Are you in search of retirement savings options and interested in learning about Goldco IRA reviews, potential complaints, annual fees, storage choices, the process of setting up a Gold IRA account with Goldco, and more?

You’ve landed on the right page!

In this comprehensive review, we have thoroughly examined all the essential details about Goldco. Our goal is to provide you with the information you need to make an educated decision regarding whether Goldco is the right precious metals company for your investment objectives.

Goldco

24025 Park Sorrento, Suite 210, Calabasas, CA 91302 www.goldco.com

Products Available:

- Bullion Bars

- Bullion Coins

- Self-Directed IRA

- Cash Sales of Precious Metals

Let’s start by looking at why a precious metals IRA would be a wise investment now when the market is volatile and a recession is on the horizon.

Best Overall Gold Ira & Precious Metals Company

4.98/5

- A+ BBB Rating & AAA BCA Rating

- Average review rating of 4.9 on Trustpilot

- Stress-free and easy gold IRA set up

- Zero fees

- Highest buy-back guarantee

- Biggest promotions in the industry

- Unmatched customer service

Why A Precious Metals IRA?

You may be familiar with IRAs, or individual retirement accounts, which offer tax benefits. But have you ever heard of a self-directed IRA for precious metals? Instead of holding paper assets, it holds physical gold, silver, or other precious metals under the account holder’s control.

Despite the fact that paper assets are practical and simple to trade, one of the biggest concerns is that they aren’t backed by actual gold but rather by a promise to provide gold at a later date, which may never materialize if the company goes out of business. Therefore, it could be wise to think about using actual gold and silver to diversify your retirement portfolio.

“In a world of ongoing pressure for policymakers across the globe to print and spend, zero interest rates, tectonic shifts in where global power lies, and conflict, gold has a unique role in protecting portfolios. It’s wise to hold some of what central banks can’t create more of.“ – Billionaire investor Ray Dalio

With that said, let us introduce you to Goldco, the indisputable market leader in retirement investments, in case you haven’t already thought about which precious metals firm to invest with. With such remarkable accolades, Goldco is the obvious choice in this industry.

Pros And Cons Of Goldco

To give you a quick recap, here are some pros and cons of Goldco:

Pros

- Zero IRA Fees

- Free Storage for Non-IRA Precious Metals

- Biggest Promotions in the Industry

- Unmatched Customer Service

- No High Pressure Sales Tactics

- Outstanding Ratings & Customer Reviews

- FREE and Easy IRA & 401(k) Rollovers

- A+ BBB Rating and AAA BCA Rating

- Highest Buy-Back Guarantee

- 2025 Stevie Award Winner

Cons

- Cannot Set Up an Account Online, Just Request a FREE Gold & Silver Guide

Goldco Pros Explained

Goldco BBB Rating, BCA Rating & Customer Reviews

Goldco boasts impressive ratings from reputable organizations, underlining their commitment to customer satisfaction and ethical business practices:

A+ BBB Rating and AAA BCA Rating: The Better Business Bureau (BBB) evaluates companies based on several factors, including customer complaints, operational practices, business longevity, advertising practices, and government actions. Goldco has excelled in the BBB evaluation, receiving an A+ rating and maintaining BBB accreditation since 2011. Additionally, the company holds an AAA rating from the Business Consumer Alliance (BCA).

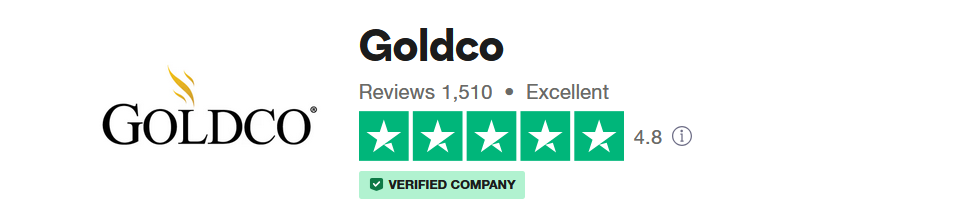

5/5 TrustLink Rating: Goldco has garnered a perfect 5-star rating on TrustLink, a testament to their excellent reputation. Furthermore, the company boasts a strong 4.9-star rating on Trustpilot. Goldco has received over 1,000 reviews on various consumer watchdog sites, with an impressive 91% of these reviews awarding the company a 5-star rating. Many of these reviews highlight Goldco’s exceptional customer service, further enhancing their reputation.

