We have examined Gold Alliance’s gold IRAs, BBB ratings, customer feedback and complaints in this in-depth Gold Alliance review for 2025 – a precious metals specialist company and dealer. We also take a look at their annual fees and storage options, plus walk you through the process of opening a gold IRA account with Gold Alliance.

Precious metals are used by many Americans to diversify their financial portfolio and to reserve long-lasting, secure assets for retirement. Even in tumultuous economic and political times, precious metals have always offered investors the protection needed in tough times.

The overall objective of this Gold Alliance review is to evaluate the company’s reliability and investment potential.

Limited Offer!

For a limited time, they are offering up to 10% of your order in FREE silver! Meaning that if you purchase metals for $100,000, you get $10,000 in FREE silver!

Most Affordable Gold Ira Gold Alliance

3.0/5

- A+ BBB rating & AAA BCA rating

- Superb customer reviews

- Dedicated Precious Metals Specialist

- Low gold IRA fees

- Reliable buy-back program

- Good new-customer promotions

- Over two decades in the industry

Gold Alliance

50 W. Liberty St. Suite 420, Reno, NV 89501 Tel: (888) 579-9440 www.goldalliance.com

Products Available:

- Bullion Bars

- Bullion Coins

- Self-Directed IRA

Gold Alliance Pros And Cons

Here is a summary of the top advantages and disadvantages of Gold Alliance before we begin our thorough review:

Pros

- A+ BBB rating & AAA BCA rating

- Good customer reviews

- Excellent customer service

- Dedicated Precious Metals Specialist

- Free consultation with a Gold Specialist and Free Gold Information Kit

- Easy IRA & 401(k) Rollovers

- $15,000 in FREE silver for qualified accounts

- Reliable buyback policy

- Mike Huckabee recommends Gold Alliance

Cons

- You can’t create an online account

- The website doesn’t offer any information on pricing or costs

- Difficult to get necessary information without speaking to a salesperson first

The Pros Explained

Okay, now that you’ve taken a quick look at our Gold Alliance review, let’s get into more detail about some of the company’s advantages.

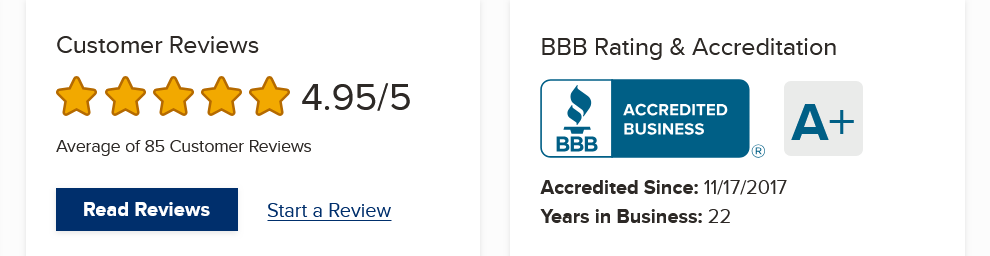

Rating Services – BBB Rating, BCA Rating & Customer Reviews

A+ BBB Rating and AAA BCA Rating – The Better Business Bureau (BBB) assesses and rates businesses based on a number of factors, such as:

- Customer complaints

- Operations & services

- Time in business

- Advertising practices

- And government investigations and/or fines

As you can see, Gold Alliance has an A+ rating and has been accredited by the BBB since 2017. The company has also received a AAA rating from the Business Consumer Alliance.

With 65 reviews, the business received a 3.5-star rating (out of 5 stars) on Trustpilot. You can read some of the reviews in more depth if you’d like.

Mike Huckabee Is Recommending Gold Alliance

Former Governor of Arkansas, Mike Huckabee, endorses Gold Alliance. As he recently stated, “Gold Alliance is the one and only precious metals company I recommend to all my family and friends.”

