary track record

- Buy-back program

- On-going promotions

- Team of former wealth managers, financial advisors, & commodity brokers

Birch Gold Group

309 Court Avenue, Suite 809, Des Moines, IA 50309 Tel: (888) 643-5536 www.birchgold.com

Products Available:

- Bullion Bars

- Bullion Coins

- Self-Directed IRA

- Cash Sales of Precious Metals

Current Promotions

Birch Gold Group currently offers these promotions investors can take advantage of:

- Get up to $20,000 in FREE Metals for qualified purchases

- First-year fees waived on IRAs over $50,000

- Free shipping for cash purchases over $10,000

- Plus, up to $10,000 in free precious metals on qualified purchases

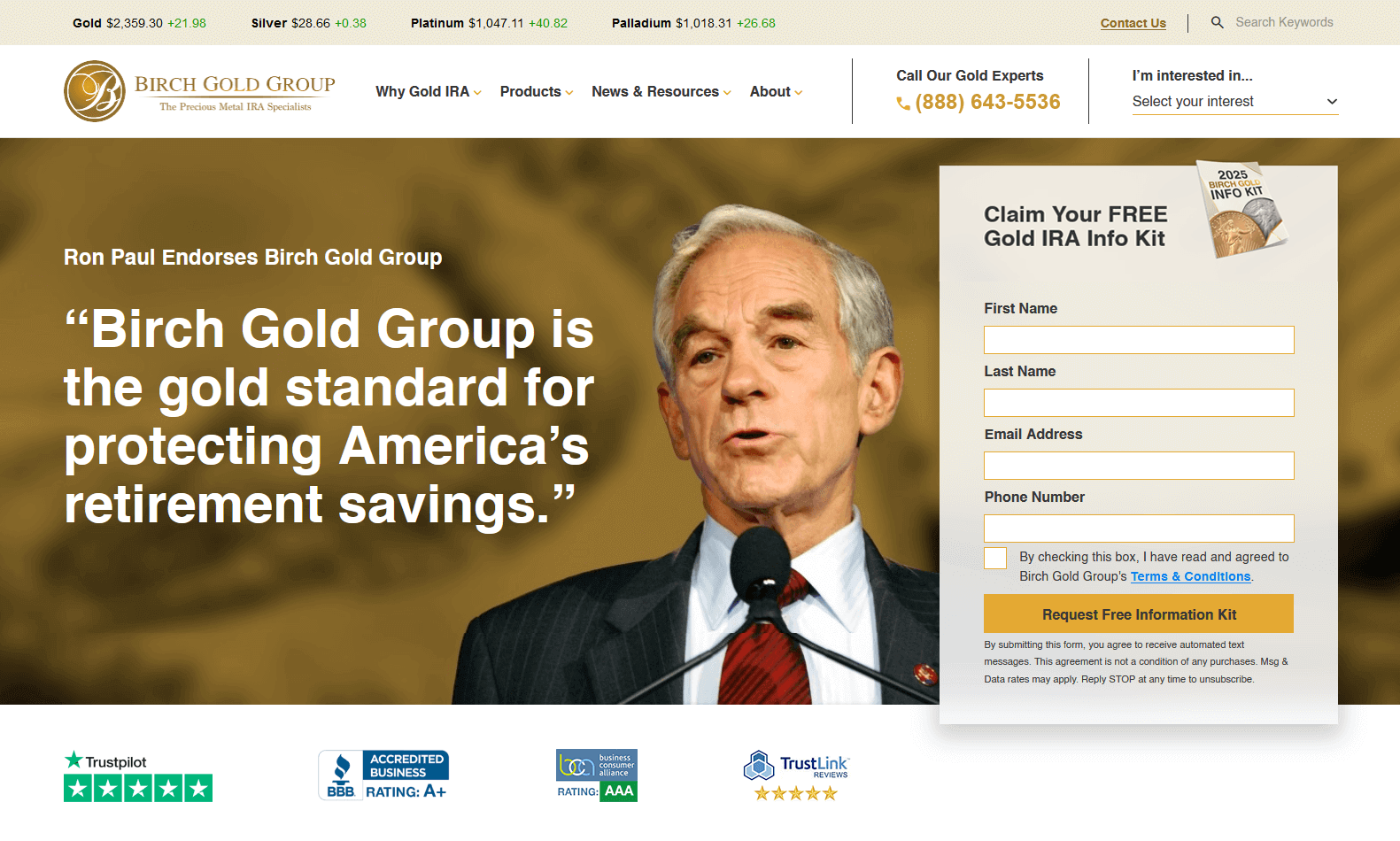

Birch Gold Reviews & Ratings

We have examined Birch Gold’s evaluations and ratings as a natural and crucial component of our review.

First off, Birch Gold has a stellar reputation in the sector because to its success. Second, their numerous awards and excellent reviews from unbiased company review groups clearly demonstrate the reputation they have built over the past nearly two decades.