Unmatched Customer Service

Many clients extol the virtues of their wonderful interactions with Goldco, praising the simplicity with which they were able to select the ideal goods and services to suit their portfolios.

Customers have stated that Goldco’s experienced and skilled staff is what distinguishes the company from competitors, in addition to its goods and services. Their precious metals specialists go above and above to assist investors with education or setting up a gold IRA. They are not simply responsive.

Knowing that Goldco’s customer support team is reachable at any time by phone, email, or online chat gives customers peace of mind. Goldco has a stellar reputation thanks to their quick response times and commitment to transparency.

The way that Goldco prioritizes individualized service, open communication, and accessibility ensures that its clients are never in the dark.

Dedicated Metals Specialist & Easy IRA & 401(k) Rollovers

Goldco offers a unique advantage that sets them apart—an exclusive feature designed to benefit investors at every level. They provide access to a dedicated precious metals specialist, ensuring that individuals who may require additional guidance during the investment process can find the support they need.

Your personal precious metals specialist serves as a valuable resource, simplifying tasks like selecting metals, identifying metals eligible for conversion into a gold IRA, and verifying their availability. They are readily available throughout the entire process, ready to address any questions, alleviate concerns, and assist you in making well-informed decisions.

Your precious metals specialist will serve as your trusted advisor for all matters related to gold and silver IRAs. They will assist you in opening your account, help you choose the ideal metals for your investment goals, and ensure that all tasks are executed seamlessly. This approach, devoid of pressure and confusion, underscores Goldco’s commitment to delivering exceptional customer experiences and prioritizing the success of each investor. You can be confident that Goldco is dedicated to assisting you on your investment journey.

Goldco Offers The Highest Buy-Back Guarantee

The good news is that Goldco will buy your precious metals back from you at a much greater price than other coin dealers if you wish to sell them later. In fact, the business guarantees the greatest buy-back price.

What Are The Criteria?

When it comes time to sell your metals, Goldco will request that you give them first dibs (you will almost certainly get a better price from Goldco than a random coin dealer or broker who usually tries to make a lowball offer). You are not compelled to return your metals to Goldco, though. You get to decide that.

User-Friendly Website With Educational Content

Goldco’s website is simple to use and provides a wealth of instructional materials for anyone wishing to remain on top of the precious metals market. The Federal Reserve, Social Security, and even advice on how to pay off debt in retirement are all covered.

They also provide a three-part handbook that covers all the essential information about gold IRAs. Overall, the information on Goldco’s website is vast and just waiting to be discovered.

Goldco Cons Explained

Can’t Set Up An Account Online

You must either call Goldco’s customer service or get our Free Gold & Silver Guide in order to open a gold IRA account and purchase precious metals. Investors may learn everything they need to know about precious metals and gold IRA investments from their Gold IRA Guide, which is a terrific resource.

If you’re ready to take action

Company Background

Goldco, headquartered in Calabasas, California, is a comprehensive investment firm offering a distinctive approach to investing in precious metals. Goldco specializes in facilitating the rollover of retirement accounts, including 401(k), 403(b), TSP, 457 plans, and similar retirement vehicles, into secure precious metals IRAs, often referred to as gold IRAs. These IRAs are safeguarded in Goldco’s state-of-the-art facility.

Goldco, headquartered in Calabasas, California, is a comprehensive investment firm offering a distinctive approach to investing in precious metals. Goldco specializes in facilitating the rollover of retirement accounts, including 401(k), 403(b), TSP, 457 plans, and similar retirement vehicles, into secure precious metals IRAs, often referred to as gold IRAs. These IRAs are safeguarded in Goldco’s state-of-the-art facility.

Alternatively, if you prefer to acquire physical precious metals for personal use, Goldco provides that option as well. Notably, Goldco boasts the industry’s highest buyback guarantee, ensuring you receive an excellent offer should you choose to sell your precious metals.

In summary, Goldco has established itself as a trusted provider of precious metals for over a decade. They have assisted clients in directing more than $1 billion into gold and silver investments, underscoring their commitment to helping individuals secure their financial futures through precious metal investments.

Who Owns Goldco?

Trevor Gerszt serves as the CEO of Goldco and has been at the helm of the company for over a decade. Under Mr. Gerszt’s leadership, Goldco has played a pivotal role in assisting numerous individuals in diversifying, expanding, and safeguarding their wealth through physical precious metals investments.

Goldco’s impressive growth trajectory has continued unabated, even amidst challenging economic conditions that have affected many companies in recent years. Notably, since January 2019, Goldco has witnessed a remarkable revenue growth of more than 189%. This remarkable achievement earned Goldco the esteemed title of “Company of the Year” in the 2024 American Business Awards.

