Thank you for visiting our Augusta Precious Metals review 2025. In this in-depth review, we have taken a deep dive into Augusta’s precious metals IRAs, ratings and complaints, IRA fees, buy-back program, storage options, Mr. Steele’s webinar as a Harvard-trained economist, and much more to see whether they are a reputable company.

Most Trusted Gold IRA Company Overall Augusta Precious Metals

4.4/5

- A+ BBB rating & AAA BCA rating

- Average review rating of 4.9 out of 5 on ConsumerAffairs

- Stress-free and easy gold IRA set up

- ZERO fees for up to 10 years (every customer qualifies)

- Buyback guarantee

- Excellent customer service

If you do not wish to read the full article, let us start with a quick summary of our Augusta Precious Metals review:

Augusta Precious Metals Review For 2025: Summary

Augusta Precious Metals definitely deserves its reputation as one of the most reliable gold IRA providers in the US. They are an excellent option for a gold IRA firm for high-income investors who want to protect their wealth with precious metals.

First of all, they have hundreds of positive ratings on reputable websites like the BBB and BCA, TrustLink, Trustpilot, and other popular watchdog sites. They also have an A+ rating from the BBB, and an AAA rating from the BCA.

Additionally, Augusta has won “Best of TrustLink” for 6 consecutive years and was featured on Money Magazine’s list of the “Best Gold IRA Companies 2025” for the 4th year in a row.

What is particularly noteworthy is that the business provides the most original method of client education through its private, one-on-one web conferences created by in-house economist Devlyn Steele, a Harvard-trained economist.

To conclude, Augusta Precious Metals has a smooth process for making your gold IRA rollover or transfer simple and stress-free. As a bonus, they offer ZERO fees for up to 10 years (all customers qualify).

Current Promotions

- If you choose to work with Augusta, up to 10 years of fees will be reimbursed to your IRA in premium silver coins

- They offer ZERO fees for up to 10 years (every customer qualifies)

- The company also offers one-on-one educational web conferences with Harvard-trained economist Devlyn Steele.

- Order the Ultimate Guide to Gold IRAs and Get Paid in Real Gold

Augusta Precious Metals

5830 East 2nd Street Casper, WY 82609 Tel: +1 855-222-6993 www.augustapreciousmetals.com

Products Available:

- Bullion Bars

- Bullion Coins

- Self-Directed IRA

With that said, let’s now examine Augusta Precious Metals in more detail!

Introduction: Augusta Precious Metals Review

As Americans rush to invest their retirement funds in precious metals to secure their wealth against inflation, geopolitical instability, Trump’s tariffs and economic uncertainty, gold IRA investment firms seem to be appearing everywhere.

In a similar way, Augusta Precious Metals is one of many gold IRA businesses vying for your business. But is Augusta Precious Metals legitimate?

In this in-depth Augusta Precious Metals review 2025, we will peel back the curtain and review the company’s history, fee structure, popular IRA eligible gold and silver coins, complaints and ratings, storage options, buy-back program, and much more. We will go through pretty much everything we can dig up on this gold and silver firm so that you can make the best choice for your hard-earned savings.

Augusta Precious Metals Reviews And Ratings

Happy I chose to use Augusta Precious Metals

I I just recently moved my old 401K from a job I left to an IRA and used Augusta Precious Metals to facilitate this. They made it so simple and made sure they answered all of questions. I did a ton of research before I contacted them and I already knew they had 5 star ratings everywhere and now I know it’s because they work hard to earn it.

Charity Windham

- Verified Customer, Trustpilot

Reviewed on: August 16, 2025

I was looking to invest my SDIRA funds in gold and conducted quite a bit of research beforehand. Augusta Precious Metals consistently came up as the top-rated choice across numerous review platforms, so I decided to reach out. From the start, the team was extremely responsive and professional. I received a personalized presentation that clearly laid out the investment process, fees, and comparisons with other providers. I was then connected with Ericka, who was incredibly knowledgeable and helpful. She answered all of my questions—especially regarding the transition from my previous custodian to Equity Trust.

On my end, I encountered a few complications due to my SDIRA being under an LLC structure. Thankfully, the team at Augusta didn’t just leave me to sort it out—they did the legwork, contacted my old custodian, and made the entire process smooth and stress-free. Because of their help and guidance, I feel far more educated about my investments and how my SDIRA functions. I have full confidence in my decision to partner with Augusta Precious Metals and truly appreciate their transparency on costs and fees, which aligned with the independent research I had already done. Highly recommend!