For more details, watch this video where Gov Huckabee shares why he has faith in gold in times of economic volatility, high inflation, and stock market corrections and why Gold Alliance is the precious metals company of his choice:

Excellent Customer Service

The majority of customer reviews are favorable, and they frequently praise Gold Alliance for the following reasons:

- Friendly, knowledgeable customer service

- The company’s staff genuinely listens to the customer and gets to know them

- Quick response time in communications

- Impressive expertise in the industry and their products

Numerous client testimonials also mention how Gold Alliance staff members take the time to understand each client’s unique investing goals and concerns. As a result, they gained the trust of their clients and gained a reputation as reliable precious metal advisors.

Dedicated Precious Metals Specialist & Easy IRA & 401(k) Rollovers

A trained precious metals specialist from Gold Alliance will provide a free consultation and help you set up a gold IRA account. assistance with 401(k) rollovers and gold purchases for non-IRA investments, as well.

A gold individual retirement account (IRA), also known as a precious metals IRA, is a particular kind of self-directed individual retirement account (IRA) that enables you to purchase real assets like gold and silver. As long as they comply with specified IRS standards, you are permitted to hold gold and silver in this Precious Metals IRA account and will receive the same advantages as with Traditional or Roth IRAs.

You can convert a portion of your existing IRA, 401(k), or other qualified retirement account funds into a gold IRA, but it needs to be kept apart from other IRAs. This is how your gold IRA works with your current accounts to create a more secure and diversified portfolio. Additionally, a new Self-Directed IRA can be started from scratch.

A knowledgeable precious metals advisor from Gold Alliance can provide you with more information and point you in the direction of an investment strategy that is more solid and diverse.They will be your go-to source for all information regarding gold and silver IRAs and can assist you in opening your account, selecting the correct metals, and carrying out all obligations without difficulty or anxiety.

If you’re ready to take action

Buyback Guarantee

One of the best buy-back policies in the business, if not the best, is what Gold Alliance is renowned for. Gold Alliance will buy back your initial precious metal purchases at the current buy-back price when you sell them.

The law forbids them from promising to buy back the goods they sell, but they have never declined to do so when it comes to the coins they have sold to customers.

Easy To Navigate Website With Basic Information

The Gold Alliance website is easy to use and is filled with details about the business and its offerings. Additionally, to assist customers in making investment decisions, Gold Alliance periodically publishes articles with projections and other statistics that provide current information on the precious metals market.

A Free Gold Information Kit, which provides comprehensive information about retirement and investing in gold and silver, is also available from Gold Alliance as an added perk. It also aids in educating you with the advantages and dangers of precious metal investment.

Simple calculators and tools for monitoring historical and current prices of raw gold and silver commodities are also available on the Gold Alliance website. There are more frequently asked questions (FAQs) that address terminology and precious metal investing to aid new investors in understanding precious metal investing and gold IRAs.

They also provide blog posts about asset strategies created by the management team. Additionally, there are guest posts from well-known industry figures that offer suggestions on how to invest in the precious metals market.

But despite being user-friendly and comprehensive, the Gold Alliance website does not contain any pricing information for any of its investment products.

Gold Alliance Cons Explained

Next, in our analysis of Gold Alliance, we delve into great length about the company’s shortcomings. These are what they include:

- You can’t create an online account

- The website doesn’t offer any pricing or cost information

- You can’t open a Gold IRA online

You Can’t Create An Account Online

There is no online account functionality on the Gold Alliance website. To help you track and manage your purchases and investments, you will need different internet accounts.

There Is No Pricing Or Costs Information On the Site

There is no pricing or cost information available on the Gold Alliance website for their bullion goods.

This means that you need to either >>>request this FREE Gold Information Kit or call them directly at (888) 579-9440 to determine the exact costs of opening a gold IRA (typically ranging from $180-$330 per year), rolling over a 401(k), or purchasing coins or bars.

You Can’t Open A Gold IRA Online

The opening of an online gold IRA account is not a service offered by Gold Alliance. Instead, as part of the application process, they must mail you all the required paperwork and documentation. You must give these forms back to Gold Alliance when you’ve completed them.

Although the majority of Gold Alliance customers report that the process takes roughly 10 days, this is common for gold IRA accounts.

You can request our Free Gold IRA Guide for more details. You can ask questions regarding the entire process of buying precious metals on the call that a Gold Alliance representative will give you if you request this gold and silver information pack.