At Goldco, the core mission is to empower investors. They achieve this by delivering exceptional customer service, offering valuable education on precious metals, and providing a wealth of resources to help investors make informed and confident decisions about their financial futures.

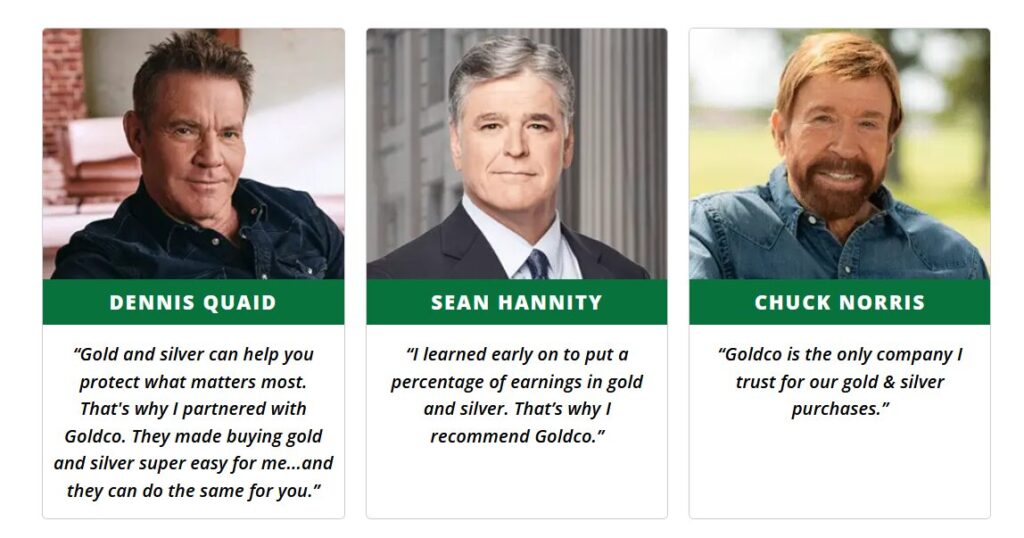

Goldco Celebrity Endorsements

Goldco has garnered endorsements from notable celebrities such as Sean Hannity, Dennis Quaid, and Chuck Norris. These prominent figures align themselves with Goldco’s mission to educate the public about the advantages of investing in gold and silver, as well as the importance of safeguarding retirement accounts like IRAs, 401(k)s, TSPs, and pensions with physical precious metals.

Here are the endorsements from a few of these celebrities:

Sean Hannity, an American talk show host, author, and conservative political analyst, shares his insight: “I learned early on to deposit a percentage of earnings in gold and silver. Because of this, I suggest Goldco.”

Chuck Norris, a renowned American actor and martial artist, confidently asserts that Goldco is the sole reliable source of gold and silver.

These endorsements from well-known individuals underscore Goldco’s reputation and credibility in the field of precious metals investments.

NEW YORK, NY – MAY 11: Sean Hannity appears on FOX News Channel’s “Hannity” at FOX Studios on May 11, 2015 in New York City. (Photo by Rob Kim/Getty Images)

Goldco’s Mission Is To Help Americans Protect & Secure Their Retirement Savings

In conclusion, Goldco’s mission is to help Americans protect their retirement savings accounts by using IRA-approved precious metals against inflation and stock market volatility.

Product Offerings

Goldco provides a number of options, such as gold and silver IRA accounts, gold coins, and gold bars, to help you diversify your holdings. Even better, they are offering a unique silver incentive for starting a precious metals IRA.

Gold IRA

You can hold actual gold in bars, ingots, and coins when you have a gold IRA. Goldco purchases gold coins that are IRA-eligible from mints all around the world and ensures that they are 99.5% pure.

You can hold actual gold in bars, ingots, and coins when you have a gold IRA. Goldco purchases gold coins that are IRA-eligible from mints all around the world and ensures that they are 99.5% pure.

Remember that all IRAs are required by IRS regulations to have custodians, which you designate to oversee and safeguard the assets. Your priceless gold and silver assets are kept by Goldco in a safe depository, as required by the IRS.

Once you reach the age of 59.5, you may withdraw the assets in their original form or as cash obtained through the sale of precious metals. For gold coins accepted by IRAs, Goldco furthermore provides a buyback guarantee.