Review from Andre'

- Verified Customer, ConsumerAffairs

Reviewed on: August 1, 2025

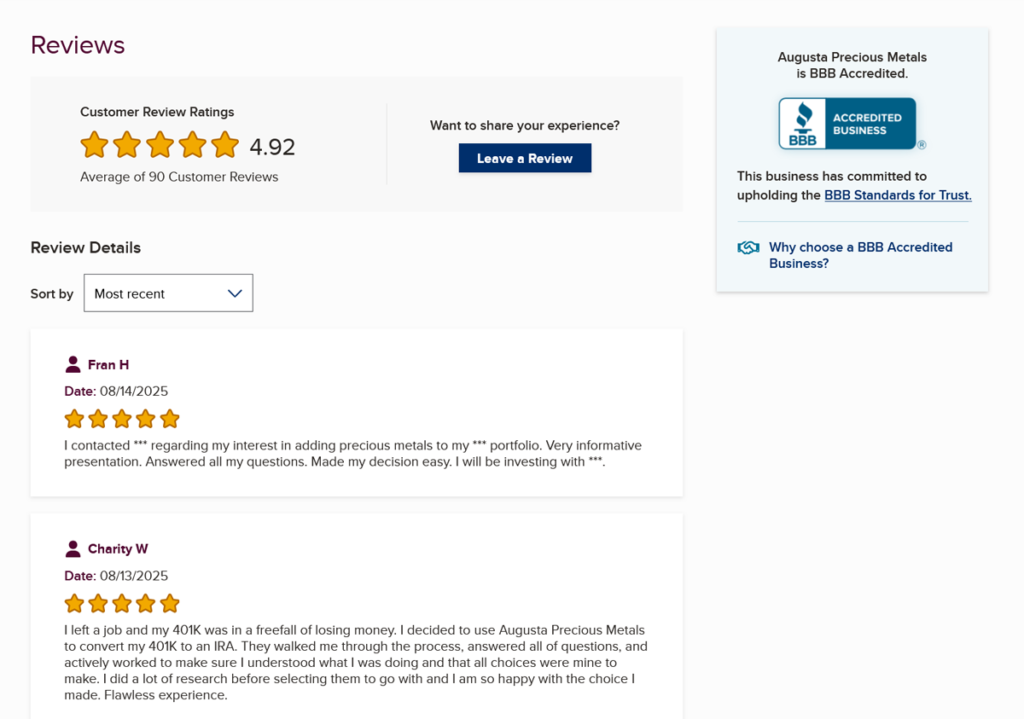

An area where Augusta Precious Metals excels is its online reputation. In today’s digital age, disgruntled clients can easily go online and post bad reviews all over the internet. But we’re pleased to say that Augusta Precious Metals has received overwhelmingly good feedback.

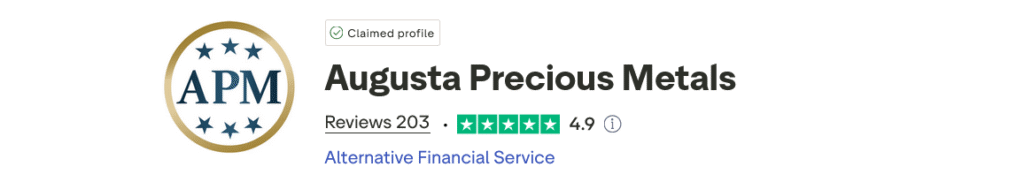

Augusta Precious Metals has hundreds of top ratings and reviews on trusted sites, such as the BBB, BCA, TrustLink, Trustpilot, and others.

- – To list a few customer reviews, Augusta Precious Metals has an A+ BBB rating on the Better Business Bureau. Plus, they have an average of 4.92 out of 5 stars based on 90 customer reviews

- – The company also has an AAA rating with the BCA and a 5 out of 5 star-rating based on 110 client reviews

- – They have a 5 out of 5 star-rating on TrustLink based on 290 customer reviews

- – Augusta also has a 5 out of 5 star-rating on ConsumerAffairs based on 152 customer reviews

- – And a 4.9 out of 5 star-rating on Google based on 566 customer reviews

- – They have a 94% recommend rating on Facebook

- – On Trustpilot, Augusta has earned a 4.9 star-rating based on 203 customer reviews

Augusta Precious Metals Complaints

As you can see, customers are speaking highly of Augusta Precious Metals. And it’s very unusual that the business has received zero complaints from the BBB and BCA.