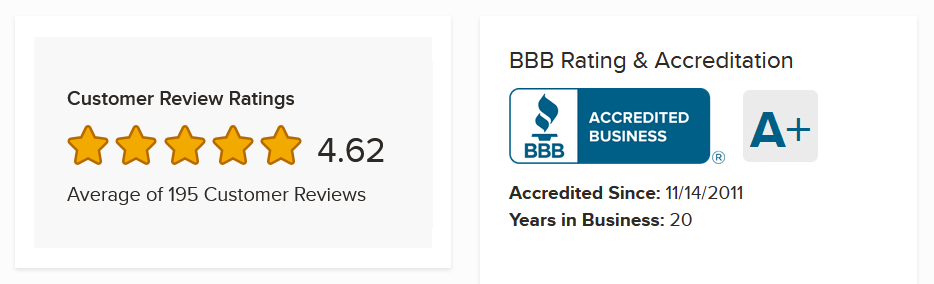

Birch Gold Group BBB Rating And Verified Customer Reviews

Here are some BBB and BCA ratings for Birch Gold Group, along with client feedback from well-known consumer protection websites:

- Better Business Bureau: Birch Gold Group currently holds an A+ rating and a 4.62/5 star rating based on 195 customer reviews

- Business Consumer Alliance: BGG holds an AAA rating (their top rating) and a 5/5 star rating based on 7 reviews with the BCA

- BGG is an accredited partner with Consumer Affairs. The company has a 5 star rating based on 182 verified customer reviews

- TrustLink: Birch Gold Group holds a 5/5 star rating based on 135 customer reviews

- Trustpilot: Birch has a 4.7/5 star rating with Trustpilot based on 246 client reviews

- Yelp: The company also has a 3.8/5 star rating on Yelp based on 10 reviews

- Google Reviews: BGG has a 4.7/5 star rating on Google. This is based on 382 customer reviews