Silver IRA

You can add silver coins, bars, and ingots to your Goldco precious metals account if you have a silver IRA. Silver coins must be 99.99% pure to be eligible for IRAs. Similar to silver coins, you can buy gold bars both inside and outside of a precious metals IRA.

Gold Coins & Gold Bars

Do not wish to establish a gold IRA. No issue! With the assistance of their precious metals experts, Goldco gives you the option to buy gold coins and bars directly. Your assets will either be delivered to a depository of your choosing or to your home. Choose among coins and bars produced by mints in the United States, the United Kingdom, Australia, Canada, the Netherlands, and New Zealand. Even delivery is free when making direct purchases at Goldco.

Silver Coins & Silver Bars

The Silver Britannia series, the Australian Crocodile, the Silver Veteran, and the Silver WWI and WWII coins are among the silver coins that Goldco offers.

The Silver Britannia series, the Australian Crocodile, the Silver Veteran, and the Silver WWI and WWII coins are among the silver coins that Goldco offers.

And how about a 1 oz. silver coin with Chuck Norris’ “Five Principles” that was produced in New Zealand? Even a wooden box and an authenticity certificate are included.

Silver bars from Goldco are available for purchase and can be held privately or used in your precious metals IRA, much like their gold equivalent. They are also varied weights and come from different producers.

Popular Goldco Gold Coins & Silver Coins

The most popular Goldco gold and silver coins and bars for IRA and non-IRA purchases are shown in the following sample:

Gold Coins

- Gold American Bald Eagle Coin

- Gold American Eagle Proof

- Gold American Eagle Coin

- Gold Buffalo Coin

- Gold Maple Leaf Coin

- Gold Lucky Dragon Coin

- Gold Australian Saltwater Crocodile Coin

- Royal Mint Gold Lunar Series: 2017-Year of the Rooster Coin

- Royal Mint Gold Lunar Series: 2018-Year of the Dog Coin

- Royal Mint Gold Lunar Series: 2019-Year of the Pig Coin

- Numerous PAMP Suisse and Perth Mint gold bars of various sizes

Silver Coins

- Silver American Bald Eagle Coin

- Silver American Eagle Coin

- Silver American Eagle Proof Coin

- Silver Lucky Dragon Coin

- Silver Maple Leaf Coin

- Silver World War I Coin

- Silver WWII Victory Coin

- Silver Australian Saltwater Crocodile Coin

- Royal Mint Silver Britannia Lunar Series: 2015-Year of the Ram Coin

- Royal Mint Silver Britannia Lunar Series: 2016-Year of the Monkey Coin

- Royal Mint Silver Britannia Lunar Series: 2017-Year of the Rooster Coin

- Royal Mint Silver Britannia Lunar Series: 2018-Year of the Dog Coin

- Royal Mint Silver Britannia Lunar Series: 2019-Year of the Pig Coin

Availability

As of 2025, Goldco has no minimum initial investment when it comes to investing in a gold IRA. Plus, the fact that you will have a dedicated agent to guide you through the account opening process is even more thrilling. Additionally, as we already noted, the firm provides excellent customer service, which places Goldco at the top of our list of the best gold IRA providers.

If you’re ready to take action

Goldco Gold IRA Fees

Now that we know what Goldco is and who they are best for, let us take a look at Goldco’s gold IRA fees.

Goldco’s preferred Custodian charges a flat annual account service fee which includes a one-time IRA account set-up fee of $50, as well as a $30 wire fee. Annual maintenance is $100, and storage is $150 for segregated storage or $100 for non-segregated storage.

Fees for gold storage and custodianship can vary depending on the company you select to handle these services (required by the IRS, as all IRA assets must be managed by a custodian). Depending on the Custodian, storage fees can range from $10 to $60 per month, or as a percentage of assets, from 0.35% to 1% annually. Goldco does not charge any storage fees for cash transactions over $25,000.

Goldco Investment Minimums

Do you have any questions about the required investment with Goldco? The minimum investments for IRA and non-IRA transactions (cash sales) are shown in the chart below:

Goldco Investment Minimums

Precious Metal IRAs

$25,000

Non-IRA Transactions (Cash Sales)

$3,500

Goldco has investment minimums of $25,000 for IRAs and $3,500 for non-IRA purchases, which makes them a competitive company. However, Noble Gold Investments offers the lowest investment minimums on the market, with only $5,000 to roll over an IRA and $2,000 for cash sales.

Goldco’s Storage Options

To begin with, you can store non-IRA metals in your house, but not IRA metals. They must be kept in an IRA-approved repository, which must be a third party’s cutting-edge vault. You don’t need to be concerned since Goldco will help you move any gold or silver bullion you buy into a safe vault.