The only complaint we have against Isaac Nuriani’s company so far is that their account minimum for opening a new gold IRA is $50,000. This limit applies to regular cash sales as well, which can be quite a high investment for new precious metals investors.

In contrast to Augusta’s high account minimums, there are thankfully gold IRA companies out there that are willing to work with new customers, offering accounts as low as $10,000.

What Is Augusta Precious Metals?

Augusta Precious Metals was launched in 2012 by founder and CEO Isaac Nuriani. Augusta aims to be every investor’s one-stop shop for precious metal investing.

The company is headquartered in Casper, Wyoming, and specializes in facilitating gold IRAs for customers across the United States.

In their 15 years of serving American retirement accounts, they have established themselves as a trusted leader in the gold IRA market. The company has received high customer ratings and reviews on popular consumer watchdog websites, such as Trustpilot and ConsumerAffairs, reflecting their strong reputation.

Additionally, they also hold an A+ rating by the BBB and an AAA rating by the BCA. In fact, the company acts as a “protector” of the industry with a variety of materials to help consumers, such as “Avoid Gold IRA Dealer Lies, Gimmicks & High Pressure Tactics” and “What is Stagflation?” as a warning for what to watch out for and as education.

Isaac Nuriani claims that his business’s main priorities are “account lifetime support” and customer education beyond the initial transaction. It appears that their priority is developing enduring and close relationships with their clients rather than producing a huge amount of sales.

This strategy makes sense since happy customers lead to more favorable reviews. For example, here is a testimonial from Brian Pannebecker – one of Augusta Precious Metals’ many happy clients:

Note: *Augusta thanks customers for reviews with a free silver coin.

Augusta’s Special Additions

Augusta has some special additions up its sleeve that are unique to the company. Let’s take a look at their unique and educational web conference.

Web Conference By Harvard-Trained Economist Devlyn Steele & His Team

Augusta offers a unique approach with an educational web conference for potential customers who want to learn about precious metals investing. Upon requesting the FREE Gold IRA Investor Kit from their website, you will be contacted by a representative to set up a 45-minute presentation.

This interactive session with on-staff Harvard-trained economist Devlyn Steele, the company’s director of education, allows you to view a presentation and directly ask questions to an Augusta educator.

It’s an excellent opportunity to gain insights into the economy and learn how diversification with precious metals works. This personal education sets Augusta apart from other gold IRA companies, making them a standout choice.

To recap, here are some benefits of working with Augusta Precious Metals:

- – One of Money Magazine’s “Best Gold IRA Companies” in 2022-2025

- – Has received two Stevie Awards for “Customer Service Success and Sales Distinction of the Year”

- – Rated “Best of TrustLink” for 6 consecutive years

- – Investopedia’s “Most Transparent” Gold IRA Company in 2022

- – A+ BBB rating and AAA Business Consumer Alliance rating

- – Free guide on how to avoid gimmicks & high-pressure tactics used by gold IRA companies

- – ZERO fees for up to 10 years (all customers qualify)

- – One-on-one web conferences by Harvard-trained economic analyst, Devlyn Steele

Trump's Golden Plan for America

Augusta’s Products And Services

Now that you know about the company’s history and partners, let us look at Augusta’s products and services next.

1. Precious Metals IRAs

As we have noted, Augusta specializes in facilitating gold and silver IRAs. They offer an easy and stress-free IRA setup process, where they will do 95% of the paperwork with you and walk you through each step.

Here is how their simple 4-step precious metals IRA setup process works:

- Step 1: Request a FREE Gold IRA Guide to learn more about precious metals investing through your IRA, and get a call back from a precious metals specialist.

- Step 2: Create your new IRA with Augusta’s preferred self-directed IRA custodian.

- Step 3: Fund your account with dollars from your existing retirement account.

- Step 4: Buy gold or silver. You simply choose and order from Augusta’s order desk and they send it to their preferred storage facility that meets IRS requirements.

As simple as that!

And the precious metals IRA agents at Augusta will ensure that the entire process is done in compliance with the IRS tax rules. If you want to learn more about gold IRAs, you can watch this educational video: What Is a gold IRA?

2. Non-IRA Precious Metals (Cash Account)

While Augusta Precious Metals specializes in providing gold and silver for IRAs, you can also purchase non-IRA metals from Augusta in what is called a cash account.