- Birdeye: BGG has a 4.7/5 star rating on Birdye based on 1157 customer reviews

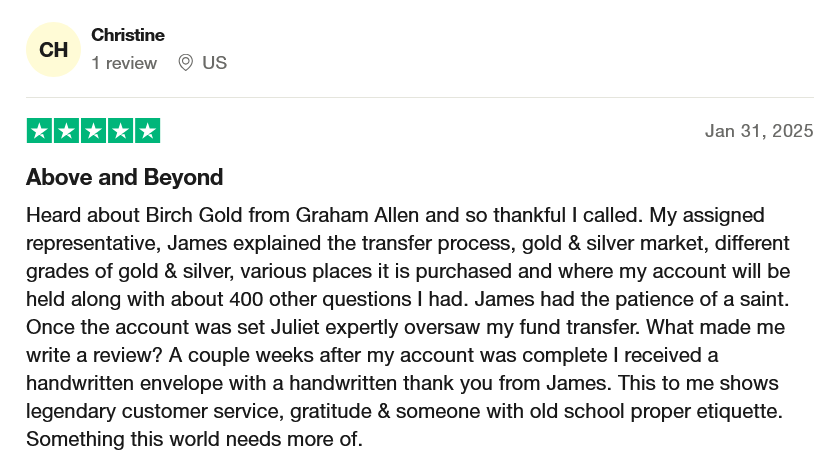

Birch Gold Group BBB And Trustpilot Reviews

Gregory & Randi B

- Verified Customer

They were very patient with me. I have never bought gold or silver before. By transferring a state 457B account before?As a matter of fact All I had to do was send the documents from the account named above the girls. Looked over it, send it back to me showed me. We’re, I needed to sign, I signed it and they sent it off to the company holding the account. So that I didn’t have to do anything. I strongly recommend this company customer service. Was a plus you don’t find that anymore in this country.

Reviewed on: June 20, 2025

Ryan F

- Verified Customer

The crew at Birch Gold were extremely helpful and knowledgeable. As a first time buyer, I had hesitancies, but their consistent communication made the process much smoother and they delivered on their promises. They handled a lot of the paperwork and made the transaction seamless. I will definitely be doing business with them in the future!

Reviewed on: June 10, 2025

Birch Gold Group Complaints

In the past three years, Birch Gold Group has received 8 complaints in total, 3 of which have been resolved in the last 3 months.

With that, let’s examine Birch Gold Group’s identity and the greatest clients for them moving forward.

Ron Paul Trusts Birch Gold Group

What Is Birch Gold Group (BGG)?

The executive team of Birch Gold Group, which was established in 2003 and has its headquarters in Des Moines, Iowa, has assisted thousands of Americans in diversifying their savings with genuine precious metals such as gold, silver, platinum, and palladium.

Birch Gold Group has been in operation for over two decades and has become one of the more well-known gold IRA companies in the US. The company’s philosophy in empowering clients via education and using a no-pressure sales style are two key factors in its success.

Investors can transfer a qualified tax-deferred retirement account into a precious metals IRA with the assistance of the Precious Metals Specialists at Birch Gold Group without incurring any taxes or penalties.

Traditional, Roth, SEP, and SIMPLE IRAs are additional accounts that qualify for a rollover. Additionally, a large number of employer-sponsored retirement savings plans, including a 401(k), 403(b), and TSP, are transferable to a gold IRA.

BGG provides cash sales of metals for physical possession in addition to the conventional precious metals IRAs. In this video, you’ll discover about Birch Gold Group and how to avoid being duped into buying gold:

Ben Shapiro's Endorsement of Birch Gold

Ben Shapiro, known for having one of the fastest-growing conservative podcasts in the United States with millions of monthly downloads and numerous advertising sponsors, has consistently endorsed Birch Gold Group.

This endorsement has resulted in Birch Gold Group being featured prominently in major news and media outlets. Notably, the company has maintained its advertising partnership with Ben Shapiro since 2016, even during periods of controversy.

This partnership has provided the public with valuable insights into retirement savings options, as Ben Shapiro emphasizes the importance of diversifying assets, stating that,

“…it is foolish not to have some assets in the one area of human activity that has never been worth zero.”

He has also played a role in popularizing the option to convert an IRA or qualifying 401(k) into an IRA backed by physical gold and silver. In this video, Birch Gold’s Philip Patrick and Ben Shapiro discuss where the economy is going and why precious metals might be your best choice to safeguard your future:

Now, let’s delve into whether Birch Gold Group is a suitable choice for individuals interested in purchasing physical gold and silver, and who would benefit most from working with them.

Get up to $20,000 in FREE Metals

Who Is Birch Gold Group Best For?

BGG is a great choice for many types of investors, including those who:

- Want to own a physical asset: Contrary to corporations, which can cease to exist at any time, precious metals have always existed and always will. Therefore, precious metals should be your pick if you desire a physical asset in your investing portfolio that will never go out of style.