Additionally, Goldco customers have a variety of storage options. The Delaware Depository, however, is the business that Goldco suggests.

They have a reinforced facility with Class 3 vaults in addition to insurance from underwriters at Lloyd’s of London and technological security.

Recent Verified Goldco Customer Reviews

Tami

- Verified Customer

Conservative Investor

The team I’ve encountered have been very helpful with any questions I’ve had and responsive within a business day to any inquiries sent forth. I appreciate this professionalism. At no point was any particular product pushed on me, everything was laid bare for me to make an informed decision. I ended the conversation feeling confident in my decisions.

Reviewed on: Dec 29, 2025

Carol

- Verified Customer

Precious metal purchases experience

Goldco has been very helpful in taking me through the process of purchasing precious metals. Even though I had purchased some precious metals prior to this one they still go through and explain everything very thoroughly and make sure I understand the process. They are friendly, timely, and very professional.

Reviewed on: Nov 1, 2025

Here’s an overview of Goldco’s BBB and BCA ratings, plus customer reviews from the most popular review sites:

Goldco BBB Ratings & Customer Reviews

- A+ Rating by the Better Business Bureau (their highest rating) and a 4.83 of 5-star rating based on 1442 customer reviews

- AAA Rating by the Business Consumer Alliance (their highest rating) and a 4.8 of 5-star rating based on 1555 customer reviews

- 3.305 Total Reviews With a 4.9 Average Star Rating on Google

- 254 Total Reviews With a 5 Star Average Rating on Trustlink

- 1,700 Total Reviews With a 4.8 Average Star Rating on Consumer Affairs

- 1,699 Reviews with 4.7 Average Star Rating on Trustpilot

- Sean Hannity, Dennis Quiad, and Chuck Norris also endorsed Goldco as the precious metals company they recommend (see celebrity endorsements below)

Goldco Complaints

61 consumer complaints about Goldco have been filed with the Better Business Bureau in the last three years, and 15 of those concerns have been resolved in the past year. Most customer complaints about buying gold and silver above spot prices or not being eligible for silver coin bonuses have been addressed.

There has only been one customer complaint reported on the Business Consumer Alliance (BCA) page in the past three years, and it has likewise been resolved. With all the years the company has been in operation, we believe this to be appropriate and normal. No matter what kind of business you run, some clients will always be dissatisfied.

Goldco Honors & Awards

Being the leading gold IRA company in the US, Goldco has earned several honors and rewards, including:

- Goldco was honored as the Company Of The Year in the 2024 American Business Awards

- They were also awarded Money.com 2025 Best Customer Service

- Inc. Magazine named Goldco the third fastest-growing financial service company in the US in 2015. And the Los Angeles Business Journal named it the 17th fastest-growing company in the greater Los Angeles Area

- In 2021, Goldco and New Zealand Mint announced the release of the 2021 Chuck Norris 1 oz. silver coin

- And they also won the 2025 Stevie Awards

How To Start A Goldco Precious Metals IRA

If you’re interested in investing in precious metals and believe that a Goldco precious metals IRA aligns with your financial goals, the process of opening an account is straightforward. Here’s how to get started:

Online Application: Begin by filling out an application online. After submitting your application, a Goldco precious metals specialist will get in touch with you.

Required Information: During the account setup, you will be asked to provide personally identifiable information, such as your social security number. If you do not already have a precious metals custodian company, Goldco will assist you in opening an account with one of their recommended custodians.

Comprehensive Guide: As part of the setup process, Goldco will send you a comprehensive guide, either via email or physical mail. This free guide is designed to provide you with all the essential information you need to make informed decisions regarding the types of precious metals you wish to include in your IRA.

In the following section, we will explore the straightforward three-step process for opening a Goldco gold IRA in more detail.

Simple 3-Step Gold IRA Opening Process

Opening a gold IRA or precious metals IRA with Goldco is simple and quick. The quick setup procedure is as follows:

Sign Your Agreement

You must read, accept, and sign a standard customer agreement in order to protect your purchase of precious metals and to acknowledge your understanding of Goldco's business policies.

Fund Your Account

Goldco gives you a couple choices for funding your account, including mailing a check to their Los Angeles headquarters or sending money via bank wire. They will even give you a FedEx mailing label if you would rather pay by check, enabling you to expedite your precious metals purchase at no additional expense.