After creating your cash account and transferring your funds, a precious metals specialist at Augusta will help you select your metals.

The investment minimum for cash sales is just like their gold IRAs, $50,000. On a positive note, they offer free shipping for your metals and they will be delivered home to you in 3-10 business days.

Additionally, for lower cash purchases, we recommend either Goldco, Birch Gold Group, GoldenCrest Metals, or Noble Gold. And if you’re into gold and silver trading, we recommend the online trading platform, BullionVault. For Bitcoin IRAs or other cryptocurrency investments, we recommend BitIRA.

Build an Inflation Hedge With Gold IRAs

Two Different Principal Types Of Gold IRAs

To provide you with as much information as possible in this Augusta Precious Metals review, we also want to walk you through the two types of gold IRAs available:

1. Traditional-Based Gold IRA

With a traditional IRA, the contributions you make are tax-deductible (subject to income limitations). When you start taking distributions from your gold IRA, the amounts withdrawn are taxable as ordinary income. And you can start taking distributions without penalty when you are age 59½.

Traditional IRAs may be good choices for those individuals who anticipate finding themselves in a lower tax bracket once they reach retirement.

That way, they can realize tax benefits from their contributions during higher-bracket working years and pay taxes at a lower rate on withdrawals once they retire.

Note that a traditional IRA – including a traditional gold IRA – comes with a required minimum distribution (RMD) mandate. This means that you must begin taking annual distributions from your IRA starting at the age of 72.

2. Roth-Based Gold IRA

In contrast to a traditional IRA, with a Roth gold IRA, the contributions you make are NOT tax-deductible. This means there is no tax benefit generated from your account contributions that you will enjoy during your working years.

However, when you make withdrawals from your Roth IRA, you do not have to pay taxes on the distributions as you do with a traditional IRA.

Roth IRAs may be a prudent account choice for those individuals who believe the tax bracket they’re in during their working years is lower than the one they’ll be in once they retire.

They will not receive a tax benefit from their contributions while they’re still working, but they won’t pay taxes at all on their withdrawals during retirement when they’re in a higher tax bracket.

Additionally, there is no required minimum distribution feature for a Roth IRA. Something else to be aware of is that as of 2025, your modified adjusted gross income must be less than $150,000 in order to contribute to a Roth IRA. If married and filing jointly, your joint MAGI must be under $236,000 in 2025.

Please be aware that the guidelines presented here for both traditional and Roth IRAs are very broad. Before choosing between a traditional and Roth IRA, you should consult with your tax advisor to ensure you’re making the best decision on behalf of your own particular tax profile.

Who Is Augusta Precious Metals Best For?

Augusta is a great choice for many types of investors, including those who:

- – Want to diversify parts of their 401(k), TSP, or similar retirement account with gold, silver, or other precious metals

- – Want to own a physical asset. Unlike companies that could go under at any moment, precious metals has been and will be around forever. So, if you want a tangible asset in your investment portfolio that will never lose all its value, precious metals should be your choice

- – Investors who want to protect their wealth from stock market volatility and inflation. If the stock market makes you a little queasy, you should minimize your risk and diversify your investment portfolio with precious metals. Typically, gold and silver tend to move in the opposite direction to traditional securities. When the market is tanking, gold and silver can help you ride out the cycle until things start to swing back up

- – People who are nearing retirement and fear another recession or stagflation. For example, the economic crisis in 2008 and the recession that’s predicted to happen in 2025. Precious metals may add stability when you need it the most and can serve as financial insurance

Gold IRA Warning

Is It Safe To Work With Augusta?

Yes! Augusta Precious Metals, an esteemed company, offers a secure investment opportunity for investors. With over a decade of experience in helping Americans diversify their retirement savings and numerous 5-star reviews on consumer watchdog sites, Augusta’s gold IRA is a safe investment.

Firstly, Augusta provides personalized assistance throughout the process of setting up your new IRA, guided by a dedicated precious metals IRA professional.

Secondly, your precious metals investments are securely stored with the depository of your choice, similar to any other IRA asset. Augusta cooperates with trusted gold IRA custodians who specialize in administering physical precious metals retirement savings and utilize secure vaults to protect your investments.

These depositories have insurance coverage in place to ensure that in the extremely unlikely event of theft or damage caused by uncontrollable circumstances, your investments will be fully protected.