- Want to protect their wealth from stock market volatility and inflation: Precious metals are a good way to reduce your risk if the market gives you the shakes. In 2021, gold's average annualized growth rate was 8.8% as opposed to the S&P 500's and the Dow Jones Industrial Average's respective rates of 5.1% and 5.0%. Therefore, many investors are drawn to gold's potential for long-term growth.

- Are nearing retirement and want to secure their retirement savings: When you need stability the most, precious metals are safe haven assets to help you hedge against market volatility. They are a store of value and provide financial protection.

BGG Offers The Following Services/Products

Let’s take a look at the services or products offered by Birch Gold Group:

1. Non-IRA Precious Metals

Direct cash purchases, shares of gold- and silver-mining firms, exchange-traded funds (ETFs), and buying actual precious metals with your IRA are just a few of the options to invest in precious metals.

Birch Gold Group is primarily recognized for permitting gold IRAs, even though they can handle direct orders that are delivered to your home.

2. Precious Metal IRAs/Gold IRAs

The IRS classifies the majority of precious metals that are prohibited from being held in an IRA as “collectibles.” However, Americans are now able to diversify retirement savings into a larger range of investments according to the Taxpayer Relief Act of 1997.

These consist of specified items made of gold, silver, platinum, and palladium that adhere to the IRS specifications and minimum purity standards. As a result, Birch Gold Group can locate virtually any bullion bar or coin that is acceptable for your IRA.

If you’re ready to take action

Annual IRA Fees And Transaction Minimums

Birch Gold Group (BGG) offers a comprehensive range of services to assist clients in opening new IRA accounts and acquiring gold and silver from reputable sources, including international mints.

The pricing of precious metals offered by the firm is based on prevailing rates in the spot market. Birch Gold Group leverages its ability to make bulk purchases at a discounted price, subsequently selling these metals at rates above the spot market. The company’s compensation is derived from the margin between the wholesale cost of the metals and the retail price of the products they provide.

Regarding precious metals IRAs, clients can expect to encounter a one-time setup fee, in addition to annual fees for the storage and maintenance of their IRA with the custodian. These fees cover the ongoing management and security of your precious metals holdings within the IRA.

1. Birch Gold Group Fees

The fees you can anticipate when starting a gold IRA with Birch Gold Group are listed below:

- One-Time Setup Fee: $50 (waived on IRAs over $50,000)

- Wire Transfer: $30 (waived on IRAs over $50,000)

- Annual Admin Fee: $100 (waived on IRAs over $50,000)

- Annual Storage Fee: $100 (Non-Segregated) / $150 (Segregated)

- Annual Total Fees: $100-$330

Birch Gold enables for purchases as low as $10,000 for both IRA and cash transactions, in contrast to many other gold IRA providers. The majority of other businesses in this industry have transaction minimums of $25,000 or more.

2. Transaction Minimums

The transaction minimums for a gold or precious metals IRA and regular cash purchases are as follows:

Minimum Purchase Amount Gold IRA

$10,000

Minimum Cash Purchase Amount

$10,000

For new accounts exceeding $50,000, BGG waives all setup fees. Additionally, shipping expenses are waived on all cash purchases of $10,000 or more.

Plus, for precious metals cash sales, the metals are sent straight to the customer’s preferred location while being fully insured.

3. New Customer Specials

You can save a lot of money with new customer promotions from Birch Gold Group:

- Get up to $20,000 in FREE Metals for qualified purchases

- First-year fees waived on IRAs over $50,000

- Free shipping for cash purchases over $10,000

- Plus, up to $10,000 in free precious metals on qualified purchases

4. Buy-Back Program

Birch Gold Group will buy back your precious metals at no additional cost when you are ready to sell any of your holdings.