Select Your Precious Metals

It's time to start considering which precious metals to deposit to your account once you have money in it. You get to choose, and Goldco takes care of shipping after that. Additionally, you have the option of having your coins transferred directly to you, to an independent, insured depository, or even to someone who qualifies for free storage.

That’s it for now. A precious metals IRA can be opened quickly—the entire process takes roughly ten days. The precious metals specialists at Goldco will also walk you through every step of the process and help you with the paperwork.

If you are still skeptical, we will go into more detail about why purchasing precious metals is a fantastic way to safeguard your cash.

Goldco IRA Reviews (2026): Worth Your Money?

Our comprehensive review of Goldco for 2026 unequivocally affirms that they stand as one of the premier and most reputable choices for individuals interested in precious metals or gold IRAs. Goldco distinguishes itself by providing unparalleled customer service, making the process of opening a new account exceptionally swift and free of complications.

If you opt for a cash sale, Goldco’s dedicated account executive ensures that delivery is prompt and hassle-free. The company’s no investment minimums, buy-back guarantee, coupled with competitive fees and an outstanding rating from the Better Business Bureau and Business Consumer Alliance, demonstrates Goldco’s commitment to delivering “white-glove service” through their knowledgeable representatives.

This commitment leaves customers highly satisfied with their investment choices.

Goldco has forged valuable partnerships with the most trusted custodians and depositories in the industry, ensuring the utmost safety for your precious metals holdings.

Their recognition as the “Company of the Year” in the 2024 American Business Awards and Money.com 2025 Best Customer Service award further underscores their excellence.

In summary, if you are considering the rollover of a retirement account into IRA-approved gold and silver coins, Goldco should be your first point of contact. Their stellar reputation, comprehensive services, and dedication to customer satisfaction make them the top choice in the field.

If you’re ready to take action

Goldco FAQ

Is Goldco a legit precious metals and gold IRA company?

Goldco has over ten years of experience assisting clients with investments totaling over $1 billion in gold and silver. What’s best? Its secure storage alternatives are supported by nationally renowned insurance providers, guaranteeing the security of your precious metals.

Goldco can assist you whether you’re interested in starting a precious metals IRA or just buying gold or silver.

What types of precious metals does Goldco offer?

Goldco provides proofs, coins, and bars of gold and silver. Palladium and platinum are not available. You can look at the following precious metals firms if you wish to invest in platinum or palladium.

What is the minimum investment required for Goldco?

As of 2026, Goldco has an investment minimum of $25,000 for gold IRAs and $3,500 for regular purchases.

How much are Goldco’s annual fees in total?

Goldco doesn’t charge any IRA fees but there will be custodian and storage fees when opening a gold IRA. Depending on whether you select segregated or non-segregated storage for your precious metals, the annual fees will range from $280 to 330 dollars.

How do I roll over my IRA or 401(k) to Goldco?

Rolling over your 401(k) or retirement account to an IRA with Goldco is a terrific alternative if you want to increase your retirement savings portfolio safely and with tax advantages.

The procedure is easy. You must first get in touch with Goldco to request an account application. Following account approval, Goldco will assist you with all aspects of the transfer procedure.

You only need to provide some basic information about your current retirement plan, such as the account number, name of the current custodian, the amount of assets available in the plan, and the type of retirement account you’re interested in rolling over. Don’t worry about this.

Can I take physical possession of the gold in my IRA?

As the proud owner of your IRA, you may feel secure knowing that your precious metals are kept in a top-notch depository in a safe and secure manner. And when you turn 59 12 and are eligible for distributions, you’ll have the enjoyable choice of taking your money out in cash or actual metals. To learn more about the policies and guidelines, visit our article Can I Take Physical Possession Of Gold In My IRA?

What are the potential risks of investing in precious metals?

It’s important to take risks into account when investing in precious metals. The value of your metals may change depending on market conditions, just like any other investment. It’s a rollercoaster ride that’s thrilling as your fortune increases and tense as it declines.

You should always conduct your research before choosing to invest in any asset class as these investments do not produce any income as they just represent a tangible asset rather than an income source. You can start by >>>requesting this Free Gold & Silver Guide to learn more.

Is everyone eligible for a precious metals IRA?

You can start a precious metals IRA if you have earned income, yes. Anyone with earned income who wants to safeguard their financial future should consider this as a fantastic choice.

Goldco Alternatives

If you prefer to explore additional options before settling on a gold IRA provider, we have conducted comprehensive reviews and ratings of the best gold IRA companies for 2026. This resource will offer you valuable insights to help you make an informed decision about your precious metals investment.