Company Background

The Reno, Nevada-based Gold Alliance was established in 2002. Additionally, they also have a location in Los Angeles.

Gold Alliance has been aiding Americans with portfolio diversification and securing peace of mind for more than 20 years with a gold IRA and other precious metal investments.

Among the precious metals that Gold Alliance offers are silver, regular bullion, rare coins, and precious metal goods that can be used as IRA investments. Gold Alliance offers a range of precious metals such as common bullion, collectible coins, silver, and precious metal products that can be used in an IRA investment. They also sell precious metal coins and bars for non-IRA investment purposes.

The company has been mentioned on Forbes, WSJ, Fox News, Bloomberg Business, Yahoo Finance, and USA Today. It was voted the #1 Fastest-Growing Gold Company in America by Inc. 5000. Also exclusively endorsing them is the late Arkansas governor Mike Huckabee.

If you’re ready to take action

Gold Alliance Leadership

Gold Alliance is led by three partners, with Joseph Sherman serving as the CEO.

Joseph Sherman – CEO / Partner

By protecting retirement money from Wall Street and bank overreach through diversification, Joseph aims to assist the general public in achieving investment protection and performance.

Joseph has been putting in a lot of effort since 2016 to warn the public about an impending financial reset by giving talks and writing articles. He has been driven by this purpose.

Joseph also co-founded the Precious Metals Retail Association and belongs to the National Ethics Association and the Industry Council for Tangible Assets.

Joseph studied law at the University of Tel Aviv and graduated with the top honors.

Kevin Troy – Director / Partner

Kevin began his career at JP Morgan Chase and later focused on the real estate lending industry, where he finally rose to the position of partner in one of the biggest San Diego mortgage brokerages.

Kevin switched from lending money for real estate to precious metal investments after the dot.com disaster because he recognized the urgent need to assist Americans in protecting their life savings.

Kevin has worked with thousands of clients over the past 15 years to secure, preserve, and safeguard their savings.

San Diego State University was where Kevin studied. He earned high honors in his marketing graduation.

Fred Abadi – Director / Partner

Fred swiftly acquired a highly sought-after skill set in corporate operations leadership after earning a degree in business management from California State University, Northridge, in 1996.

Fred became interested in precious metals after realizing that he could establish long-lasting relationships with the investors he could assist thanks to his love of people and his passion in commodities trading.

After more than 15 years in the business, Fred is now able to give his clients the best possible service. He puts in a lot of effort to customize his approach to diversifying the savings of each of his clients.

We look at their investment products as the next part of our Gold Alliance review.

Gold Alliance Investment Products

Here are the results of several reviews of Gold Alliance investment products.

Gold IRA

A gold IRA is a tax-advantaged account that can help you save money for retirement, just like other IRAs. A gold IRA has the same benefits and drawbacks as either a Traditional IRA or a Roth IRA, depending on whether it is funded with pre-tax or post-tax funds.

A gold IRA is a tax-advantaged account that can help you save money for retirement, just like other IRAs. A gold IRA has the same benefits and drawbacks as either a Traditional IRA or a Roth IRA, depending on whether it is funded with pre-tax or post-tax funds.

However, the gold IRA has two distinct benefits over a Traditional IRA or a Roth IRA:

- Typical IRAs limit your asset choices to stocks, bonds, and other paper assets, but a gold IRA allows you to acquire physical precious metals

- By including physical gold in your savings, you could benefit from the protection and growth that gold and other precious metals have offered historically

Assets can be withdrawn once you reach the age of 59½, in their original form or as cash resulting from the sales of the precious metals. Gold Alliance will ship the gold acquired within your gold IRA to an IRS-approved depository that you choose.

Your assets will be in an account under your name, and you will have 24/7 access to your statements and holdings, just like any paper asset in your IRA account. And if you want to, in most cases, you can visit your metals investment.

Silver IRA

A silver IRA is a different kind of precious metals IRA that lets you add genuine silver to the list of permitted assets in other IRAs.

Silver coins must be 99.99% pure to be eligible for IRAs. The custodian and storage requirements are the same as for a Gold IRA. Similar to gold, silver coins and bars can be bought both inside and outside of a precious metals IRA.

