Important Notice!

Before we go more in-depth on this Nationwide Coin And Bullion Reserve review, we know that choosing a precious metals IRA company is an important financial decision that can impact your financial future for years to come.

Our goal is to provide you with the most accurate and reliable information to help you identify the best option to grow and protect your wealth today.

With careful and extensive research, we have reviewed and rated the 8 best precious metals IRA companies for 2025 to help make your decision easier!

Current Promotions

For a limited time, our #1 recommendation of precious metals company are offering up to 10% of your order in FREE silver! Meaning that if you purchase metals for $100,000, you get $10,000 in FREE silver!

Rating Overview From The Same Company:

- Free Storage for Non-IRA Precious Metals

- Biggest Promotions in the Industry

- Unmatched Customer Service

- No High-Pressure Sales Tactics

- Outstanding Ratings & Customer Reviews

- FREE and Easy IRA & 401(k) Rollovers

- A+ BBB Rating and AAA BCA Rating

- Highest Buy-Back Guarantee

With that being said, let us now look at how Nationwide Coin and Bullion Reserve measures up!

Pros & Cons Of Nationwide Coin & Bullion Reserve

To give you a quick overview, here are some pros and cons of Nationwide Coin And Bullion Reserve:

Pros

- Hundreds of positive reviews have great things to say about the company

- A clear listing of some products that appear to be in a permanent discount

- A fairly wide selection of numismatics coins that can even be ordered in bulk

Cons

- Some negative reviews that, while for the most part addressed by the company, still leave one wondering what’s going on

- A very strange approach to selling American Gold Eagles and gold bars, two of the most popular options for physical precious metals investors

- A bare-bones website that doesn’t even tell us anything about the company, ethical commitment notwithstanding

Okay, with the pros and cons of Nationwide Coin And Bullion Reserve out of the way, let’s give you a brief introduction to the company.

Introduction: Nationwide Coin And Bullion Reserve Review

Maintaining a pristine reputation becomes increasingly challenging for companies as they venture further from dealing exclusively in gold IRA bullion and enter the realm of regular precious metals trading. This trend has been observed with IRA providers in the past and is a common occurrence when dealing with suppliers of physical precious metals.

This challenge can be attributed to the complexities involved in understanding, selling, and purchasing bullion that is not eligible for IRAs. The wide array of options can lead to customer dissatisfaction and disputes related to product quality, pricing, and other factors.

Nationwide Coin and Bullion Reserve, a well-established bullion supplier with over a decade of experience, primarily focuses on gold and silver coins, including many rare varieties.

While their inventory is impressive, some customer reviews raise questions. It’s important to note that while the majority of feedback is positive, dealing in collectibles tends to result in more customer dissatisfaction compared to selling standard American Eagle coins.

Here is one of the company’s introduction videos on why you should own gold:

Now, let’s go over what the company is about.

What Is Nationwide Coin And Bullion Reserve?

Established in 2009, Nationwide Coin and Bullion Reserve boasts nearly 15 years of industry experience. While their official about page doesn’t provide extensive details, it highlights the team’s wealth of expertise in the precious metals field.

Our research indicates that Nationwide Coin and Bullion Reserve is headquartered in Houston, Texas, and routinely ships its products to Europe, catering to both domestic and international customers.

Their website, characterized by its simplicity, features a limited knowledge base primarily aimed at promoting the case for precious metals investment. Notably, their Ethics section underscores a commitment to addressing potential customer concerns.

Within this section, they caution against expecting short-term gains from the unregulated rare coin market. They emphasize their commitment to transparent product representation and offer the possibility of a full refund for dissatisfied customers. However, it’s essential to note that the term “can” suggests that a complete refund may not be guaranteed based on a single instance of dissatisfaction.

If you’re ready to take action

Nationwide Coin And Bullion Reserve Reviews

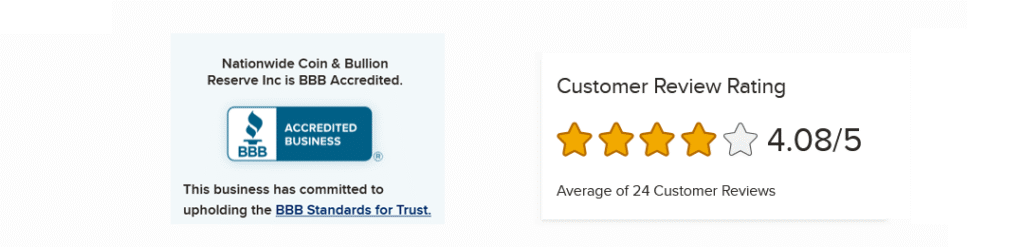

Upon closer examination of Nationwide Coin and Bullion Reserve’s reviews, their reputation on the Better Business Bureau (BBB) page is notably less favorable compared to the Business Consumer Alliance (BCA) page. On the BBB, the company has received a rating of 4.08/5 stars based on 24 customer reviews.

They’re not accredited with the BBB, and they’ve lodged 15 complaints on the website. Interestingly enough, the BBB says complaints started pouring in from June 2017 and onwards.