Get up to $20,000 in FREE Metals

Custodians And Storage

Birch Gold Group (BGG) has established strategic partnerships with well-regarded self-directed IRA custodians and secure gold vault storage companies, ensuring cost-effective solutions for your gold IRA rollover.

BGG collaborates closely with two reputable custodians, Equity Trust and STRATA Trust, both of which levy a modest annual fee of $100 for administering your IRA.

For storage services, Birch Gold Group works with Delaware Depository and Brinks Global Services. As a BGG client, you can anticipate an annual fee of $100 for securely storing your precious metals, regardless of whether you choose Delaware Depository or Brinks for your storage needs.

It’s worth noting that when compared to gold IRA competitors, Birch Gold Group’s custodial and storage fees are reasonable and consistent with industry standards. Additionally, some of their competitors have also established relationships with Equity, STRATA, Brinks, and Delaware Depository.

Importantly, Birch Gold Group does not impose any additional fees on top of what these service providers charge. Your custodial and storage fees are billed directly by the providers you select for your gold IRA rollover.

Popular Precious Metals Coins And Bars

We have divided popular precious metals coins and bars for IRA investments and cash sales, starting with Birch gold coins and gold bars, to provide you an overview of the items Birch Gold is selling.

Birch Gold Coins & Gold Bars

- American Buffalo Gold Coins

- American Gold Eagle Coins

- American Gold Eagle Coins

- Canadian Gold Maple Leaf Coins

- Austrian Philharmonic Gold Coins

- Australian Nugget/Kangaroo Gold Coins

- Gold Gyrfalcon Coins

- Gold Polar Bear and Cub Coins

- Gold Rose Crown Guinea Coins

- Gold Twin Maples Coins

- Valcambi Combi Gold Bars

- A Variety of Gold Bars and Rounds

Birch Gold Coins & Gold Bars

- American the Beautiful Silver Series Coins

- American Silver Eagle Coins

- Canadian Silver Maple Leaf Coins

- Austrian Philharmonic Silver Coins

- Australian Kookaburra Silver Coins

- Mexican Libertad Silver Coins

- Silver Gyrfalcon Silver Coins

- Silver Polar Bear and Cub Coins

- Silver Rose Crown Guinea Coins

- Valcambi Combi Gold Bars

- Silver Twin Maples Coins

- A Variety of Silver Bars and Rounds

Birch Palladium Coins & Palladium Bars

- Canadian Palladium Maple Leaf Coins

- A Variety of Palladium Bars and Rounds

Birch Platinum Coins & Platinum Bars

- American Platinum Eagle Platinum Coins

- A Variety of Platinum Bars and Rounds

If you’re ready to take action

Birch’s Gold IRA Setup Process

Birch will assist you in setting up your new IRA so that the procedure is simple and stress-free. Additionally, we’ll help you move money to your new IRA custodian and make sure everything is done in accordance with IRS tax regulations.

Here is a more detailed explanation of the gold IRA setup procedure:

- Step 1. Request your Free Birch Gold IRA 2025 Info Kit or call: (888) 643-5536 to get started. Your introduction to the business and the finest ways to invest in precious metals is provided in this comprehensive guide.

- Step 2. You will be given the opportunity to discuss your reasons for being interested in gold and silver when a Precious Metals Specialist from Birch contacts you in the following phase.

- Step 3. If you decide to proceed, you will then contact with an IRA Specialist who will inquire about your present retirement account and assist in determining your eligibility for a rollover.

- Step 4. Additionally, if you are qualified to convert your current retirement assets into a gold IRA, you must open an account with a custodian qualified to manage self-directed IRAs. Don't worry; Birch Gold will make a few recommendations and help you with the paperwork.

- Step 5. Birch will assist you with transferring money from your current retirement account to a new self-directed IRA once the necessary documentation is completed.

- Step 6. Birch's Gold IRA Specialists will help you buy the precious metals you want with the money in your new self-directed IRA.

- Step 7. Your precious metals will subsequently be kept at a depository that has been approved and insured up to $1 billion.