Precious Metal Coins & Bars

Gold Alliance features a wide assortment of gold, silver, and platinum coins and bars if you’re interested in buying them separately rather than for an IRA investment. You can go through and pick from coins and bars made by mints in the United States, the United Kingdom, Australia, Canada, the Netherlands, and New Zealand.

The Gold Alliance website doesn’t provide information about prices or delivery costs. You must either call the business and speak with a consultant or request our >>>Free Gold IRA Guide to discover more about prices and shipping fees.

Popular Gold & Silver Coins

As part of our review, here’s a quick look at some of Gold Alliance’s more popular gold, silver, platinum, and palladium coins and bars for IRA and non-IRA purchases:

- American Eagle Gold Coins

- Gold American Eagle Proofs Coins

- Gold Australian Striped Marlin Coins

- Australian Gold Osprey Coins

- Liberty Gold Coins

- Gold Canadian Polar Bear Coins

- Gold Canadian Polar Bear & Cub Coins

- Canadian Gold Maple Leaf

- Silver American Eagle Coins

- Silver American Eagle Proof Coins

- American Silver Bald Eagle Coins

- Silver America The Beautiful Coins

- Canadian Silver White Falcon

- Silver Maple Leaf Coin

Platinum & Palladium Coins And Bars

- Platinum Canadian Maple Leaf

- Platinum British Britania

- Australian Platinum Striped Marlin

- Platinum Bar – 1 oz

- Palladium Bar – 1 oz

Specialist Availability

Each customer of Gold Alliance gets access to a professional precious metal specialist who can assist with opening an account, making purchases of precious metals, and answering any inquiries.

As you can see from various sections of our review, Gold Alliance has received excellent customer service and availability ratings, making them a business that is absolutely worth researching further for your investment alternatives.

Gold Alliance Gold IRA Fees

One drawback in terms of fees and expenses is that none of the costs are published online. We were able to learn that Gold Alliance charges $180 annually, though. This cost covers online account access, insurance, storage, and quarterly financial statements. In contrast to other vendors, Gold Alliance really charges comparatively less for upkeep.

Just so you know, even though this is not a cause for concern, Gold Alliance seems to make up for the reduced maintenance fees by charging slightly higher markups for their investment products, which is typical for Gold IRA firms.

Usually, these businesses charge more than the market price for the metals they purchase. They are typically marked up anywhere between 17% and 33%. Given that the values of the metals can change with the markets, it is customary for precious metals IRA firms like Gold Alliance to not immediately divulge the prices of the metals they sell.

There aren’t any additional fees for services, administration, or investments besides the fee on the account and the price of the metals. However, as we have stated in past evaluations, it is wise to examine several businesses to determine how much maintenance costs are relative to product markup.

Gold Alliance Investment Minimums

Here are the transaction minimums for a Gold IRA and regular cash purchases at Gold Alliance:

Minimum Purchase Amount Gold IRA

$10,000

Minimum Cash Purchase Amount

$10,000

Just like GoldenCrest Metals, Birch Gold Group, and Noble Gold they have rather low investment minimums.

Storage Options

It’s essential to first understand the legal restrictions on the storage of precious metals. Only non-IRA metals may be kept at home; IRA metals are not allowed. According to IRS laws, such metals must be stored in an IRA-approved depository, such as a state-of-the-art third-party vault.

There are typically two methods for storing non-IRA metals at home. First off, little amounts of precious metals can be easily hidden on your property. There is a danger associated with this decision.

Second, you can keep your investment in a home safe. A safe is a less dangerous choice for home storage, but as they are typically not climate controlled, there is still some risk to the long-term condition of your metals.

The Gold Alliance admonishes you to keep your precious metals in a third-party depository in order to:

- Depositories offer all the room you require.

- They are also moisture- and climate-controlled to ensure your precious metals are kept under optimal conditions

- More importantly, depositories are highly guarded and provide the optimal level of security

The Wilmington, Delaware vault of Delaware Depository Services is suggested by Gold Alliance. Every month, transactions worth billions of dollars are handled by this IRS-approved depository. Additionally completely insured and covered by London Underwriters is Delaware Depository.