In contrast, the BCA profile presents a more positive outlook, with a 4/5 star rating derived from 14 reviews.

Furthermore, TrustPilot appears to be a prominent platform for customer feedback, hosting a substantial 984 reviews for Nationwide Coin and Bullion Reserve. Of these, 80% are rated as Excellent.

Mostly Positive Customer Reviews, Despite What The BBB Says

Nationwide Coin and Bullion Reserve has received a significant amount of positive feedback on its TrustPilot profile. Despite this, customer complaints on the BBB page should still be considered since BBB is a reputable consumer watchdog.

Some customers have mentioned instances of “bait and switch,” where sales representatives use aggressive tactics and deliver coins that differ slightly from their labels. Nationwide Coin and Bullion Reserve has responded to most of these reviews, providing call records that dispute the complaints. While the responses are detailed, it can be challenging to determine who is in the right.

Additionally, some customers claim that the company refused to resend or refund orders shipped to the wrong address. However, it is commendable that the company takes the time to address both negative and positive reviews thoroughly.

Overall, there is a multitude of positive reviews on TrustPilot and BBB, praising the company’s products, conduct, and operation. Dissatisfied customers on TrustPilot primarily express dissatisfaction with their assigned salesperson, but many of them have received compensation from the company.

With an overwhelming number of positive reviews on Trustpilot (984 and counting), it is difficult to disregard the company’s good reputation. Although the complaints should be acknowledged, the overall positive feedback should not be overlooked.

Digital Dollar Nightmare To Become A Reality?

Nationwide Coin And Bullion Reserve Products

As previously mentioned, Nationwide Coin and Bullion Reserve do not offer any form of gold IRA or precious metals IRA. Instead, their primary focus is on dealing with gold and silver coins and bars, including a notable emphasis on rare coins. Their inventory exhibits some distinctive characteristics, which we will explore shortly.

One notable aspect that draws attention is the absence of precise pricing for their bullion. While this may not be uncommon, particularly when dealing with rare coin merchants, it is less than ideal. In the case of Nationwide Coin and Bullion Reserve, the pricing situation is somewhat mixed.

Certain coins, often considered “standard” offerings, come with clear price tags, while rarer coins prompt customers to reach out for pricing details. While a few customers have reported discrepancies in the quoted prices, we believe that this approach is reasonable given the nature of rare coin markets.

The company categorizes its products into “gold,” “silver,” and “pre-1933 gold” sections. Let’s begin by examining their selection of gold coins and bars, as it represents the category with the fewest available products.

1. Nationwide Gold Coins & Bars

Interestingly, the Nationwide Coin and Bullion Reserve website states that due to limited supplies, they are imposing a one-per-household lifetime limit on American Eagle Gold coins. The 1oz Gold Eagle, priced at $1,730, is listed below the spot price and comes with no shipping cost.

This approach raises questions. Is it a unique sales tactic? Regardless, this doesn’t seem to be the ideal destination for stocking up on bullion Gold Eagles. The company offers a substantial range of commemorative proof coins, each packaged in its own box. These coins span a variety of themes, from baseball-themed releases to limited-edition proof and uncirculated mintages.

With the exception of those commemorating the 75th anniversary, most of these coins were produced quite recently. Notably, there seems to be no purchase limit on the 1/10oz American Eagle Gold coins.

The website indicates a one-bar-per-customer limit, adding to the peculiarity of their inventory. They claim that buyers have the option to choose the mint, which is an advantage compared to many sellers who only offer bars “of their own selection.”

Once again, the gold bars are listed below the spot price, which is highly unusual for physical gold. We’re uncertain about the reasoning behind this pricing strategy. Perhaps it’s a method to attract new customers. Nonetheless, the limitation of buying only a single gold bar from your preferred vendor may not be ideal, even with attractive pricing.

2. Nationwide Silver Coins & Bars

Their selection of silver coins isn’t as extensive as their gold offerings, but due to the absence of purchase limits, it appears more diverse. They have individual 1 oz. American Silver Eagles, commemorative proof coins, and even some historic silver coins available in packages of at least 50 coins.

Collectors may find the vintage silver coins, such as those from 1964, appealing, although a minimum packaging requirement of 50 coins might be a bit excessive for some.

Regrettably, the only silver bar they offer, a 10-ounce bar, is currently marked as “sold out.” Our speculation is that silver bars didn’t face the same limitations as their gold products.

It’s worth noting that several of their other products also carry the “sold out” label, reinforcing the idea of potential inventory constraints and lending credence to the practice of restricting customers to just one American Gold Eagle or gold bar purchase.

3. Nationwide Pre-1933 Collectible Gold Coins

Their selection consists exclusively of gold coins, albeit in limited variety. These U.S. gold coins all hail from the 20th century and hold historical significance for many collectors. While the collection appears substantial, the absence of coin pricing is noteworthy.

For example, they have set a limit of ten of their 1908 gold coins per household. While it’s evident that the market for modern Gold Eagles is broader than that for these vintage coins, it seems unusual to restrict the former to just one coin while allowing the latter to be purchased in larger quantities.