Lastly, Augusta stands out in the industry with numerous top ratings and reviews, including an A+ rating with the Better Business Bureau and an AAA rating with the Business Consumer Alliance. This distinguishes Augusta as a reputable and reliable company within this niche.

Augusta IRA Eligible Gold And Silver Bullion

The company’s website shows a wide selection of gold and silver bars and coins. Their focus again is on IRA-eligible bars and coins, but they are able to source a wide variety of precious metals.

This list is just a small example of the gold and silver coins/bars offered:

- Gold or Silver American Eagles

- Gold or Silver American Eagles (Proof coins)

- Gold or Silver American Buffalos

- Gold or Silver Canadian Maple Leafs

- South African Gold Krugerrands (Not IRA eligible)

- Australian Striped Marlin

- Gold or Silver Austrian Philharmonics

- Silver America the Beautiful Coins

- Canadian Silver Soaring Eagle

- Canadian Silver Eagle With Nest

- Gold or Silver Bullion Bars

- American Silver Eagles

- And more.

By now in this Augusta Precious Metals review, we bet you are wondering about fees and transaction minimums, so let us look at that next.

Get FREE Gold!

Augusta Precious Metals IRA Fees And Pricing

If you have gone through any of the articles or guides on this site, you probably know about the various fees associated with your gold IRA. Apart from the purchase of gold and silver, the storage and custodial fees are the only other significant fees.

In addition, Augusta is able to collaborate with your preferred custodian or storage provider. It is worth mentioning that they have undertaken thorough research and evaluation of gold IRA custodians and storage options, and they recommend using the businesses listed below.

It is important to note that Augusta Precious Metals provides reimbursement of up to 10 years of fees to your IRA in the form of premium silver coins. So, don’t forget to inquire with your IRA agent regarding how much you are eligible for.

1. Gold IRA Vault Storage Fees

Augusta Precious Metals’ vault storage provider of choice is Delaware Depository.

The annual costs to have your precious metals stored with Delaware comes out to $100 annually for commingled storage for most accounts. Or $150 annually for segregated vault storage (the specific pieces of gold or silver you buy are set aside as the exact pieces you purchased and will be returned to you when taking a distribution).

Non-Segregated Storage Fees

$100

Segregated Storage Fees

$150

Most customers are happy with commingled vault storage, but you can discuss the pros and cons of each with your IRA Specialist. For some, the additional $50 each year for segregated storage is worth it.

2. Augusta’s Gold IRA Custodians

Augusta’s preferred self-directed IRA (SDIRA) custodian is Equity Trust. If you choose to work with Equity Trust, you can expect a one-time setup fee of $50 and an annual maintenance fee of $100.

They also have partnerships with GoldStar Trust in Texas and Kingdom Trust in Kentucky.

3. Gold IRA Annual Fees

- Initial Setup Fee: $50 (Covered by Augusta)

- Annual Maintenance Fee: $80 (Covered by Augusta)

- Total Annual Fees: $200 (Covered by Augusta)