And that’s it!

The majority of the labor-intensive work is handled by Birch Gold, which also guides you through each phase of setup.

Get up to $20,000 in FREE Metals

Pros And Cons Of Birch Gold Group

To recap this Birch Gold Group review, here are some pros and cons of the company:

Pros

- With over two decades in business, BGG is an established gold IRA company

- A+ rating by the BBB and AAA rating by the BCA

- Great customer reviews

- Educational, no-pressure sales approach

- Easy and stress-free gold IRA setup

- $10,000 investment minimum (less than most competitors)

- Waives shipping fees on all cash purchases

- Offers a buy-back program

- On-going promotions

Cons

- BGG only does business in the United States

- Cannot set up an account online, just request a FREE Info Kit

Why Invest In Precious Metals?

If you share our concerns about the current state of the United States’ political and economic landscape, you’re not alone. It’s evident that the last years have been filled with turmoil for investors, and some hedge fund managers are even predicting a potential global societal collapse.

Factors such as Trump’s tariffs, inflation, geopolitical tensions, soaring food prices, and the Federal Reserve’s interest rate hikes have all taken a toll on the finances of everyday Americans. Many are witnessing their retirement savings dwindle as the market experiences significant declines.

The Federal Reserve has been grappling with the challenge of controlling inflation, while the specter of a looming recession looms. Research firm Ned Davis has even placed the probability of a global recession at a staggering 98%. Some experts suggest the possibility of experiencing stagflation, prompting a significant number of Americans to redirect their investments away from traditional investments toward safe-haven assets like physical gold and silver.

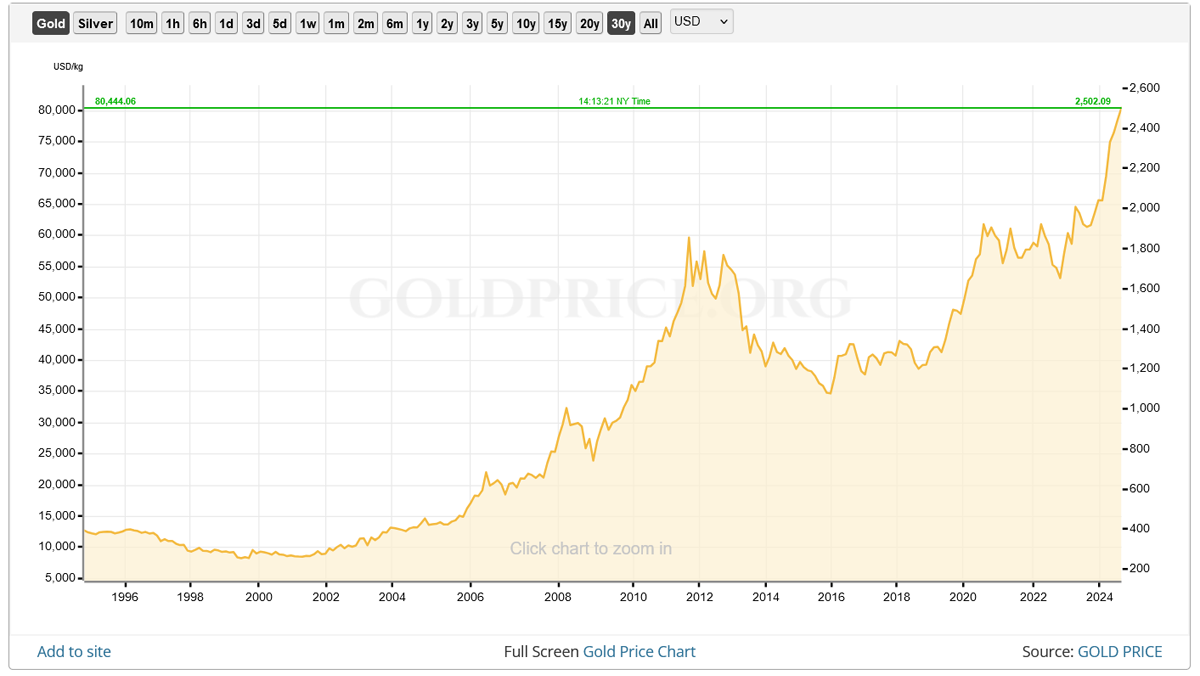

Over the past three decades, the global spot price of gold has experienced substantial growth, highlighting its status as a reliable asset class for investors.