Despite the limited availability of coins in this category, the option to purchase them in quantity is undoubtedly advantageous for those in search of specific coins listed.

If you’re ready to take action

Verdict: Nationwide Coin And Bullion Reserve Review For 2025

Nationwide Coin and Bullion Reserve is a bullion vendor that stands out due to its unusual website and approach. In this Nationwide Coin and Bullion Reserve review, we have explored their unique approach to selling coins.

While other retailers quickly purchase American Gold Eagles from the US Mint, causing inventory depletion and selling them at a premium, Nationwide Coin and Bullion Reserve takes a different approach. They claim to sell these coins at a discount, albeit on a limited basis.

This strategy may be aimed at attracting new customers, as evidenced by the offer of gold bars exclusively to new customers. Presumably, these customers then become regular buyers of silver and collectibles as well.

Whether this approach appeals to rare coin collectors or not is debatable, as collectors typically purchase coins wherever they are available, irrespective of discounts on contemporary gold products. Nevertheless, if you find items of interest in Nationwide Coin and Bullion Reserve’s inventory, there is no reason not to give it a try.

Nationwide Coin & Bullion Reserve Reviews

Many of the negative reviews about this company seem to be primarily related to individual sales representatives rather than the company itself. Addressing customer grievances can only go so far in resolving such issues.

It is worth noting that the inability to offer American Gold Eagles or gold bars in multiple quantities may discourage some buyers, as these are popular products often purchased in bulk. However, considering the company’s near 15-year presence in a competitive industry, their unique business approach seems to be working.

Overall, if you are intrigued by the offerings in Nationwide Coin and Bullion Reserve’s inventory, there is no reason to hesitate.

Nationwide Coin and Bullion Reserve FAQ's

Lastly, here’s a summary of our Nationwide Coin and Bullion Reserve review in an easy FAQ format.

Is investing in precious metals a good idea?

We think it is. Gold and silver values have historically moved counter to those of paper assets, making them effective hedges against inflation. Although past results don’t guarantee future results, the data suggests that gold has often performed better when the dollar has been weaker in the past. In actuality, many people perceive the relationship between gold and the dollar to be inverse.

Why starting a gold IRA?

After retirement, traditional IRA investments might not be sufficient to support you and your loved ones. Not if the economy continues to look as iffy as it has lately.

Investors have long looked to gold as a way to potentially counter losses brought on by economic unrest. By actually owning physical gold (and silver) within a retirement plan, a gold IRA or precious metals IRA enables you to diversify a component of your retirement portfolio, including pre-existing IRAs and former 401(k)(s) with previous employers. As a result, you are able to safely keep physical precious metals in an account that is tax-deferred.

Should I invest in physical gold, futures options (ETFs), gold mining stocks, or gold funds?

It is significantly riskier to invest in gold indirectly than to buy the actual commodity. You run the danger of losing your investment if you rely on a third party to manage your wealth for you, regardless of whether they are an individual or business. You have control over your riches when you own physical gold. You have an extra layer of security and safety with physical gold that you don’t have with gold exchange traded funds (ETFs), gold mining stocks, or funds.

You can possess physical gold coins or gold bars while still receiving the same tax advantages from an IRA when you invest in a gold IRA.

Do my precious metals have to be bars or can they be coins?

Yes. Although well-known gold IRA providers frequently suggest Equity Trust as their preferred custodian and Delaware Depository as a storage option, you are free to select your own custodian and storage provider.

Can I store my precious metals at home?

Yes, for non-IRA precious metals. not precious metals for a real IRA. IRS regulations restrict storing precious metals in IRAs at home or in a conventional safety deposit box. They must be kept by an authorized non-bank trustee or a bank that complies with access-restrictive IRS regulations. To maintain compliance with deposit and distribution requirements, access to the precious metals in your precious metals IRA must be restricted in specific ways, just like it would be with a standard IRA.

Are the values of the precious metals I buy for my IRA guaranteed?

No. Precious metals’ future value, like that of all assets, is uncertain and subject to a range of market factors. But we think your best bet to protect yourself against a stock market catastrophe, inflation, and the devaluation of the dollar is actual precious metals.

When will I be eligible for distributions from my gold IRA?

The IRS states that you or the beneficiary of your precious metals IRA can begin drawing withdrawals from the account without incurring penalties at age 59.5.

How long does it take to rollover a traditional IRA into a gold or silver IRA?

Usually between two and three weeks, but since every application is unique, the time required varies from case to case.

What is the advantage for customers to set up an IRA with a gold IRA company as opposed to going to the custodian and setting it up with them?

The IRA Processing Department of the gold IRA company will give the customers with excellent support and specialist account setting knowledge throughout the entire process. 95% of the paperwork is completed by them. Customers may rest easy knowing that any gold IRA firm mentioned on How To Invest Gold will keep them informed at every stage of the transfer procedure via daily calls or emails from the IRA Processing staff. Additionally, these businesses frequently offer lifetime account assistance.

Nationwide Coin And Bullion Reserve Alternatives

If you want to further research and compare companies before deciding what Gold IRA company to choose, we have reviewed and rated the best gold IRA companies for 2025.