To find out more about the depository’s offerings and prices, get in touch with it. A member of the Gold Alliance team can also go over additional storage possibilities.

There is one other thing to consider as well. In the event that you pay with conventional currency, Gold Alliance will transport any gold or silver bullion you buy to you for free.

After discussing the available products, yearly costs, and storage choices from Gold Alliance, let’s take a closer look at what clients have to say about the company in their evaluations.

Gold Alliance IRA Reviews

First Purchase

“This was my first time to purchase precious metals. Kevin and James worked very patiently with me in making this investment. Each of them demonstrated knowledge and skill as they answered my questions and designed a package that met my needs. Thanks!“

D. R. Tate

- Varified Customer

Reviewed on: August 15, 2023

Hands down a great experience

“Hands down, what made my experience with Gold Alliance great was Ms Tracy Hymes! She was a constant source of information, keeping me in touch all along the progress of my purchase, then going beyond the call of duty to act as my personal FedEx tracker, when a cyber glitch prevented me from doing my own tracking! This was my first experience purchasing gold online, and I was a bit nervous about what to expect, and had I made a mistake, etc. The crew coordinated everything perfectly, with Tracy keeping me in the loop. I would order again in a heartbeat!“

Yvonne

- Varified Customer

Reviewed on: March 08, 2023

Gold Alliance’s Gold IRA has received much praise and positive reviews. Here is an overview of what consumers had to say in terms of opening a gold IRA with Gold Alliance:

- First of all, the firm consistently receives close to 5-star evaluations and is ranked quite highly on all the important business ranking and review systems.

- Most clients praised Gold Alliance for its extremely competent and welcoming customer service.

- The degree of individualized care provided by the committed Account Executives at Gold Alliance consistently received favorable feedback.

- Customer comment praises the Account Executive’s expertise, the simplicity of the buying process, and the degree of confidence they felt in the Gold Alliance employees.

If you’re ready to take action

Summary of Gold Alliance Reviews & Ratings

- A+ rating by the Better Business Bureau (their highest rating) and a 4.95 out of 5-star rating based on 89 customer reviews

- AAA rating by the Business Consumer Alliance(their highest rating) and a 5-star rating based on 13 customer reviews

- 69 reviews with a 3.5 Average star rating on Trustpilot

- Former Arkansas governor Mike Huckabee has endorsed Gold Alliance as the precious metals company he recommends

Naturally, a study of Gold Alliance would not be complete without examining customer concerns, so we go on to it in the next section.

Gold Alliance Complaints

Since you cannot open the IRA online, you must either call Gold Alliance directly at (888) 579-9440 or complete this online application to request a callback from a representative.

Your investing needs, as well as how to start an IRA and transfer or roll over money from an existing retirement account, will be discussed during the phone consultation. A Gold Alliance IRA specialist is available for a free consultation and will be pleased to walk you through this procedure and explain it to you.

With that said, Gold Alliance offers a simple 3-step process for opening a Gold IRA:

How To Open A Gold Alliance Gold IRA

Since you can’t open the IRA online, you’ll need to either fill in this online application to receive a callback from a representative.

The phone consultation will go through your investment needs and how to open the IRA or transfer or rollover over funds from your existing retirement account. A Gold Alliance IRA expert is available for a free consultation and is happy to explain and guide you through this process.

With that said, Gold Alliance makes it easy to open a Gold IRA in 3 easy steps:

- Step 1: Open A Self-Directed IRA

You can select where to put your IRA funds by forming a self-directed IRA. With a self-directed IRA, you can buy precious metals, and Gold Alliance’s IRA experts can assist you with this.

They will describe the operation of a Precious Metals IRA and present a wide selection of IRA-acceptable metals for your savings in order to maximize its diversity and allow you total control over your assortment of assets.

- Step 2: Fund Your Account

You must move money to your self-directed IRA’s custodian account, which will be in your name, from an existing qualifying retirement plan (such as a 401(k), 401(a), 403(b), 457, Thrift Savings Plans, and annuities).

Although Gold Alliance aids in the process, you alone are in charge of your account; they do not retain your money or precious metals. Their support staff will walk you through this procedure and has a plethora of knowledge. Additionally, collaborating closely with Gold Alliance employees will lower the possibility of transaction process problems.