Additionally, the precious metals market is projected to reach a staggering $403.08 billion within the 2021-2028 timeframe, demonstrating a compound annual growth rate (CAGR) of 5.6%.

While investing in gold, like any asset class, comes with its own set of advantages and disadvantages, 2025 appears to be the beginning of what many anticipate as a bull market for precious metals.

2025 Gold Price Prediction

Prominent analysts and experts in the financial industry are expressing bullish sentiments about the future of precious metals, particularly gold:

Goldman Sachs is advising its clients to “Go for gold,” forecasting that prices could soar to $4,000 per ounce by the end of 2025 (which already happened some months ago when gold crushed the $4,300 level). This outlook underscores gold’s enduring appeal as a safe-haven asset in uncertain times.

Ole Hansen, a renowned commodity expert at Saxo Bank in Denmark, has also projected gold reaching $4,000. He anticipates that gold prices could reach an all-time high of $4,000 per ounce. Hansen’s prediction hinges on the belief that if global markets continue to perceive rising inflation despite monetary tightening measures, gold is poised for substantial gains.

Notable billionaires like Thomas Kaplan and Jeff Gundlach are voicing confidence in gold’s future prospects. They foresee the yellow metal potentially reaching prices between $3,000 (we have already passed that level) and $5,000 per ounce.

Given these bullish forecasts, it’s worth considering what precious metals can offer to your investment portfolio.

What Precious Metals Can Do For You!

Precious metals can help you:

- Hedge against a weaker dollar and inflation

- Protect from market volatility

- Limit exposure to economic uncertainty

- Mitigate the effects of geopolitical instability

- Diminish negative fallout from the coronavirus economic crisis

- Diversify your portfolio

- Take private ownership of your financial future

As you can see, buying actual gold, silver, or other precious metals as investments can help you diversify your investments, build wealth, and safeguard your retirement assets. Coincidentally, as a result of demands from nervous investors in the US, the number of gold IRA companies has multiplied.

Advertising for gold firms like Goldco, Augusta Precious Metals, and GoldenCrest Metals seems to be everywhere.

Verdict: Birch Gold Group Review (2025)

Is Birch Gold Group A Leader In The Gold IRA Industry?

Based on our thorough analysis and review of Birch Gold Group, we are confident in recommending them as one of the most reputable and reliable gold IRA providers in the industry. With their excellent track record, they live up to being a true gold IRA specialist.

Birch Gold Group has established a strong reputation in the industry, and here are some key reasons for our endorsement:

Impressive Ratings: Birch Gold Group has earned high ratings, including an A+ from the Better Business Bureau (BBB) and an AAA rating from the Business Consumer Alliance (BCA). These ratings reflect their commitment to customer satisfaction and ethical business practices.

Positive Customer Feedback: With over 15,000 customers nationwide, Birch Gold Group has accumulated numerous 5-star reviews from satisfied clients. This positive feedback underscores their dedication to providing excellent service.

Longevity and Experience: With nearly two decades of experience in the industry, Birch Gold Group has a proven track record of assisting retirees and investors with their precious metals investments. Their longevity suggests they will continue to serve clients effectively.

Customer Support: Birch Gold Group distinguishes itself with its informative, no-pressure sales approach. Their team of IRA Specialists guides clients through the process of setting up a self-directed IRA and offers support throughout.