- Investment Minimum (Precious Metals IRA): $50,000

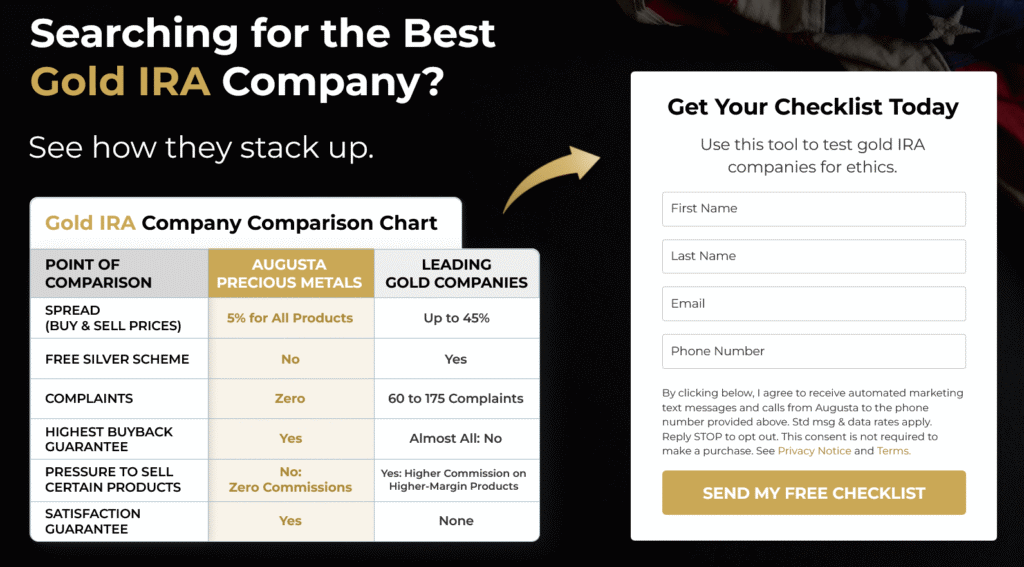

- Markup on Bullion: 5%

As previously mentioned, if you choose to work with Augusta, they now cover all fees. You can also get up to 10 years of fees reimbursed to your IRA in premium silver coins.

Also, Augusta will provide robust, professional customer service for the lifetime of your account without charging any management fees of their own.

4. Augusta’s Price Guarantee

Augusta Precious Metals and similar companies source their products at wholesale bullion prices. They then mark up the price of gold and silver IRA-eligible bullion bars and coins to competitive retail prices.

Augusta Precious Metals and similar companies source their products at wholesale bullion prices. They then mark up the price of gold and silver IRA-eligible bullion bars and coins to competitive retail prices.

Investors should note that the profit earned by Augusta is through the spread from wholesale to retail prices.

According to Augusta itself, they offer a price guarantee on all coins and competitive bullion pricing.

5. Gold And Silver Buy-Back Program

If you ever want to liquidate your account or sell any of your precious metals, we are convinced that you can be confident Augusta Precious Metals will offer a fair value for your gold and silver.

We reached out to the firm directly and they claim to have never turned down a buy-back request from any of their customers. This is part of their account lifetime commitment to their customers.

Pros And Cons Of Augusta Precious Metals

Pros

- Money Magazine’s “Best Gold IRA Companies" in 2025

- Hundreds of top ratings — plus hundreds of top reviews with the BBB, BCA, TrustLink, and others

- Unique, free one-on-one educational web conference designed by Augusta’s on-staff, Harvard-trained economist

- Up to 10 years of fees reimbursed to your IRA in premium silver coins (ask what you qualify for)

- Educational, no-pressure sales approach

- Easy and stress-free IRA setup, with a streamlined process

- A+ rating with the BBB and AAA rating from the BCA

- Buyback program

- Free guide on how to avoid gimmicks & high-pressure tactics used by gold IRA companies

Cons

- IRA minimum deposits start at $50,000

- Cannot Set Up an Account Online, Just Request a FREE Gold IRA Guide

If you’re still not convinced, let’s take a look at why you may want to invest in precious metals.

Why Invest In Precious Metals?

The last post COVID years have been extremely tumultuous years for investors, and hedge fund managers even predict a looming collapse globally.

Fed struggles to keep inflation in check and Trump is shocking the world with tariffs. Many Americans are shifting their money out of the stock market and into safe-haven assets, such actual gold and silver, as a result of the possibility of new stagflation.