- Step 3: Select IRA-Approved Gold And Silver

All that is left to do after the first two stages are finished is to add precious metals to your Gold IRA account. Your personal Gold Alliance Account Executive will inform you of the best-performing gold and silver coins and bars as well as your alternatives for diversifying your portfolio by adding platinum and palladium.

You can see that the procedure is simple. Additionally, the entire process of opening a Precious Metals IRA with Gold Alliance takes roughly 10 days.

Our analysis of Gold Alliance looked closely at the business, its offerings, client feedback, fees, and ratings. It’s time to sum up everything we learned.

If you’re ready to take action

Conclusion: Gold Alliance Review 2025

Here’s a summary of our comprehensive Gold Alliance review:

Overall Results & Findings

According to our analysis of Gold Alliance, they are one of the best and most reliable solutions for precious metals or gold IRAs. The organization also makes investing in precious metals simple and provides excellent customer service.

Here is a summary of what we discovered:

- – Gold Alliance maintains a BBB A+ 4.95/5 rating with over 89 reviews

- – Their customer service team are all well-informed about their products and the precious metals industry and help customers in a friendly and informative manner

- – There are hardly any complaints against Gold Alliance, and they appear to have resolved all but one

- – The only negative is the lack of pricing information and costs – you need to call for these details

- – They have a generous promotion of $15,000 in FREE silver for qualified accounts

- – The company was named #1 Fastest-Growing Gold Company in America by Inc. 5000, and has been featured on Forbes, WSJ, Fox News, Bloomberg Business, Yahoo Finance, and USA Today

- – Lastly, they are also exclusively recommended by Mike Huckabee – former governor of Arkansas

As a result, it is obvious that Gold Alliance is a trustworthy precious metal investing firm that is worthwhile of further investigation. That being said, Gold Alliance should be on your call list if you’re thinking about converting your retirement account to gold or silver coins that are IRA-approved.

If you’re ready to take action

Gold Alliance IRA Review FAQ

Lastly, here’s a summary of our Gold Alliance review in an easy FAQ format.

Is Gold Alliance a reputable company to work with?

Yes. According to our investigation and assessment, Gold Alliance seems to be a reliable firm with expertise in precious metals. From the BBB and other business review services, they have received exceptional ratings and scores. Additionally, the majority of their client reviews are favorable.

What precious metal products do they offer?

Goal Alliance offers Gold IRAs and 401(k) rollover services and sells precious metal coins and bars, including gold, silver, palladium, and platinum.

If you want to securely expand your retirement savings portfolio with tax advantages, rolling over your 401(k) or retirement account to a Gold IRA through Gold Alliance is likely a fantastic option.

Can I take physical possession of the gold in my IRA?

No, gold and other precious metals used in IRAs must be stored in IRS-approved depositories. While choosing the depository is up to you, Gold Alliance recommends the Delaware Depository Services Company’s vault in Wilmington, DE.

Also, the Delaware Depository offers reliable insurance underwritten by London Underwriters, so you have peace of mind concerning the storage of your precious metals. Any non-IRA coins or bars you purchase can be kept in your possession, but you’ll want to consult the company about ideal storage conditions.

For more information about these rules and regulations, visit our article can I take physical possession of gold in my IRA?

What are the potential risks of investing in precious metals?

Like any other asset, gold and silver prices fluctuate. Ultimately, looking at the historical performance of precious metals will give you a better understanding of the market.

However, historically precious metals have been relatively safe and stable investment strategies. You should always do your due diligence before investing in any asset class. And you can start by >>>requesting this FREE Gold Information Kit to learn more.

Is everyone eligible for a precious metals IRA?

Yes, any adult can create a precious metals IRA. To own gold, whether in coins or bullion, in an IRA, you need to open a Self-Directed IRA due to IRS regulations that require the coins or bullion to be in the custodian’s possession.

Gold Alliance Investment Alternatives

If you want to further research and compare companies before deciding what Gold IRA provider to choose, we have reviewed and rated the best Gold IRA companies for 2025.