Cost Savings: Birch Gold Group offers cost-saving benefits, including waiving setup fees for new accounts over $50,000 and covering shipping fees for cash purchases of $10,000 and more. They also have a buy-back program for easy liquidation when needed.

Considering these factors, we believe that Birch Gold Group is an excellent choice for individuals looking to set up a gold IRA and protect their retirement savings.

We recommend starting the process by filling out their online application, and if you open an account with at least $50,000, they will pay your account fees during the first year. This demonstrates their commitment to helping you achieve your financial goals through precious metals investments.

If you’re ready to take action

Birch Gold Group FAQ's

Lastly, here’s a summary of our Birch Gold Group review in an easy FAQ format.

Is investing in precious metals a good idea?

We think it is. Gold and silver values have historically moved counter to those of paper assets, making them effective hedges against inflation. Although past results don’t guarantee future results, the data suggests that gold has often performed better when the dollar has been weaker in the past. In actuality, many people perceive the relationship between gold and the dollar to be inverse.

Why starting a gold IRA?

After retirement, traditional IRA investments might not be sufficient to support you and your loved ones. Not if the economy continues to look as iffy as it has lately.

Investors have long looked to gold as a way to potentially counter losses brought on by economic unrest. By actually owning physical gold (and silver) within a retirement plan, a gold IRA or precious metals IRA enables you to diversify a component of your retirement portfolio, including pre-existing IRAs and former 401(k)(s) with previous employers. As a result, you are able to safely keep physical precious metals in an account that is tax-deferred.

Should I invest in physical gold, futures options (ETFs), gold mining stocks, or gold funds?

It is significantly riskier to invest in gold indirectly than to buy the actual commodity. You run the danger of losing your investment if you rely on a third party to manage your wealth for you, regardless of whether they are an individual or business. You have control over your riches when you own physical gold. You have an extra layer of security and safety with physical gold that you don’t have with gold exchange traded funds (ETFs), gold mining stocks, or funds.

You can possess physical gold coins or gold bars while still receiving the same tax advantages from an IRA when you invest in a gold IRA.

Do my precious metals have to be bars or can they be coins?

Yes. Although well-known gold IRA providers frequently suggest Equity Trust as their preferred custodian and Delaware Depository as a storage option, you are free to select your own custodian and storage provider.

Can I store my precious metals at home?

Yes, for non-IRA precious metals. not precious metals for a real IRA. IRS regulations restrict storing precious metals in IRAs at home or in a conventional safety deposit box. They must be kept by an authorized non-bank trustee or a bank that complies with access-restrictive IRS regulations. To maintain compliance with deposit and distribution requirements, access to the precious metals in your precious metals IRA must be restricted in specific ways, just like it would be with a standard IRA.

Are the values of the precious metals I buy for my IRA guaranteed?

No. Precious metals’ future value, like that of all assets, is uncertain and subject to a range of market factors. But we think your best bet to protect yourself against a stock market catastrophe, inflation, and the devaluation of the dollar is actual precious metals.

When will I be eligible for distributions from my gold IRA?

The IRS allows penalty-free distributions from your precious metals IRA to begin at age 59½, either for you or your designated beneficiary.

How long does it take to rollover a traditional IRA into a gold or silver IRA?

Usually between two and three weeks, but since every application is unique, the time required varies from case to case.

What is the advantage for customers to set up an IRA with a gold IRA company as opposed to going to the custodian and setting it up with them?

The IRA Processing Department of the gold IRA company will give the customers with excellent support and specialist account setting knowledge throughout the entire process. 95% of the paperwork is completed by them. Customers may rest easy knowing that any gold IRA firm mentioned on How To Invest Gold will keep them informed at every stage of the transfer procedure via daily calls or emails from the IRA Processing staff. Additionally, these businesses frequently offer lifetime account assistance.

Birch Gold Group Alternatives

If you want to further research and compare companies before deciding what Gold IRA provider to choose, we have reviewed and rated the best gold IRA companies for 2025.