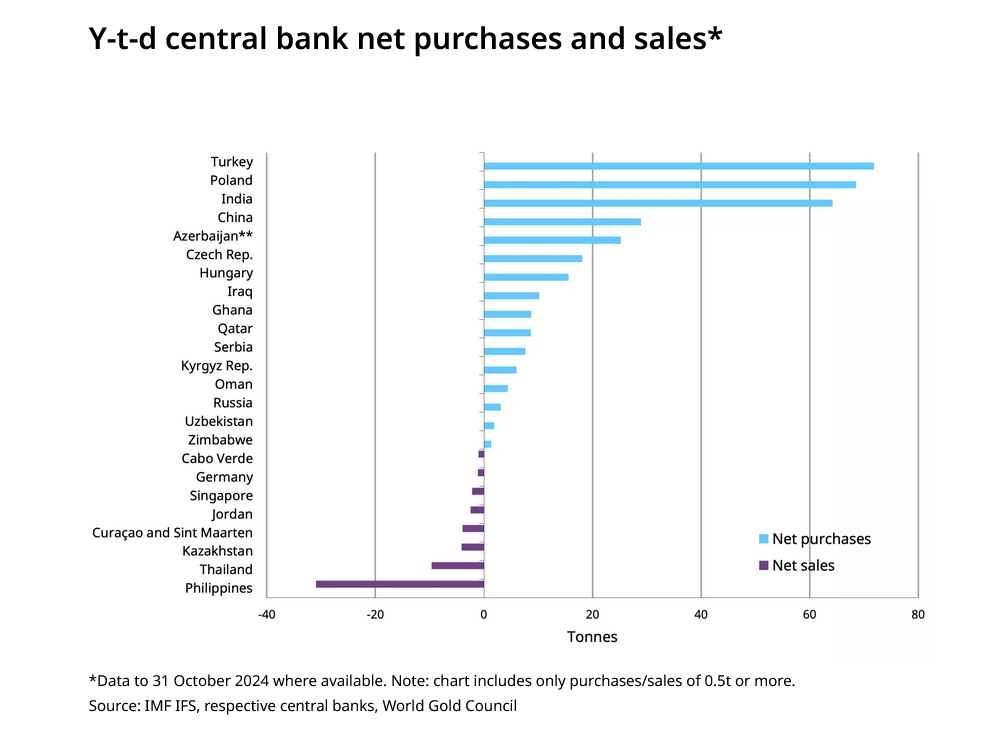

Mirroring big banks is always a smart move. Central banks are stocking up on gold now more than ever. According to the World Gold Council, central banks stocked up on more gold than ever in 2024 with Turkey, Poland, and India in the lead. And the buying spree is continuing in 2025.

Individual investors are taking cues from central banks for several reasons. Firstly, gold can serve as a hedge in any portfolio, offering a counterbalance against stock market crashes or economic downturns. As we observe central banks hoarding more gold, it serves as an indicator of economic sentiment among the fiscal authorities.

Secondly, the benefits of owning physical gold go beyond mere portfolio diversification. Unlike stocks and bonds, gold isn’t subject to the same level of volatility or market risk. It provides privacy and confidentiality in holdings, is highly liquid, and is worldwide accepted as a high-value asset.

We saw a bull market for gold in 2024, which has continued to sky-rocket in 2025 as a result of out-of-control fiscal expenditures, Trump tariffs and persistently high inflation.

2025 Gold Price Prediction

According to Samantha Dart, co-head of commodities research at Goldman Sachs, gold prices could soar to $4,000 an ounce in 2025.

A renowned commodity specialist from Saxo Bank in Denmark named Ole Hansen also forecast that gold prices might rise to an all-time high of $4000 per ounce. Ole thinks the yellow metal is poised for gains if markets decide that global inflation will continue to increase despite monetary tightening!

Additionally, billionaires like Jeff Gundlach and Thomas Kaplan predict gold will eventually reach $3000 to $5000 per ounce. The outlook for yellow metal is positive and we have already seen it rise by over 40 % last year.

Let’s now examine the benefits that precious metals can offer you.

What Precious Metals Can Do For You

Precious metals will help you:

- Hedge against a weaker dollar and increasing inflation

- Limit exposure to economic uncertainty

- Mitigate the effects of geopolitical instability

- Diminish negative fallout from the coronavirus economic crisis

- Diversify your portfolio

- Take real ownership of your financial future

Additionally, the average retirement account is getting smaller as living expenses rise. You may learn more about how the retirement situation has worsened by watching this video featuring economist Devlyn Steele, a Harvard-trained professional.

In unpredictable times like these, it is more crucial than ever to look to assets that can protect your funds from inflation and other economic strains.

Build an Inflation Hedge With Gold IRAs!

Conclusion: Augusta Precious Metals Review

To conclude this Augusta Precious Metals review for 2025, we believe that Augusta truly lives up to being a highly trusted gold IRA company.

With a remarkable track record, top ratings, and stellar reviews from reputable sources like the BBB, BCA, and TrustLink, Augusta stands out in the industry.

What sets them apart is their unique approach to customer education through their free one-on-one web conferences conducted by Harvard-trained economist Devlyn Steele and his team. This personal touch goes beyond what many other competitors offer.

Overall, Augusta Precious Metals offers a seamless and stress-free process for gold IRA rollovers or transfers, with no fees for up to 10 years. While the $50,000 account minimum may be higher than competitors, it allows Augusta to best serve customers looking to invest in gold and silver.

In summary, when considering companies for your precious metals IRA, Augusta Precious Metals should be on your list of gold firms to contact.

Augusta Precious Metals Alternatives

If you want to do a little more research before deciding on a provider for your gold IRA, we have analyzed and ranked the best gold IRA companies for 2025.